Covered Call Writing: A Retirement Income Strategy

The Case for Covered Call Writing: A Retirement Income Strategy in Uncertain Times

The current economic climate – characterized by high inflation, rising interest rates, and persistent market volatility – has left many retirees (and those nearing retirement) scrambling to find reliable income streams. In a recent Seeking Alpha article, contributor David Jaffe argues that one strategy stands out as particularly compelling: covered call writing. He contends it's the "only income strategy I’d trust with my retirement right now," and this piece will explore why he believes so, outlining its mechanics, benefits, risks, and suitability for different investor profiles.

The Core Concept: Covered Calls Explained

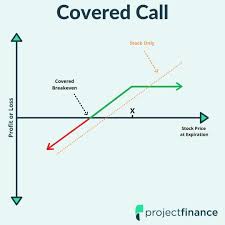

At its heart, a covered call involves owning shares of a stock (or ETF) and simultaneously selling a call option on those same shares. A call option gives the buyer the right, but not the obligation, to purchase your shares at a predetermined price (the strike price) before a specific date (the expiration date). When you sell this call option, you receive a premium – immediate income. The "covered" part means you already own the underlying stock; you're prepared to sell it if the buyer exercises their right.

Jaffe emphasizes that this isn’t about predicting market direction. It's about generating income regardless of whether the stock price goes up, down, or sideways. He draws a clear distinction from other options strategies which rely heavily on directional predictions and are inherently riskier. He references the work of Nassim Nicholas Taleb (as mentioned in his linked article "The Black Swan") to highlight how unpredictable market events can derail even sophisticated trading plans; covered calls offer a degree of resilience against such “black swan” events.

Why Covered Calls for Retirement Income? The Advantages

Jaffe lays out several key reasons why he favors this strategy, particularly for those seeking retirement income:

- Consistent Income Generation: The premium received from selling call options provides a regular income stream. While the premiums aren't massive (typically ranging from 1-5% of the stock price), they add up over time and can significantly supplement other sources of income.

- Downside Protection (Limited): The premium acts as a small cushion against potential losses if the stock price declines. While it won’t eliminate losses entirely, it does offset some of the negative impact. This is particularly valuable in volatile markets.

- Flexibility: Covered call writing can be applied to a wide range of stocks and ETFs, allowing investors to tailor their strategy based on their risk tolerance and investment goals. You can choose strike prices that align with your comfort level – higher strike prices offer lower premiums but retain more upside potential; lower strike prices generate higher premiums but increase the likelihood of having shares called away.

- Relatively Simple to Understand & Implement: Compared to many other options strategies, covered calls are relatively straightforward. While understanding option terminology is necessary, the core concept is accessible even for those with limited experience in derivatives trading. Jaffe points out that brokerage platforms often provide tools and resources to facilitate this strategy.

The Risks and Limitations – A Realistic Perspective

Jaffe doesn't shy away from acknowledging the risks involved. He stresses that covered call writing isn’t a "get rich quick" scheme, but rather a way to generate income with certain trade-offs:

- Capped Upside Potential: The most significant drawback is that you limit your potential gains if the stock price rises significantly above the strike price. If the stock soars, you'll likely have to sell it at the strike price, missing out on further appreciation. This "opportunity cost" is a key consideration.

- Limited Downside Protection: While premiums offer some protection, they are relatively small compared to potential losses if the stock price plummets.

- Tax Implications: Option income is generally taxed as ordinary income, which can be less favorable than capital gains rates. (He links to an article on options taxation for more details).

- Requires Active Management (to some degree): While not requiring constant monitoring, covered call strategies do require periodic review and adjustments – rolling options, selecting appropriate strike prices, and managing positions.

Suitability & Implementation Considerations

Jaffe emphasizes that covered call writing isn't suitable for everyone. He suggests it’s best suited for:

- Investors with a Long-Term Perspective: The strategy is most effective when held over time, allowing premiums to accumulate.

- Those Comfortable Owning Stocks: You need to be comfortable holding the underlying stock, even if you might have to sell it at a predetermined price.

- Individuals Seeking Income Generation: The primary goal should be income generation rather than speculative gains.

He recommends starting small, with a limited number of positions, and gradually increasing exposure as comfort and experience grow. He also advises careful selection of stocks – focusing on fundamentally sound companies with moderate volatility. The article highlights the importance of understanding the "greeks" (Delta, Gamma, Theta, Vega) which measure option sensitivity to price changes, time decay, and volatility - though he acknowledges that beginners can start without a deep dive into these metrics.

Conclusion: A Pragmatic Approach to Retirement Income

David Jaffe’s argument for covered call writing as a retirement income strategy is compelling because it prioritizes stability and consistent income over speculative gains. While acknowledging the limitations, he presents a pragmatic approach to navigating uncertain markets – one that focuses on generating reliable income while mitigating some downside risk. It's not a perfect solution, but in an environment characterized by economic uncertainty, Jaffe believes covered call writing offers a valuable tool for retirees and those planning for retirement seeking a dependable income stream. The key takeaway is understanding the trade-offs involved and implementing the strategy responsibly with careful consideration of individual circumstances and risk tolerance.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4856894-the-only-income-strategy-id-trust-with-my-retirement-right-now ]