QQQ: Can the Nasdaq 100 ETF Sustain Its Gains?

Locales: New York, California, UNITED STATES

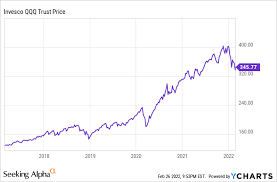

Wednesday, February 11th, 2026 - The Invesco QQQ Trust (QQQ), an exchange-traded fund tracking the Nasdaq 100 index, has been a star performer for investors. Boasting a remarkable 90% increase in value over the past five years (from February 10th, 2021 to February 10th, 2026), the question now isn't whether it has delivered, but whether it can continue to do so. With valuations stretched and economic headwinds potentially gathering, a critical assessment of QQQ's future is warranted.

A Retrospective of Remarkable Returns

The QQQ's journey hasn't been a straight line upward. While 2021 saw a robust 21.6% gain, 2022 presented a challenging environment, with a 17.4% decline attributed to rapidly rising interest rates. However, the ETF demonstrated impressive resilience, bouncing back with gains of 36.4% in 2023 and a further 33.9% in 2024. Year-to-date (YTD) gains for 2025 currently stand at 8.0%, indicating continued, albeit more moderate, growth.

QQQ's composition focuses on the 100 largest non-financial companies listed on the Nasdaq. This heavily skews the portfolio towards the technology sector, with significant allocations also in consumer discretionary, healthcare, and communications services. This concentration is both a source of strength and a potential vulnerability, as we'll explore.

The Valuation Question: Is 31 P/E Sustainable?

Currently, QQQ trades at a trailing price-to-earnings (P/E) ratio of approximately 31. This is substantially higher than the historical average P/E ratio for the broader S&P 500, which generally fluctuates between 15 and 20. This premium reflects investor optimism regarding the growth prospects of the companies within the Nasdaq 100. Investors are essentially paying more today for the expectation of higher earnings tomorrow.

The critical question is whether this expectation is realistic. While the Nasdaq 100 comprises innovative and rapidly growing companies, sustaining such high valuations requires consistently exceeding expectations. Any sign of slowing growth could trigger a correction. Furthermore, the high P/E ratio implies a reduced margin of safety; even a slight earnings miss could lead to a significant drop in the ETF's price.

The Power of a Few: Concentration Risk

A significant portion of QQQ's performance is driven by a handful of mega-cap technology stocks, most notably Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA). These giants have indeed demonstrated impressive growth and profitability, but their sheer size and influence mean that any weakness in their performance will have an outsized impact on the overall QQQ. Nvidia, in particular, has been a major driver of recent gains, and its valuation is currently extremely high. A correction in Nvidia's stock would logically translate into a notable decrease for QQQ.

Navigating the Risks: A Complex Landscape

Several factors pose potential risks to QQQ's continued success:

- Interest Rate Environment: Continued or increased interest rate hikes by the Federal Reserve could dampen investor appetite for growth stocks, putting downward pressure on valuations.

- Macroeconomic Conditions: A broader economic slowdown or recession would likely reduce demand for technology products and services, impacting the earnings of QQQ's holdings.

- Competitive Pressures: The technology sector is fiercely competitive. While current leaders enjoy strong positions, disruption from smaller, more agile companies is always a threat.

- Geopolitical Concerns & Supply Chain Issues: Global instability and ongoing supply chain disruptions could hinder production and profitability.

- Regulatory Scrutiny: Increasing regulatory pressure, particularly surrounding antitrust concerns and data privacy, could impact the growth and profitability of major tech companies.

Opportunities Remain: Innovation and Long-Term Growth

Despite the risks, QQQ isn't without its opportunities:

- Technological Innovation: The Nasdaq 100 is a breeding ground for innovation, with companies constantly developing groundbreaking technologies in areas like artificial intelligence, cloud computing, and biotechnology.

- Secular Growth Trends: Many of the companies within QQQ are benefiting from long-term secular growth trends, such as the increasing digitization of the economy and the growing demand for cloud-based services.

- Dominant Market Positions: QQQ's top holdings often possess strong competitive advantages, including brand recognition, network effects, and substantial research and development capabilities.

- Long-Term Capital Appreciation: If these innovative companies can continue to demonstrate strong earnings growth, they could deliver substantial capital appreciation over the long term.

Final Assessment: Proceed with Caution

The Invesco QQQ Trust has undoubtedly been a winning investment over the past five years. However, its high valuation and concentration in a single sector necessitate a cautious approach. While the ETF still offers long-term growth potential, investors should carefully consider the risks and diversify their portfolios accordingly. The question isn't necessarily if there will be a correction, but when. Investors should be prepared for potential volatility and avoid chasing returns at these elevated levels.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/02/10/after-soaring-90-in-5-years-is-the-invesco-qqq-tru/ ]