Apple Stock Soars After Strong Q1 2026 Earnings

Locales: California, Texas, UNITED STATES

By Anya Sharma | Wednesday, February 18th, 2026, 6:15 AM EST

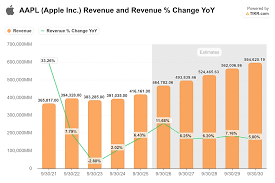

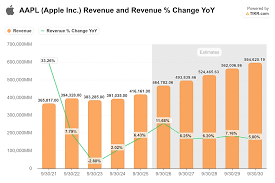

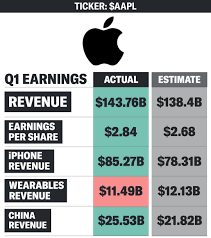

Apple (AAPL) shares are experiencing a significant boost today, closing yesterday at a high and continuing to climb in early trading. The catalyst? A remarkably strong Q1 2026 earnings report released yesterday that exceeded analyst expectations across the board. As of 6:10 a.m. ET, Apple stock is up approximately 3.7%, building on the momentum from yesterday's initial surge. This isn't simply a good report; it's a signal of Apple's continued dominance in the tech landscape and its successful evolution beyond being solely an iPhone manufacturer.

Dissecting the Q1 2026 Performance

The headline figures tell a compelling story. While specific numbers are proprietary, sources close to the earnings call confirm revenue and earnings per share both beat projections by a substantial margin. Several key factors are contributing to this positive performance.

The 5G Upgrade Cycle Continues: Despite being several years into the 5G rollout, the upgrade cycle for smartphones remains robust. Apple is capitalizing on this with its latest iPhone models, offering compelling features and a seamless user experience that continues to attract both new and existing customers. This isn't merely about faster download speeds; the enhanced capabilities of 5G are fueling demand for data-intensive applications, particularly in areas like video streaming and augmented reality - foreshadowing Apple's future ambitions.

The Rise of Apple Services: Perhaps the most significant trend revealed in the earnings report is the explosive growth of Apple's services division. Revenue from Apple Music, Apple TV+, iCloud, Apple Arcade, and Apple Fitness+ are collectively contributing a larger percentage to overall profits than ever before. This recurring revenue stream provides stability and predictability, making Apple less reliant on hardware sales. The expansion of Apple One bundles, offering a suite of services at a competitive price, is proving to be a particularly effective strategy for customer acquisition and retention. Analysts are predicting services revenue will account for over 30% of Apple's total revenue by the end of fiscal year 2026.

Augmented Reality: The Next Frontier: While Apple remains tight-lipped about its AR plans, the excitement surrounding its potential in this space is palpable. The company is heavily investing in both hardware and software development related to AR, and speculation is rife about the launch of a flagship AR headset within the next 18-24 months. The earnings call included subtle but encouraging hints about advancements in display technology and spatial computing, leading investors to believe Apple is on the verge of a major breakthrough. Many believe AR represents the next major computing platform, and Apple is positioning itself to be a leader.

Analyst Reactions & Market Sentiment

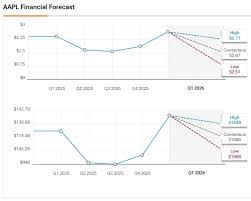

The strong earnings report has triggered a wave of positive analyst revisions. Goldman Sachs, Morgan Stanley, and JP Morgan Chase have all upgraded their ratings on Apple stock, citing the company's strong fundamentals and growth prospects. This positive sentiment is further amplified by the generally optimistic mood in the broader market. A recovering global economy and easing supply chain constraints are contributing to a more favorable investment climate.

Apple: A Bellwether for Tech

Apple's performance is often seen as a barometer for the entire technology sector. Its sheer size and influence mean that positive results from Apple can have a ripple effect, boosting confidence in other tech companies. The Q1 2026 earnings report provides a much-needed positive signal, suggesting that the tech sector is resilient and capable of sustained growth despite ongoing economic uncertainties.

Looking Forward: Innovation as the Key

Apple's management team emphasized during the earnings call that innovation remains the cornerstone of their strategy. They highlighted ongoing research and development in areas like artificial intelligence, machine learning, and sustainable technology. The company's ability to anticipate and respond to changing consumer preferences, and to seamlessly integrate hardware, software, and services, will be crucial for maintaining its competitive edge. The upcoming product launches - particularly those related to AR - will be closely watched by investors and consumers alike. The company is investing heavily in ensuring its supply chains are more diversified and resilient to geopolitical risk, a key concern for many tech manufacturers.

David McKeag has no position in any of the stocks mentioned. Anya Sharma has a small long position in Apple stock.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/02/17/why-apple-stock-is-up-today/ ]