Zepbound: A Paradigm Shift in Weight Loss

Locales: Indiana, Massachusetts, UNITED STATES

The Zepbound Phenomenon: Reshaping the Weight Loss Landscape

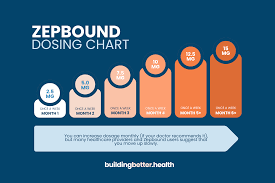

Zepbound, a GLP-1 receptor agonist, isn't just another weight-loss drug; it represents a paradigm shift in how obesity is treated. Clinical trials have demonstrated remarkable efficacy, with patients achieving an average weight loss of 22.4% over 16 months - a figure significantly exceeding that of existing treatments. This compelling data is driving exceptional demand, far outpacing Eli Lilly's current production capacity. While supply chain constraints are a typical challenge for rapidly adopted drugs, for Eli Lilly, it's a 'good problem to have,' granting the company leverage in prioritizing distribution to those with the greatest medical need and reinforcing its pricing power.

The weight loss market is massive and largely underserved. Traditional methods like diet and exercise often prove insufficient for long-term success, and previous pharmaceutical interventions have yielded modest results. Zepbound's demonstrated efficacy fills a critical gap, potentially capturing a substantial share of this multi-billion dollar market. Analyst projections consistently forecast multi-billion dollar annual revenue for Zepbound, with growth expected to continue as production scales and eligibility criteria broaden. Beyond the sheer revenue potential, Zepbound positions Eli Lilly as a leader in a rapidly evolving field, attracting further research and development opportunities.

Diabetes Care: A Foundation for Continued Growth

While Zepbound currently dominates headlines, it's crucial to remember that Eli Lilly's success isn't solely dependent on a single drug. The company boasts a robust and well-established portfolio of diabetes treatments that continue to generate significant and consistent revenue. Diabetes remains a global health crisis, with an increasing prevalence worldwide, ensuring a sustained demand for effective therapies. Eli Lilly's long-standing commitment to diabetes research and innovation has solidified its position as a trusted provider of solutions for this chronic condition.

This established diabetes franchise acts as a crucial bedrock for the company's overall financial health. It provides a stable revenue stream that can fund ongoing research and development efforts, including further expansion of the Zepbound product line (potentially including oral formulations) and exploration of new therapeutic areas. Diversification within the pharmaceutical sector is vital, and Eli Lilly's dual focus on weight loss and diabetes offers a compelling balance.

Navigating the Valuation: Is Eli Lilly Worth the Price?

Eli Lilly's stock price has experienced a substantial increase, leading to a high price-to-earnings ratio. This naturally raises concerns about whether the stock is overvalued. However, focusing solely on current metrics overlooks the company's substantial growth potential. The market is factoring in the anticipated revenue from Zepbound, and potentially other pipeline drugs, reflecting optimism about its future earnings.

Considering the potential for decades of revenue from Zepbound, combined with the consistent performance of its diabetes portfolio, the current valuation appears justifiable. Eli Lilly isn't just a pharmaceutical company; it's a growth stock with a solid foundation and a promising future. The company's ability to consistently innovate and bring groundbreaking treatments to market warrants a premium valuation.

Long-Term Perspective: A 'Never Sell' Strategy?

While no investment is without risk, the fundamental strength of Eli Lilly's business model, combined with its innovative product pipeline, suggests a strong case for a long-term 'buy and hold' strategy. The potential for continued growth from Zepbound and its established diabetes franchise, coupled with ongoing research and development, positions the company for sustained success in the years to come.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market carries inherent risks, and you could lose money. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/02/17/1-reason-id-buy-eli-lilly-stock-and-never-sell/ ]