Berkshire Hathaway: A History of Wealth Creation

AOL

AOLLocale: Nebraska, UNITED STATES

Berkshire Hathaway: More Than Just Insurance – A Legacy of Wealth Creation

For decades, Berkshire Hathaway has been synonymous with financial success, not just for its leadership but also for its shareholders. The AOL article "Berkshire Hathaway: The Millionaire Maker" delves into the company's remarkable history and explains why investing in it, even with relatively modest amounts over time, has proven to be a potent path to wealth creation. It’s more than just an insurance conglomerate; it's a masterclass in long-term value investing, driven by the principles of Warren Buffett and Charlie Munger.

From Textile Troubles to Investment Titan:

The story begins not with financial prowess but with a struggling textile manufacturer. Berkshire Hathaway was originally founded in 1839 as Valley Forge Fabrics. By the early 1960s, it was facing serious challenges. Enter Warren Buffett, then a young investment manager, who saw an opportunity to acquire the company and transform it. He initially bought stock, eventually gaining control and using Berkshire Hathaway as a vehicle for his burgeoning investment strategy.

Buffett’s initial plan wasn't to revive the textile business (which he recognized was fundamentally flawed). Instead, he used it as a holding company to acquire other businesses – insurance companies being a key early target. The acquisition of GEICO in 1952, detailed further in an interview with Buffett on Forbes [https://www.forbes.com/sites/bernadettemarcus/2023/04/26/warren-buffett-geico-insurance-company/?sh=78d4a2195f6b], proved pivotal. GEICO’s low-cost operating model and direct-to-consumer approach generated significant float – the money collected in premiums before claims are paid. This "float" became a crucial source of capital for Berkshire, allowing it to invest in other businesses without needing external funding.

The Power of Compounding & Patience:

The article highlights the core reason behind Berkshire's success: compounding. Buffett’s philosophy isn't about chasing quick gains; it's about investing in fundamentally sound companies with strong management teams and a durable competitive advantage, holding them for the long term, and reinvesting profits back into the business or further investments. This simple formula, consistently applied over decades, has generated extraordinary returns.

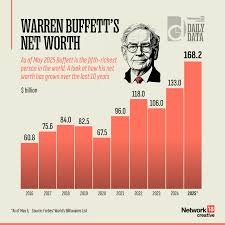

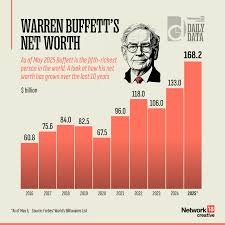

Consider this: someone who invested $10,000 in Berkshire Hathaway in 1965 would have seen that investment grow to approximately $378,000 by early 2024 (as of the article's writing). That’s an average annual return exceeding 19%, significantly outperforming the broader market. The key takeaway isn't the initial investment amount but the time invested. The longer you hold, the more powerful compounding becomes.

Beyond Insurance: A Diversified Portfolio:

While insurance remains a cornerstone of Berkshire’s operations, the company has diversified into numerous sectors. Today, its portfolio includes everything from railroads (BNSF Railway) and energy companies (Berkshire Hathaway Energy) to consumer goods brands like See's Candies, Dairy Queen, and Coca-Cola (a significant holding that Buffett has famously held for decades). This diversification mitigates risk and provides a stable base of earnings.

The article emphasizes the importance of understanding Berkshire’s structure. It's not just one company; it's a collection of businesses operating under the Berkshire Hathaway umbrella, each managed by its own leadership team but guided by Buffett and Munger’s overarching principles. This decentralized management style allows for entrepreneurial flexibility while maintaining overall financial discipline.

The Succession Question & Future Outlook:

A recurring theme in discussions about Berkshire is the question of succession. With Warren Buffett nearing 90 years old, the market naturally wonders who will take over his role and maintain the company's exceptional performance. While Buffett has publicly named Greg Abel as his successor as CEO, and Ajit Jain to lead insurance operations, the transition remains a key focus for investors. The article acknowledges this uncertainty but points out that Berkshire’s robust financial position and decentralized structure should provide stability even after Buffett departs.

Furthermore, the changing economic landscape presents new challenges. Rising interest rates, inflation, and geopolitical instability all have the potential to impact Berkshire's businesses. However, Buffett's emphasis on value investing – buying companies at prices below their intrinsic worth – is designed to weather these storms. He famously stated that he prefers to buy "wonderful companies at fair prices" rather than "fair companies at wonderful prices."

Key Lessons for Investors:

The AOL article ultimately offers several valuable lessons for investors, regardless of their experience level:

- Think Long-Term: Avoid short-term speculation and focus on building a portfolio of high-quality businesses you can hold for decades.

- Understand Your Investments: Don't invest in what you don’t understand. Research companies thoroughly before putting your money at risk.

- Embrace Compounding: The power of compounding is real, but it requires patience and discipline.

- Value Investing Matters: Focus on intrinsic value rather than market hype.

- Diversification Reduces Risk: Don't put all your eggs in one basket.

In conclusion, Berkshire Hathaway’s journey from a struggling textile mill to a financial powerhouse is a testament to the enduring power of value investing and long-term thinking. While future challenges undoubtedly lie ahead, the company’s strong foundation, disciplined management, and remarkable track record suggest that it will continue to be a wealth-creating machine for years to come – proving its title as a true "millionaire maker."

Read the Full AOL Article at:

[ https://www.aol.com/articles/berkshire-hathaway-stock-millionaire-maker-000500765.html ]