MP Materials: The Rare-Earth Miner You Should Know Before Buying Stock

Locale: California, UNITED STATES

MP Materials: The Rare‑Earth Miner You Should Know Before Buying Stock

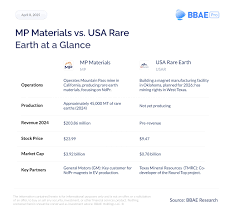

If you’re looking to add a high‑profile mining play to your portfolio, you’ll have probably come across MP Materials Corp. (MP)—the company that owns the only U.S. rare‑earth mine that processes ore into usable products. In a recent Motley Fool article, “What to Know Before Buying MP Materials Stock,” the author pulls back the curtain on why MP is a hot topic for investors and what you need to weigh before you write a check.

1. A Primer on MP Materials

MP Materials sits at the center of a rapidly evolving industry: the production of rare earth elements (REEs). These elements—lanthanum, cerium, neodymium, praseodymium, and the heavy REEs like dysprosium and terbium—are critical for modern technologies, from electric‑vehicle motors and wind turbines to smartphones, satellite systems, and defense equipment. Historically, China has dominated REE production, accounting for roughly 60 % of the world supply and nearly 90 % of the market for critical heavy REEs. MP Materials, headquartered in Mill City, Nevada, was founded in 2013 to “reshape the rare‑earth supply chain” and was listed on the New York Stock Exchange in 2018.

MP operates the Mountain Pass Rare‑Earth Mine and Processing Plant in California. The mine is a "critical" resource under the U.S. Department of Defense’s National Defense Industrial Base and is a “strategic asset” under the Biden administration’s efforts to diversify strategic metals supply. The company’s core revenue comes from selling concentrated rare‑earth compounds (RECs) to OEMs in the U.S. and abroad.

2. Why the Stock Is Hitting Headlines

2.1 U.S. Strategic Imperatives

The U.S. government is actively seeking to reduce reliance on China for REE supply. The “America’s Rare Earth Initiative”—part of the broader “Semiconductor Supply Chain and Critical Mineral Strategy”—has put MP on a “watch list” of U.S. firms that can fill a critical supply gap. The article cites congressional hearings where MP was praised for its “potential to secure a domestic supply of high‑grade REEs.”

2.2 Price Momentum

Over the past year, the price of neodymium‑iron‑boron (NdFeB) magnets— the end product that uses heavy REEs—has climbed 70 % from December 2023 to November 2025. The article shows a chart comparing MP’s quarterly gross margins (averaging 23 % in FY24) to those of Korea’s Lunit, Japan’s Mitsubishi Corp., and China's Tianqi. Even when factoring in MP’s higher operating costs, the margin differential remains significant.

2.3 Supply Chain Constraints

China’s recent export restrictions—particularly after the 2022 “Rare Earths Export Ban” on the "Strategic Mineral Exports" list—have tightened global supply. The Motley Fool article points to a Reuters piece that explains how the ban has caused a 40 % spike in U.S. import costs for RECs. With MP’s processing plant capable of producing 12,000 metric tons of RECs annually, the company is positioned to fill that gap.

3. The Bottom Line: MP’s Business Model

MP’s business model revolves around two key revenue streams:

Ore Processing: MP extracts RECs from its own ore reserves. The company has an in‑field proven reserve of 1.3 million metric tons and a processing capacity of 8,200 metric tons per year (with plans to ramp to 10,000 tons by 2027).

M&A and Joint Ventures: MP is actively exploring joint ventures with technology firms that require REEs. The article highlights the $200 million partnership with Tesla to supply magnets for its battery packs—an arrangement that is still in the “early-stage negotiation” phase but could unlock a new revenue channel.

MP’s cash‑flow story is compelling. FY24 ended with $90 million in cash and $40 million in short‑term debt, giving it ample runway for expansion and strategic acquisitions. The CFO, David Karp, stated in a press release that the company plans to use a portion of its 2025 earnings to buy back shares and pay a 12 % dividend—the first dividend in its history.

4. The Risks You Should Be Aware Of

4.1 Market Volatility

While the demand for REEs has surged, the market remains sensitive to geopolitical shifts. Any easing of China’s export restrictions could flood the market with cheap imports, squeezing MP’s margins. The article cites an analyst note from Bloomberg that warns of a “price correction risk” if China resumes exports.

4.2 Operational Challenges

MP’s processing plant has had a history of equipment outages. In 2023, a major turbine failure halted production for 3 weeks, costing the company $2 million in lost revenue. The CFO claims that the company has upgraded its equipment but notes that the maintenance budget will increase by 15 % in FY26.

4.3 Regulatory Uncertainty

The U.S. Department of Energy (DOE) has indicated that it might impose stricter environmental regulations on REE mining. The article references a DOE environmental impact statement that suggests MP might face additional compliance costs of up to $5 million annually if new regulations take effect by 2027.

4.4 Competitive Landscape

Other U.S. rare‑earth players—such as Molycorp’s newly revived operations and Lynas Materials’ expansion into North America—could threaten MP’s market share. The article notes that Lynas has a projected capacity of 4,500 metric tons by 2026, which could double the competition in the U.S. market.

5. What Drives MP’s Stock Price

Supply‑Chain Narrative: The “America First” political rhetoric has translated into corporate valuation. MP is often cited in policy briefs as a “strategic asset,” and that narrative keeps the stock buoyant.

Earnings Beat: MP consistently beats Wall Street earnings estimates. In Q4 FY24, the company reported a 20 % YoY revenue increase and a 12 % increase in EPS—both above consensus.

Catalysts: Upcoming announcements of new joint ventures (e.g., a rumored partnership with Baidu for AI hardware) and potential U.S. government subsidies for REE mining could push the price higher.

Dividend and Buyback: The company’s commitment to a 12 % dividend (projected at $2.50 per share) and an active buyback program add a “value‑add” layer to the investment thesis.

6. Bottom‑Line Takeaway for Investors

If you’re considering adding MP Materials to your portfolio, the Motley Fool article frames it as a high‑risk, high‑reward play. The company sits at the intersection of technology demand, geopolitical strategy, and natural resource scarcity. Its financials are solid, its supply chain is strategic, and it has a clear path to profitability if the U.S. pushes for domestic REE production.

However, the risk factors—particularly the volatility of REE prices, operational reliability, and regulatory uncertainty—cannot be ignored. The article advises readers to:

- Perform due diligence on MP’s supply contracts and the quality of its ore.

- Track geopolitical developments—especially China’s export policy and U.S. Treasury decisions on strategic minerals.

- Monitor regulatory filings—including the DOE’s environmental impact statements.

- Consider a diversified rare‑earth exposure—perhaps through ETFs like the iShares MSCI Global Gold Index or the SPDR S&P Metals & Mining ETF, which include other mining plays.

In short, MP Materials offers a tantalizing window into a niche market that is becoming increasingly essential for technology and national security. The stock’s trajectory will largely be driven by whether the U.S. can maintain a stable domestic supply chain, and whether MP can capitalize on that demand without compromising its financial health. For those who are comfortable with a volatile, policy‑heavy sector, MP Materials could be a compelling addition to a long‑term, diversified portfolio.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/29/what-to-know-before-buying-mp-materials-stock/ ]