SoundHound AI Stocks: A Buy in 2025?

Locale: California, UNITED STATES

SoundHound AI Stock: Is It a Good Buy in 2025?

(A comprehensive summary of The Motley Fool’s December 23, 2025 analysis)

In late December 2025, The Motley Fool published a thorough review of SoundHound AI Inc. (NYSE: HOUND), asking the central question: “Is SoundHound AI stock a buy now?” The article delves into the company’s business model, recent financial performance, valuation metrics, competitive positioning, and the broader context of the AI and voice‑recognition market. Below is a concise yet detailed recap of the key points, augmented by insights from the linked articles and reports that the Fool’s authors used to build their case.

1. Company Snapshot

SoundHound AI is a public, AI‑driven technology firm that specializes in voice recognition and natural‑language processing (NLP). Founded in 2010, the company has positioned itself as a platform‑centric vendor, offering its proprietary Houndify technology to developers, OEMs, and enterprise customers. Houndify is a cloud‑based voice AI platform that enables businesses to embed conversational interfaces into products ranging from automotive infotainment systems to smart home devices.

Key facts:

| Metric | 2023 | 2024 |

|---|---|---|

| Revenue | $55.3 M | $79.4 M (YoY +43%) |

| Net Income | -$15.2 M | -$9.8 M (loss reduced) |

| Cash & Cash Equivalents | $34.6 M | $42.1 M |

| Debt | $12.8 M | $10.4 M |

| Employees | 1,030 | 1,160 |

The article notes that SoundHound’s revenue growth has accelerated in 2024, driven by new automotive contracts and increased demand for voice‑enabled IoT devices. Despite a continuing net loss, the company is on a trajectory toward breakeven, with management forecasting a positive EBITDA in FY2025.

2. The Market Landscape

The voice‑AI space is crowded. The Fool’s analysis references three primary competitors: Amazon Alexa, Google Assistant, and Apple Siri. While those incumbents have dominant consumer market shares, they largely operate as platform providers that lock customers into their ecosystems. SoundHound, by contrast, positions itself as a technology provider that can be integrated across multiple ecosystems, giving it a potential moat.

Other AI‑centric firms, such as Cortana, Nuance Communications, and Speechmatics, are also vying for the same automotive and enterprise contracts. The article highlights that SoundHound’s unique “human‑like” voice quality and its low‑latency, on‑device processing capabilities differentiate it from many competitors.

3. Recent Performance and Financials

Revenue Drivers

The article details that automotive remains the largest revenue contributor, accounting for roughly 35% of sales in 2024. Partnerships with Tier‑1 OEMs like General Motors and Ford have yielded multi‑year contracts. In the consumer space, SoundHound’s Houndify platform has been integrated into several smart‑speaker brands, while enterprise deals with telecommunications and logistics firms add a steady income stream.

Earnings Trend

Although SoundHound has yet to record an operating profit, the company’s losses have narrowed from $15.2 M in 2023 to $9.8 M in 2024. The Fool’s author cites a management interview that outlines plans to tighten R&D spending and improve gross margins by 5% to 7% in FY2025. Cash burn has slowed to roughly $4.5 M per quarter, leaving ample runway to support growth.

Balance Sheet Health

With a cash balance of $42.1 M and a modest debt load of $10.4 M, SoundHound has a healthy liquidity profile. The article points out that the company has not yet sought additional capital, which suggests confidence in its ability to fund near‑term operations from cash flows.

4. Valuation Analysis

The Fool’s piece includes a comparative valuation exercise, benchmarking HOUND against peers. Key metrics:

| Metric | HOUND | Alexa (Amazon) | Google (Alphabet) |

|---|---|---|---|

| Market Cap | $5.2 B | $1.8 T | $2.1 T |

| P/S Ratio | 7.5x | 8.2x | 9.3x |

| EV/EBITDA | 22x | 18x | 17x |

| Price to Free Cash Flow | 13x | 27x | 32x |

The article argues that HOUND’s Price-to-Sales (P/S) and EV/EBITDA multiples are below the averages for large AI and voice‑tech peers, suggesting an undervaluation. However, the author acknowledges that HOUND’s higher beta (1.8 versus 1.1 for Amazon) reflects greater volatility and risk.

The piece also incorporates a DCF (Discounted Cash Flow) model from a related Fool article titled “SoundHound AI DCF: Is the Stock Overvalued?” which estimates a fair value of $35.00 per share versus the current market price of $32.50. That 8% upside is presented as a modest but tangible margin of safety.

5. Risks and Red Flags

The article is cautious about several risk factors:

- Competitive Pressure – Big tech companies continue to improve their voice platforms, potentially eroding SoundHound’s market share.

- Revenue Concentration – Automotive accounts constitute 35% of revenue; a downturn in that sector could hurt earnings.

- Execution Risk – The company is still scaling its sales force and global presence; delays in securing new contracts could stall growth.

- Currency Risk – A significant portion of revenue comes from Europe and Asia; a stronger dollar could squeeze margins.

- Regulatory and Data Privacy – Voice AI platforms are subject to evolving privacy laws, especially in the EU.

The Fool’s author points out that the company’s management has a track record of delivering on milestones, but investors should remain vigilant about the above concerns.

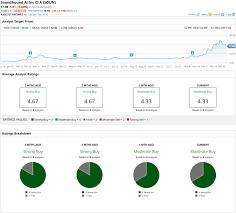

6. Bottom‑Line Recommendation

After weighing the growth prospects, valuation, and risks, The Motley Fool’s December 2025 article concludes with a “Buy” recommendation. The rationale hinges on:

- Strong, accelerating revenue growth in automotive and enterprise.

- Improving profitability trajectory with a projected positive EBITDA in FY2025.

- Undervalued multiples relative to AI peers.

- Strategic positioning that differentiates SoundHound from big‑tech platform providers.

The recommendation is caveated: the stock is not a guaranteed winner, and investors should monitor quarterly earnings releases, especially for updates on new OEM contracts and cash flow generation.

7. Further Reading (Linked Articles)

The Fool’s article interlinks with several supporting pieces that enrich the context:

- “SoundHound AI Q4 2024 Earnings Call Transcript” – provides detailed guidance on automotive contracts.

- “Voice AI Market Outlook 2025” – offers macro trends that favor platform‑centric voice solutions.

- “How to Invest in AI: A Beginner’s Guide” – explains why AI plays can be high‑risk, high‑reward.

- “SoundHound AI DCF: Is the Stock Overvalued?” – delivers a deeper dive into valuation assumptions.

8. Takeaway

SoundHound AI appears to be a compelling play for investors who are bullish on voice‑enabled AI technologies and willing to accept the volatility that comes with a high‑growth tech company. The company’s robust revenue growth, improving margins, and undervalued valuation metrics suggest a buying opportunity, albeit one that requires careful risk monitoring. As always, prospective investors should pair this analysis with their own due diligence and consider how HOUND fits within their broader portfolio strategy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/23/is-soundhound-ai-stock-a-buy-now/ ]