SpaceX Innovation Index ETF Faces Valuation Scrutiny

Locales: Texas, Florida, California, UNITED STATES

Saturday, February 14th, 2026 - The meteoric rise of the SpaceX Innovation Index (XI) ETF continues to draw scrutiny, with analysts increasingly voicing concerns that the index's valuation is dangerously divorced from reality. A recent Breakingviews analysis, published on February 12th, has amplified these anxieties, pointing to a potent cocktail of "fear of missing out" (FOMO) and speculative fervor driving the index to potentially unsustainable heights.

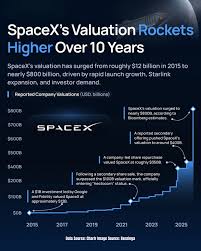

The XI ETF, ostensibly designed to mirror the performance of SpaceX, has experienced an unprecedented surge in value over the past several weeks. This growth isn't necessarily indicative of SpaceX's fundamental strength, but rather a reflection of investor behavior. The comparison to the dot-com bubble of the late 1990s is becoming ever more apt, a chilling reminder of past market manias built on hype and speculation rather than solid earnings and sustainable growth. While SpaceX, under the visionary leadership of Elon Musk, is demonstrably innovative - revolutionizing space travel, satellite internet with Starlink, and pushing the boundaries of electric vehicles via Tesla - that innovation doesn't automatically translate into an endlessly escalating stock price.

Liquidity Concerns and the Concentration Risk

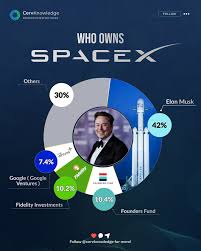

The core of the problem lies in the structure of the XI. The index is overwhelmingly concentrated in a relatively small number of assets linked directly to SpaceX. This lack of diversification creates a significant liquidity risk. Imagine a scenario where a major institutional investor decides to offload a substantial portion of its XI holdings. The limited number of available shares could trigger a cascade of selling, leading to a rapid and severe price correction. This scenario isn't hypothetical; highly concentrated indices are notoriously vulnerable to such shocks. Unlike broad market ETFs that spread risk across hundreds of companies, the XI is essentially placing all its eggs in one, albeit impressive, basket.

The Opaque Financials of a Private Giant

Compounding the liquidity issue is a lack of transparency surrounding SpaceX's financials. As a privately held company, SpaceX isn't subject to the same rigorous reporting requirements as publicly traded corporations. This makes it exceedingly difficult for investors - and even seasoned analysts - to accurately assess the company's true value. Standard valuation metrics, like price-to-earnings ratios, are largely meaningless without access to verifiable financial data. The market is, in effect, operating on assumptions and projections, heavily influenced by Musk's often-optimistic pronouncements and ambitious timelines. While the Starship program continues to show promise, delays and technical challenges are inherent in such complex endeavors, and these risks aren't adequately reflected in the current XI price.

Starlink's Uncertain Path to Profitability

A significant portion of SpaceX's valuation hinges on the success of Starlink, its satellite internet service. While Starlink has rapidly expanded its user base, the path to sustained profitability remains uncertain. The costs of launching and maintaining a vast constellation of satellites are substantial, and competition from established telecom providers and other emerging satellite internet services is intensifying. Furthermore, the long-term sustainability of low Earth orbit (LEO) satellite constellations is an environmental concern that could lead to increased regulation and operational costs.

A Potential Correction Looms Large

Experts are overwhelmingly advising caution. Investing in the XI solely based on FOMO is akin to chasing a rocket that might be running on fumes. The index's performance is inextricably linked to SpaceX's continued technological triumphs and the fickle nature of investor sentiment. Any negative news - a failed rocket launch, a significant Starlink setback, or even a perceived cooling of market enthusiasm - could trigger a substantial correction. Those who enter the market now, driven by the fear of missing out, risk suffering significant losses when the inevitable reckoning arrives.

The situation is a microcosm of broader market trends. The current low-interest-rate environment and an abundance of capital seeking returns have fueled a surge in speculative investments across various sectors. However, history teaches us that such bubbles inevitably burst. The SpaceX Innovation Index serves as a stark warning: even seemingly revolutionary companies aren't immune to the laws of financial gravity.

Read the Full reuters.com Article at:

[ https://www.reuters.com/commentary/breakingviews/spacex-index-thrust-preys-market-fomo-2026-02-12/ ]