Barclays Forecasts 18% CAGR in Global AI Spending for 2026

CNBC

CNBCLocale: New York, UNITED STATES

AI Spending to Stay Strong in 2026 – Barclays Points to Key Stocks That Could Benefit

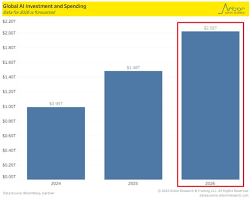

Barclays’ latest research, published on December 23, 2025, forecasts that global spending on artificial‑intelligence (AI) will continue to accelerate into 2026, driven by a surge in demand for high‑performance compute, data‑center infrastructure, and AI‑enabled services. The bank’s model projects a compound annual growth rate (CAGR) of roughly 18 % for AI expenditures over the next two years—up from the 12 % pace recorded in 2024. The key takeaway? Companies that supply the underlying hardware, software, and cloud platforms for AI are poised for substantial upside, and Barclays has highlighted a curated list of equities that could see significant gains as the trend unfolds.

What Drives the 2026 AI Spending Surge?

Barclays identifies three core catalysts that underpin its 2026 forecast:

Widespread AI Adoption Across Industries

From autonomous vehicles and robotics to finance and healthcare, businesses are embedding AI into core processes to increase efficiency, reduce cost, and unlock new revenue streams. In particular, the banking sector is investing heavily in generative AI for customer service and risk modelling, while the automotive industry continues to roll out AI‑driven safety features.Increased Need for Compute Power

Generative AI models, such as large language models (LLMs) and vision‑based systems, demand vast amounts of GPU and TPU compute. Barclays’ analysis suggests that the global GPU market could grow to over $25 billion by 2026, driven by both data‑center usage and edge‑device deployments.Expansion of Cloud‑Based AI Services

Major cloud providers are launching new AI‑specific services and offering pre‑trained models, lowering the barrier to entry for enterprises. This, coupled with the shift to hybrid‑cloud architectures, is projected to boost spending on AI‑optimized cloud infrastructure.

Barclays’ Stock Picks

Barclays’ research team points to a mix of chipmakers, cloud giants, and AI‑software specialists that stand to benefit from the projected spending wave. Below is a concise overview of the key names and why they were selected.

| Stock | Sector | Why Barclays? | Linked CNBC Piece |

|---|---|---|---|

| NVIDIA (NVDA) | GPU & AI Hardware | Dominant position in high‑performance GPUs, strong pipeline of AI‑specific chips (Grace, Hopper). | NVIDIA Stock: Why the AI Chipmaker Is Set to Keep Thriving |

| Intel (INTC) | CPU & AI Chips | Expanding AI silicon with Intel Habana and Xe GPU lines; growing AI data‑center business. | Intel’s AI Push: Will the New Chips Deliver? |

| Advanced Micro Devices (AMD) | CPU & GPU | Strong performance in CPU/GPU hybrids; strategic partnership with Google for TPU‑based inference. | AMD’s Next‑Gen AI Chips – What Investors Need to Know |

| Taiwan Semiconductor Manufacturing Co. (TSM) | Semiconductor Foundry | Critical to all AI silicon supply chain; ramping up 5 nm and 3 nm production for AI chips. | TSM’s 2026 Outlook: Chip Supply and AI Demand |

| Micron Technology (MU) | Memory | AI workloads need high‑bandwidth memory; Micron’s high‑speed DDR and GDDR products are essential. | Micron’s Memory for AI: The Untold Story |

| Amazon (AMZN) | Cloud & AI Services | AWS continues to launch AI‑specific services (SageMaker, Bedrock) and expand GPU‑accelerated instances. | Amazon’s AI Strategy: How AWS is Capturing AI Cloud |

| Microsoft (MSFT) | Cloud & AI Services | Azure’s AI platform and partnership with OpenAI; Azure’s GPU clusters are a key growth driver. | Microsoft’s Azure AI: A Deep Dive into the Future |

| Alphabet (GOOGL) | Cloud & AI Services | Google Cloud’s Vertex AI, TPU deployments; Alphabet’s AI research pushes commercialisation. | Alphabet’s AI Ambitions: Cloud, GPUs, and More |

| Palantir (PLTR) | AI‑Enabled Data Platforms | Enterprise focus on data‑driven insights; Palantir’s platform is increasingly AI‑powered. | Palantir’s AI‑Driven Data Platforms: The Competitive Edge |

| C3.ai (AI) | AI SaaS | Enterprise AI software across manufacturing, utilities, and finance; strong revenue growth. | C3.ai’s AI Software: Why It’s Gaining Traction |

Barclays notes that, while all of these companies are poised to benefit, NVIDIA remains the most prominent play because of its dominant position in GPU technology and its expansive ecosystem of partners and developers. However, the research team also highlights that diversification across the AI stack—hardware, cloud, and software—is essential for capturing the full upside.

Market Outlook and Risks

Barclays’ forecast is tempered by a few key risks that could dampen spending momentum:

- Chip Supply Constraints – Even though TSMC is expanding capacity, the semiconductor industry is still facing shortages, which could delay AI chip deliveries.

- Geopolitical Tensions – US‑China trade tensions may restrict access to advanced silicon and software components, affecting companies like Nvidia and Intel.

- Economic Slowdown – A broader economic downturn could reduce corporate R&D budgets, delaying AI initiatives.

- Regulatory Scrutiny – Heightened scrutiny over AI’s societal impact could slow adoption in certain sectors.

Nonetheless, the bank maintains a bullish stance, citing the resilience of AI spending even in the face of macro‑economic headwinds.

Where to Learn More

If you’re interested in deeper dives into each of these stocks or the macro‑economic backdrop to AI spending, CNBC offers a rich set of resources:

- Barclays AI Spending Forecast – An overview of the research methodology and key metrics.

- NVIDIA Stock Analysis – A detailed look at how Nvidia’s product roadmap aligns with AI demand.

- AWS vs. Azure: The AI Cloud Showdown – Comparative analysis of the two largest cloud providers’ AI offerings.

- Chip Supply Chain Updates – Ongoing coverage of semiconductor capacity and its impact on AI firms.

These articles collectively paint a comprehensive picture of why AI spending is expected to remain robust in 2026 and which stocks are positioned to benefit most.

Bottom Line

Barclays’ 2025 research suggests that AI spending will continue to rise at a healthy rate into 2026, fueled by growing demand for compute power and cloud‑based AI services across industries. Companies that supply GPUs, memory, and cloud infrastructure—especially NVIDIA, Intel, AMD, TSM, Amazon, and Microsoft—are highlighted as top candidates to capture this growth. While supply chain constraints and geopolitical risks exist, the overall trajectory remains positive, making the AI sector an attractive area for investors looking to benefit from the next wave of digital transformation.

Read the Full CNBC Article at:

[ https://www.cnbc.com/2025/12/23/ai-spending-is-expected-to-stay-strong-in-2026-barclays-thinks-these-stocks-will-benefit.html ]