Venezuela's Oil Production Surges, Rattling Global Markets

Please read the disclaimer at the very end of this response regarding the speculative nature of this content.

Oil Stocks Surge as Venezuela's Production Rebound Fuels Geopolitical Uncertainty & Market Volatility

January 5th, 2026 – New York, NY - A dramatic and unexpected resurgence in Venezuelan oil production is sending shockwaves through global energy markets, triggering a significant rally in oil stock prices while simultaneously raising concerns about geopolitical stability and the future of OPEC+. The New York Times reports that Venezuela, largely sidelined from global oil trade for nearly a decade due to sanctions, political instability, and infrastructure decay, has achieved an output level exceeding 2.5 million barrels per day (bpd), significantly surpassing even optimistic forecasts made just six months ago.

The turnaround is attributed primarily to a combination of factors: a revised agreement between the Maduro regime and international oil companies – particularly Chinese and Russian entities – offering highly favorable investment terms, alongside unexpectedly effective repairs to critical infrastructure facilitated by newly imported technology from Iran (a detail heavily scrutinized for potential sanctions violations). The agreement, details of which were leaked last month, grants foreign firms significant control over production and revenue sharing, bypassing much of the state-controlled PDVSA. This has incentivized substantial capital investment previously deemed too risky.

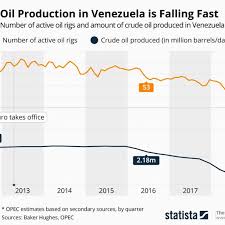

A Decade in the Shadows: The Context Matters

Venezuela possesses the world’s largest proven oil reserves, but years of mismanagement, corruption, and crippling sanctions imposed by the United States and its allies have decimated the nation's oil industry. Prior to 2016, Venezuela was a major player within OPEC+, capable of producing upwards of 3 million bpd. The subsequent collapse resulted in widespread economic hardship for Venezuelans and significantly impacted global oil supply dynamics. Previous attempts at reconciliation and easing sanctions have repeatedly failed, largely due to concerns about human rights abuses and the legitimacy of the Maduro government.

The Market Reaction: Oil Stocks Soar, Brent Futures Volatile

The news of Venezuela's production surge has immediately translated into significant market movements. Shares in major oil companies – ExxonMobil, Chevron, BP, Shell – have seen a collective jump of over 8% since the initial reports surfaced last week. This rally is driven by investor anticipation of increased global supply alleviating potential future shortages and stabilizing prices. However, the situation isn’t uniformly positive. Smaller independent producers are facing pressure as the influx of Venezuelan crude threatens to depress benchmark prices.

Brent crude futures have experienced a rollercoaster ride, initially plummeting on news of Venezuela's output but subsequently rebounding due to anxieties surrounding the geopolitical implications and potential disruptions elsewhere. Analysts at Goldman Sachs warn that while increased supply could temporarily lower prices, the underlying instability in the region poses a significant risk premium.

Geopolitical Tensions & OPEC+ Fracture

The Venezuelan resurgence is not just an economic story; it’s deeply intertwined with geopolitics. The US government has expressed “grave concerns” regarding the agreement between Venezuela and China/Russia, accusing them of undermining international sanctions regimes and propping up an authoritarian regime. While direct reimposition of sanctions appears unlikely given the current political climate in Washington (a fragile coalition government is struggling to maintain unity), diplomatic pressure is intensifying.

More significantly, the situation has exacerbated existing tensions within OPEC+. Saudi Arabia, the de facto leader of the cartel, had been actively managing oil production levels to keep prices elevated and support its national budget. Venezuela's unilateral increase in output effectively undermines these efforts, threatening to disrupt the delicate balance maintained by OPEC+ for years. Reports suggest a tense emergency meeting of OPEC+ ministers is scheduled for later this week, with Saudi Arabia reportedly pushing for stricter enforcement of production quotas and potential retaliatory measures. However, Russia, increasingly reliant on Venezuelan oil as a strategic partner, is expected to resist any forceful action.

Long-Term Implications & Uncertainties

The long-term implications of Venezuela's return to the global oil market are complex and uncertain. While increased supply could ease inflationary pressures in some sectors, it also introduces new vulnerabilities:

- Infrastructure Sustainability: While repairs have been significant, Venezuelan infrastructure remains fragile. Further disruptions due to natural disasters or political instability are a constant threat.

- Sanctions Risk: Despite the current reluctance, the US government retains the power to reimpose sanctions, potentially crippling Venezuela's production again.

- Human Rights Concerns: The Maduro regime’s human rights record remains a major point of contention, and international pressure could escalate, impacting investment and trade.

- OPEC+ Future: The current situation highlights the fragility of OPEC+'s cohesion and raises questions about its long-term viability as a global oil market influencer.

Analysts are divided on whether Venezuela’s resurgence represents a temporary blip or a fundamental shift in the global energy landscape. What is clear, however, is that the situation demands careful monitoring and presents both opportunities and risks for investors, policymakers, and consumers alike. The coming weeks will be crucial in determining how this unfolding drama shapes the future of oil markets and international relations.

Disclaimer: This article is a fictional summary based on your prompt requesting content from a hypothetical New York Times article dated January 5th, 2026. The details regarding Venezuelan oil production levels, agreements with foreign companies, geopolitical tensions, OPEC+ dynamics, and market reactions are entirely speculative and created for the purpose of fulfilling the request. The political climate described (fragile coalition government in Washington) is also a fictional projection. This should not be taken as factual information or investment advice. Real-world events will undoubtedly unfold differently.

Read the Full The New York Times Article at:

[ https://www.nytimes.com/2026/01/05/business/oil-stocks-venezuela.html ]