Realty Income REIT: A Potential Path to $1,000/Month Passive Income

Building a $1,000+ Monthly Passive Income Stream: This REIT Could Be Your Key (and the Math Behind It)

The allure of passive income – earning money while you sleep, travel, or pursue other interests – is powerful. Many investors dream of generating enough passive income to supplement their current earnings or even retire early. A recent article on The Motley Fool explores a strategy for achieving this goal, specifically targeting an extra $1,000 per month ($12,000 annually) in 2026 using a single investment: Realty Income (O).

The core concept revolves around dividend yield and the power of compounding. Realty Income is a Real Estate Investment Trust (REIT), a type of company that owns and operates income-producing real estate. REITs are legally obligated to distribute a significant portion of their taxable income as dividends, making them attractive for income-seeking investors. The Fool's article highlights Realty Income’s reputation as "The Monthly Dividend Company" due to its consistent payouts every month – a feature that simplifies budgeting and provides a steady stream of cash flow.

Understanding the Math: How Many Shares Do You Need?

The article begins by outlining the necessary calculations. To generate $1,000 per month (or $12,000 annually), you need to consider Realty Income's current dividend yield. As of late December 2024, Realty Income’s annual dividend yield is approximately 5.3%. This means for every $100 invested in the stock, you can expect roughly $5.30 per year in dividends.

To calculate the number of shares required, the formula is simple:

- Desired Annual Income / Dividend Yield = Number of Shares

- $12,000 / 0.053 = Approximately 226,415 shares

This figure represents a massive investment – roughly $22.6 million based on Realty Income’s current stock price (around $100 per share). Clearly, most individual investors won't be able to purchase that many shares. However, the article emphasizes that this calculation serves as an illustration of how dividend yield works and provides a framework for scaling down the goal.

Scaling Down: A More Realistic Approach

Recognizing the impracticality of purchasing hundreds of thousands of shares, the article then pivots to a more realistic scenario. It suggests aiming for a smaller number of shares that aligns with your investment budget. For example, if you have $10,000 to invest, let's see how much income that would generate:

- Investment Amount / Stock Price = Number of Shares

- $10,000 / $100 = 100 shares

- *Number of Shares Dividend Yield = Annual Income**

- 100 shares * 0.053 = $5.30 annual income per share

This translates to an annual income of $530 from a $10,000 investment in Realty Income. While this is far short of the initial $12,000 goal, it demonstrates the principle and provides a starting point for building towards that larger objective.

The Importance of Time & Compounding

The article stresses that achieving significant passive income takes time and leverages the power of compounding. Reinvesting those dividends – using the dividend payments to purchase more shares of Realty Income – accelerates growth. Over several years, this reinvestment can significantly increase your total dividend income. The Fool’s article links to an explanation of how dividend reinvestment works, highlighting its potential for exponential returns over time.

Risks and Considerations

While Realty Income is considered a relatively stable REIT with a strong track record, the article doesn't shy away from acknowledging risks. These include:

- Interest Rate Risk: Rising interest rates can negatively impact REITs as borrowing costs increase and potentially depress property values.

- Economic Downturns: A recession or economic slowdown could lead to lower occupancy rates and reduced rental income for Realty Income’s properties.

- Dividend Cuts: While rare, there's always a risk that a company might reduce its dividend payout. The article points out that while Realty Income has an impressive history of consistent dividends, no dividend is guaranteed.

- Stock Price Volatility: Like any stock, Realty Income's price can fluctuate based on market conditions and investor sentiment.

Why Realty Income? Key Strengths Highlighted

Despite the risks, Realty Income remains a compelling option for income investors due to several factors:

- Long-Term Leases: The company focuses on properties with long-term leases (often 10+ years), providing predictable rental income streams.

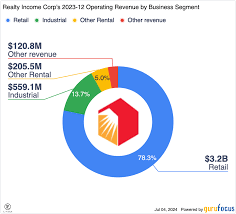

- Diversified Portfolio: Realty Income owns a geographically diverse portfolio of retail properties, mitigating risk associated with any single location or tenant.

- Strong Balance Sheet: The REIT maintains a healthy balance sheet, allowing it to weather economic downturns and continue paying dividends.

- Inflation Hedge: Rental income often increases with inflation, providing a hedge against rising costs.

Conclusion: A Long-Term Strategy for Passive Income

The Fool's article isn’t a get-rich-quick scheme but rather a demonstration of how consistent dividend investing can build substantial passive income over time. While achieving $1,000 per month in 2026 from Realty Income alone requires significant capital and patience, the principles outlined – understanding dividend yield, reinvesting dividends, and considering risk – are applicable to any income-generating investment strategy. The article serves as a valuable reminder that building passive income is a marathon, not a sprint, and that consistent effort and smart investing can lead to financial freedom. It encourages readers to start small, stay informed about the risks involved, and focus on long-term growth.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/29/want-to-make-over-1000-of-passive-income-in-2026-i/ ]