[ Yesterday Afternoon ]: Her Campus

[ Yesterday Afternoon ]: Morning Call PA

[ Yesterday Afternoon ]: UPI

[ Yesterday Afternoon ]: investorplace.com

[ Yesterday Afternoon ]: Sky Sports

[ Yesterday Afternoon ]: reuters.com

[ Yesterday Morning ]: Finbold | Finance in Bold

[ Yesterday Morning ]: Business Insider

[ Yesterday Morning ]: ThePrint

[ Yesterday Morning ]: KSTP-TV

[ Yesterday Morning ]: Investopedia

[ Yesterday Morning ]: Detroit Free Press

[ Yesterday Morning ]: Global News

[ Yesterday Morning ]: CBS News

[ Yesterday Morning ]: MarketWatch

[ Yesterday Morning ]: WTOP News

[ Yesterday Morning ]: socastsrm.com

[ Yesterday Morning ]: The Financial Times

[ Yesterday Morning ]: CoinTelegraph

[ Yesterday Morning ]: moneycontrol.com

[ Yesterday Morning ]: Dayton Daily News

[ Yesterday Morning ]: Seeking Alpha

[ Yesterday Morning ]: The Motley Fool

[ Yesterday Morning ]: CNBC

[ Last Friday ]: Deadline.com

[ Last Friday ]: Phys.org

[ Last Friday ]: gizmodo.com

[ Last Friday ]: Orlando Sentinel

[ Last Friday ]: SPIN

[ Last Friday ]: Zee Business

[ Last Friday ]: KCTV News

[ Last Friday ]: The Sun

[ Last Friday ]: WPTV-TV

[ Last Friday ]: Seeking Alpha

[ Last Friday ]: Investopedia

[ Last Friday ]: Fortune

[ Last Friday ]: reuters.com

[ Last Friday ]: The Motley Fool

[ Last Friday ]: digitalcameraworld

[ Last Friday ]: WTOP News

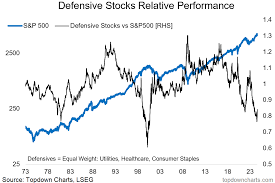

Defensive Sectors Outperform in Downturns

Locales: California, Texas, UNITED STATES

Here's a breakdown of key strategies:

- Defensive Sector Prioritization: While no sector is entirely immune to economic headwinds, certain areas tend to outperform during downturns. Healthcare, consumer staples (necessities like food and household goods), and utilities consistently demonstrate resilience. Demand for these products and services remains relatively stable even when disposable income declines.

- Quality Over Quantity: This is paramount. Focus on companies with robust balance sheets, consistent profitability, and demonstrably capable management teams. These businesses are better positioned to weather storms, maintain dividends, and even capitalize on opportunities that arise during market corrections. Look for companies with strong cash flow and low debt levels.

- Dynamic Portfolio Management: Rigidity is the enemy. Investors must be prepared to actively adjust their portfolios in response to changing market conditions. This doesn't necessarily mean frequent trading, but rather a willingness to rebalance allocations and trim positions in overvalued assets.

- Liquidity is King: Maintaining a healthy cash position isn't about fear-mongering; it's about opportunity. Cash provides the flexibility to capitalize on market dips, purchase undervalued assets, and potentially accelerate returns when the recovery begins. It's a safety net and a potential springboard.

- Embrace Continuous Assessment & Vigilance: Complacency is a dangerous trap. Don't assume that historical patterns will repeat themselves. Continuously reassess your investment strategy, monitor economic indicators (both traditional and alternative), and stay informed about emerging risks and opportunities.

Beyond these core strategies, investors should also consider diversifying their asset allocation. Exploring alternative investments like real estate, infrastructure, or even commodities can provide a hedge against traditional market volatility.

The age of predictable recessions is over. We're now navigating a world of economic shocks that are faster, fiercer, and less predictable. Successfully navigating this new landscape requires a paradigm shift - a move away from reactive strategies and towards a proactive, resilient, and adaptable approach to investing. The future favors those who embrace change and prioritize long-term stability over short-term gains.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4841014-the-new-paradigm-of-recessions-investing-in-era-of-brief-brutal-downturns ]

Similar Stocks and Investing Publications

[ Thu, Feb 05th ]: fox17online

[ Tue, Feb 03rd ]: Seeking Alpha

[ Tue, Feb 03rd ]: Seeking Alpha

[ Tue, Feb 03rd ]: Seeking Alpha

[ Mon, Feb 02nd ]: Seeking Alpha

[ Sat, Jan 31st ]: Investopedia

[ Tue, Jan 27th ]: AOL

[ Sun, Jan 25th ]: Seeking Alpha

[ Tue, Jan 20th ]: Forbes

[ Thu, Jan 15th ]: The New York Times

[ Mon, Jan 12th ]: The Motley Fool

[ Wed, Dec 10th 2025 ]: Fox 11 News