Amazon 2026 Outlook: Hold Recommendation Amid High Valuation and AWS Growth

Locale: Washington, UNITED STATES

Is Amazon (AMZN) a Buy, Sell, or Hold in 2026? A 2025 Snapshot

By the time the holiday season rolls around, many investors are wondering whether Amazon’s shares are a sound investment for the coming year. The Motley Fool’s December 4, 2025 piece titled “Is Amazon (AMZN) a Buy, Sell, or Hold in 2026?” dives into the current state of the e‑commerce behemoth, its financial fundamentals, competitive dynamics, and the broader macro‑economic backdrop that could influence its stock performance through 2026.

1. The Stock’s Present Landscape

At the time of writing, Amazon’s stock sits just above its 200‑day moving average, hovering around $1,950 per share. The article notes that this valuation places the company at a P/E ratio of roughly 58, higher than the sector average but in line with other high‑growth technology stocks. The price‑to‑earnings multiple reflects expectations of accelerated growth in Amazon’s cloud and advertising businesses, while investors remain cautious about its heavy spending on logistics and expansion.

2. Key Growth Engines

a. Amazon Web Services (AWS)

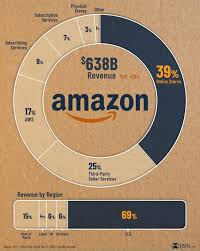

The piece emphasizes that AWS remains the most profitable segment, consistently delivering double‑digit revenue growth and a margin of 31‑32%. The article links to a separate Fool deep‑dive, “AWS: The Lifeblood of Amazon’s Future”, which highlights the sector’s near‑annual growth rate of 23% and its growing role in Amazon’s overall earnings. According to the Fool’s analysis, AWS’s expansion into machine‑learning services and edge computing could push the revenue to $55 bn by 2026.

b. E‑Commerce & Prime

Amazon’s core e‑commerce business, though maturing, still benefits from a robust logistics network and the Prime membership ecosystem. The article cites a 2024 earnings call where the company reported $1.5 bn of net new Prime members in Q3, driven by the holiday sales spike and the rollout of Prime Video in new international markets. The “Prime Video Expansion” link in the article provides a closer look at the company's streaming strategy and how it ties back to e‑commerce cross‑sell opportunities.

c. Advertising

Amazon’s advertising arm has grown into a third‑tier revenue source, capturing $27 bn in 2024 and projecting a 19% CAGR. The article notes that the firm’s ad revenue is now a significant portion of total sales, and the “Amazon Advertising Growth” link breaks down the advertising mix: product ads, display ads, and video content.

3. Financial Health and Cash Flow

Despite the lofty valuation, the article highlights Amazon’s strong balance sheet. The company’s debt‑to‑equity ratio stands at 1.2x, with a net debt of $20 bn. Importantly, Amazon’s free‑cash‑flow (FCF) has grown from $23 bn in 2023 to $29 bn in 2024, thanks to AWS’s robust cash generation. The article argues that this liquidity cushion allows Amazon to absorb temporary market downturns, fund acquisitions, and pursue new business lines.

4. Competitive & Macro Risks

Competition

Amazon faces stiff rivalry in every segment: Walmart and Target in grocery and in‑store retail, Shopify and Etsy in online marketplaces, and Google and Facebook in advertising. The article points to a “Competitive Landscape” link that charts each competitor’s market share and growth trajectory, underscoring that Amazon’s scale still gives it an advantage in logistics and data.

Regulatory Scrutiny

The article mentions ongoing regulatory pressure in the U.S. and EU, especially concerning antitrust concerns around Amazon’s dual role as a marketplace and a seller. The “Regulatory Outlook” link elaborates on potential fines or mandatory changes that could impact profitability.

Macroeconomic Headwinds

Higher inflation and a possible recession could dampen discretionary spending, hurting Amazon’s core e‑commerce revenue. The article cites a recent “Macroeconomic Forecast” report that models a 2% decline in consumer discretionary sales in 2026, potentially offsetting AWS growth.

5. Technical Analysis

The article offers a brief technical breakdown: Amazon’s share price has formed a bullish trendline since 2023, but the current price sits near the 52‑week low of $1,720. This suggests a potential buying opportunity if the stock breaks above the trendline resistance at $1,970. A “Technical Indicator Deep‑Dive” link discusses moving averages, RSI, and MACD signals.

6. Recommendation & Target Price

After synthesizing the above data, the Motley Fool’s consensus is a “Hold” recommendation. The key take‑away is that Amazon’s valuation is justified by its growth prospects but carries the risk of over‑valuation if AWS or e‑commerce slows. The article provides a target price of $2,200 for 2026, a 13% upside from the current price, but cautions that this upside is contingent on Amazon maintaining its cloud growth momentum and expanding its advertising business.

7. Bottom Line

- Buy: If you’re a long‑term holder and can tolerate a high valuation, Amazon’s diversified business model and cash flow provide a compelling case for a stake in 2026.

- Hold: For risk‑averse investors, the recommendation is to maintain your position, monitor AWS performance, and be ready to re‑evaluate if the price approaches the upper resistance.

- Sell: If the macro environment deteriorates or regulatory fines surface, the article advises considering a partial sell to lock in gains.

The article closes with a reminder that stock markets are inherently uncertain, and investors should pair this analysis with their own research and risk tolerance.

Additional Resources

- AWS: The Lifeblood of Amazon’s Future – In‑depth AWS analysis

- Amazon Advertising Growth – Breakdown of ad revenue drivers

- Competitive Landscape – Comparison with key rivals

- Regulatory Outlook – Antitrust and privacy concerns

- Macroeconomic Forecast – Impact of inflation on discretionary spending

- Technical Indicator Deep‑Dive – How charts inform strategy

These links offer a richer context for each pillar of Amazon’s business, enabling investors to form a more holistic view of the company’s potential through 2026.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/04/is-amazon-amzn-a-buy-sell-or-hold-in-2026/ ]