S&P 500 ETFs in 2026: Returns and Hidden Fees

Locales: Delaware, UNITED STATES

The S&P 500 ETF in 2026: Navigating Returns and the Hidden Cost of Fees

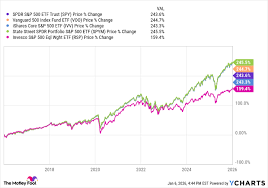

For years, financial advisors have touted S&P 500 Exchange-Traded Funds (ETFs) as a cornerstone of a sound investment strategy. Offering instant diversification across 500 of the largest U.S. companies, these ETFs have become incredibly popular, particularly for beginners. As we move into 2026, the fundamental appeal of S&P 500 ETFs remains strong - but investors need to be acutely aware of a critical factor that can significantly impact long-term returns: expense ratios.

The Enduring Appeal of Broad Market Exposure

The continued popularity of S&P 500 ETFs isn't simply a matter of hype. They provide access to a broad swath of the American economy, mitigating the risk inherent in putting all your eggs in one basket (i.e., individual stocks). This diversification is particularly valuable in a world marked by economic uncertainty and rapidly changing market conditions. Compared to actively managed mutual funds, S&P 500 ETFs typically boast considerably lower expense ratios, allowing a greater portion of your investment to work for you.

Historically, the S&P 500 has demonstrated a tendency to deliver positive returns over extended periods. While historical performance is, of course, not indicative of future results, the index's long-term track record provides a degree of confidence for long-term investors. The strength of the U.S. economy, coupled with innovation and corporate profitability, continues to support the potential for growth within the index.

The Silent Erosion: Understanding Expense Ratios

However, this is where the crucial caveat comes in. Expense ratios, the annual fees charged by ETF providers to cover operational costs, are often overlooked by investors. These fees, expressed as a percentage of assets under management (AUM), can seem negligible at first glance - commonly falling within the 0.03% to 0.20% range. But these small percentages can accumulate into substantial sums over the life of an investment.

Let's illustrate the impact. Imagine a $10,000 investment achieving an average annual growth rate of 8%. Over 20 years, this investment could potentially grow to approximately $34,850. Now, consider the same investment burdened by a 0.20% annual expense ratio. After two decades, the value would diminish to roughly $32,450 - a loss of $2,400 simply due to fees. While this may seem small in the context of a larger portfolio, the impact compounds over time, especially for smaller investors or those saving for long-term goals like retirement.

Volatility and the ETF Shield (to a Degree)

It's vital to remember that even the lowest-cost S&P 500 ETF doesn't shield investors from market volatility. The stock market is inherently cyclical, and corrections (a 10% or greater decline) and bear markets (a 20% or greater decline) are inevitable. An S&P 500 ETF exposes you to this volatility, but it does so in a diversified manner, potentially lessening the blow compared to owning individual stocks prone to more drastic swings.

Building a Truly Diversified Portfolio: Beyond the S&P 500

While an S&P 500 ETF can certainly serve as a foundational element in a well-rounded portfolio, relying solely on it is a strategic limitation. In 2026, and moving forward, a truly diversified portfolio should incorporate a broader range of asset classes. This includes international stocks (to capture growth opportunities outside the U.S.), bonds (to provide stability and income), and potentially alternative investments like real estate or commodities.

Diversification is not just about spreading your investments across different stocks; it's about allocating capital to assets with different risk-return profiles and correlations. This approach can help mitigate overall portfolio risk and potentially enhance long-term returns. Before committing to an S&P 500 ETF, or any investment, carefully consider your risk tolerance, investment goals, and time horizon, and always prioritize minimizing unnecessary fees to maximize your potential gains.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/28/investing-in-an-sp-500-etf-in-2026-theres-a-major/ ]