Okta Poised for Growth: Sales Productivity Drives Potential

Locale: California, UNITED STATES

Okta Poised for Continued Growth: A Deep Dive into Rising Sales Productivity & Long-Term Potential

Okta (OKTA), the leading provider of identity management solutions, has faced significant headwinds in recent times, impacting its stock price. However, a recently published Seeking Alpha article argues that these challenges are temporary and that Okta remains a "fantastic investment" due to a compelling combination of factors, primarily driven by improving sales productivity and a massive, underserved market. This analysis will delve into the key arguments presented in the article, exploring why Okta’s future looks brighter than current investor sentiment suggests.

The Recent Struggles & Investor Concerns:

The Seeking Alpha piece acknowledges that Okta's stock has been under pressure. This stems from several factors including macroeconomic uncertainty impacting IT spending, a slowdown in deal sizes (particularly with larger enterprise clients), and concerns about the impact of increased competition. The acquisition of Auth0, while strategically important, also presented integration challenges and initially weighed on profitability. Investors have understandably reacted to these pressures, leading to a significant decline in Okta’s valuation. The article highlights that this negativity has created an opportunity for long-term investors.

The Core Thesis: Sales Productivity is the Key:

The central argument of the analysis revolves around a dramatic improvement in sales productivity within Okta. The company has been actively restructuring its sales organization, shifting towards a more specialized and targeted approach. Previously, Okta’s sales team was criticized for being too broad, attempting to sell across multiple product lines to various customer segments. This resulted in lower close rates and longer sales cycles.

The restructuring involves several key changes:

- Specialized Sales Teams: Okta is now organizing its sales force around specific industries (like financial services or healthcare) and use cases (like workforce identity or customer identity). This allows salespeople to develop deeper expertise, understand client needs better, and tailor solutions more effectively.

- Focus on Smaller & Mid-Sized Businesses (SMBs): While enterprise deals remain important, Okta is prioritizing growth within the SMB market. These customers often have shorter sales cycles and are less susceptible to macroeconomic fluctuations than large corporations. This shift allows for quicker revenue generation and a more predictable growth trajectory.

- Improved Sales Enablement: Okta has invested in better training, tools, and resources for its sales team, empowering them to be more effective. This includes improved demo capabilities and access to customer success stories.

The article points to recent earnings calls where management explicitly highlighted these improvements. Specifically, the number of deals closed per salesperson is increasing, and average contract values are stabilizing. While deal sizes might still be smaller than pre-pandemic levels, the increased volume of successful sales is driving overall revenue growth. This improvement in sales productivity directly translates into higher margins and a more efficient business model.

The Massive Market Opportunity:

Beyond the immediate improvements in sales productivity, Okta operates within a massive and growing market for identity management. As digital transformation accelerates and remote work becomes increasingly prevalent, organizations are realizing the critical importance of secure and seamless access to applications and data. The article emphasizes that:

- Identity is the New Perimeter: Traditional security models focused on protecting network perimeters. However, with cloud adoption and mobile devices, the perimeter has dissolved. Identity management – verifying who users are and what they can access – has become the new primary defense mechanism.

- Expanding Use Cases: Okta’s solutions address a wide range of identity needs, including workforce identity (managing employee access), customer identity (allowing customers to securely log in to applications), and universal directory services. The potential for cross-selling these products within existing clients is significant.

- TAM Growth: The Total Addressable Market (TAM) for Okta’s solutions continues to expand, driven by the increasing complexity of digital environments and evolving regulatory requirements around data privacy and security.

Financial Considerations & Valuation:

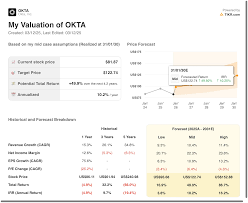

The Seeking Alpha article argues that Okta's current valuation doesn't fully reflect its improving fundamentals and long-term growth potential. While acknowledging that a premium is paid for high-growth software companies, the author suggests that the recent sell-off has created an attractive entry point. Key financial metrics to watch include:

- Revenue Growth: Continued acceleration in revenue growth driven by improved sales productivity and market expansion.

- Gross Margin: Maintaining or expanding gross margins as Okta achieves economies of scale.

- Operating Margin: Improving operating margin through efficient cost management and leveraging the benefits of a more focused sales organization.

- Free Cash Flow: Generating consistent free cash flow to fund future growth initiatives and return value to shareholders.

The article doesn't provide specific price targets but suggests that investors who are patient and willing to weather short-term volatility could be rewarded with significant returns as Okta’s performance continues to improve.

Risks & Considerations:

While the outlook is positive, the Seeking Alpha piece also acknowledges potential risks:

- Competition: The identity management market is becoming increasingly competitive, with players like Microsoft (Azure Active Directory) and Ping Identity vying for market share.

- Macroeconomic Conditions: A prolonged economic downturn could continue to impact IT spending and slow down Okta’s growth.

- Integration Risks: Further acquisitions carry integration risks that could negatively affect profitability.

Conclusion:

The Seeking Alpha article presents a compelling case for Okta as an undervalued investment opportunity. The company's focus on improving sales productivity, coupled with its exposure to a massive and growing market, positions it well for long-term success. While challenges remain, the recent restructuring efforts appear to be yielding positive results, and the current valuation offers investors a chance to capitalize on Okta’s potential resurgence. The key takeaway is that focusing on the operational improvements within Okta – particularly the rise in sales productivity – provides a more optimistic view than the prevailing market sentiment currently suggests.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4856890-okta-fantastic-investment-as-sales-productivity-rises ]