Adani Shares Rise Amid Project Approvals, Debt Concerns

Locales: Gujarat, Maharashtra, Delhi, INDIA

Tuesday, February 17th, 2026 - Shares of Adani Enterprises and Adani Ports are once again at the forefront of market attention, driven by a mix of promising project developments and persistent investor concerns regarding the conglomerate's financial structure and regulatory landscape. Today's news - approval for a significant data center project and robust cargo volume growth - paints a picture of continued expansion, but doesn't fully dispel the shadow cast by substantial debt and ongoing investigations.

Data Center Expansion Signals Digital Infrastructure Ambitions

Adani Enterprises' recent approval for a 200MW data center in Chennai, Tamil Nadu, is a strategic move that underscores the group's growing commitment to the digital infrastructure sector. This isn't a standalone project; it's part of a larger, ambitious plan to capitalize on India's rapidly expanding digital economy. Demand for data center services is soaring, fueled by increasing internet penetration, cloud adoption by businesses, and the proliferation of data-intensive applications like AI and the Internet of Things (IoT). The Chennai facility represents a considerable investment, signaling Adani's intent to become a major player in this critical infrastructure segment.

Industry analysts predict that India's data center capacity needs will more than double in the next five years, creating a lucrative market for companies able to meet the growing demand. Adani Enterprises, with its access to capital and experience in large-scale infrastructure projects, is well-positioned to benefit. The Chennai project isn't just about servers and cooling systems; it's about enabling the digital transformation of businesses across South India and beyond. The location itself is strategic, offering connectivity advantages and access to skilled labor.

Adani Ports: A Beacon of Operational Strength

Alongside the digital push, Adani Ports and Special Economic Zone (APSEZ) continues to demonstrate operational resilience. The reported 13% year-on-year increase in cargo volume is a testament to the company's efficient port management and strategic infrastructure investments. This growth isn't merely a number; it reflects a broader trend of increasing global trade and India's role as a key logistics hub.

APSEZ's success is linked to its focus on modernization and capacity expansion. The company has been actively investing in port infrastructure, including deepening channels, increasing berth capacity, and deploying advanced technologies like automated container handling systems. These upgrades have not only boosted efficiency but also attracted larger vessels and increased throughput. Furthermore, APSEZ's integrated logistics solutions - encompassing rail, road, and warehousing - provide a seamless supply chain for its clients, enhancing its competitiveness. The 13% growth rate signifies that APSEZ is outpacing the overall growth of India's port sector, solidifying its position as a market leader.

The Debt Cloud and Regulatory Scrutiny Persist

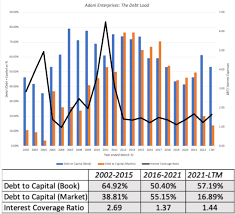

However, the positive developments are tempered by persistent concerns surrounding the Adani Group's debt levels. While the group has undertaken steps to reduce its leverage, including asset sales and equity infusions, the overall debt burden remains significant. High debt levels increase financial risk, making the group vulnerable to economic downturns and interest rate fluctuations. Investors are closely monitoring the group's ability to manage its debt obligations and maintain a healthy financial profile.

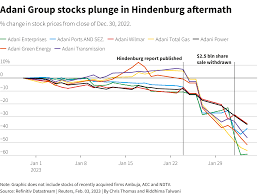

Adding to the complexity is the ongoing regulatory scrutiny. Investigations into alleged violations of securities laws and corporate governance practices continue to cast a shadow over the group. While the Adani Group maintains its innocence and is cooperating with the authorities, the investigations have eroded investor confidence and led to volatility in its stock prices. The outcome of these investigations could have a significant impact on the group's reputation, financial performance, and future growth prospects.

Looking Ahead: Balancing Growth with Financial Prudence

Analysts are now engaged in a delicate balancing act - assessing the potential of Adani's expansion into high-growth sectors like data centers and logistics against the backdrop of its financial challenges and regulatory risks. The group's success will depend on its ability to deliver on its projects, generate strong cash flows, and demonstrate a commitment to transparency and corporate governance. The market will likely remain cautious until there is greater clarity on the debt situation and the outcome of the regulatory investigations. Adani Enterprises and Adani Ports are clearly ambitious players, but sustained success will require not only strategic vision but also a steadfast commitment to financial prudence and regulatory compliance.

Read the Full Business Today Article at:

[ https://www.businesstoday.in/markets/stocks/story/adani-enterprises-adani-ports-shares-in-news-today-heres-why-516388-2026-02-17 ]