Canada's Energy Sector at Critical Juncture Amidst Challenges and Opportunities

Locales: Alberta, Saskatchewan, British Columbia, Ontario, CANADA

Wednesday, February 11th, 2026 - As the trading year commences, Canada's energy sector finds itself at a critical juncture, grappling with a confluence of challenges and opportunities. Years of declining oil sands investment, vocal activist opposition, and shifting global geopolitics have created a complex landscape. Now, the industry confronts the added pressures of ambitious government climate policies alongside continued volatility in international energy markets.

Natural Gas: A Beacon in Turbulent Times

While significant hurdles remain, Canada's natural gas sector is currently exhibiting resilience and emerging as a relative bright spot. The geopolitical turmoil stemming from Russia's ongoing war in Ukraine has sent European gas prices soaring, significantly increasing demand for Canadian exports. The development of infrastructure capable of exporting Liquefied Natural Gas (LNG) to overseas markets has become a central priority, drawing substantial investment attention.

John Augustine, senior vice-president of investments at CIBC World Markets, highlights LNG as "the biggest catalyst for investment in the Canadian energy sector right now." The potential to supply energy-hungry global markets offers a promising avenue for growth. However, capitalizing on this opportunity isn't without its obstacles. Permitting delays, regulatory hurdles, and mounting environmental concerns continue to impede the timely completion of crucial LNG projects. The substantial capital expenditure required to construct LNG terminals, coupled with increasing competition from established gas-producing nations like the United States, Qatar, and Australia, poses a significant challenge.

Recent reports indicate that several proposed LNG projects along Canada's coasts are facing renewed scrutiny regarding their environmental impact assessments, specifically concerning methane emissions and potential effects on marine ecosystems. This regulatory tightening, while intended to ensure responsible development, adds both time and cost to these ventures.

The Rise of CCUS and Hydrogen: Investing in a Low-Carbon Future

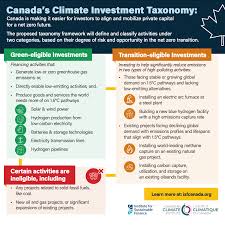

Beyond natural gas, the Canadian energy sector is actively exploring investment in carbon capture, utilization, and storage (CCUS) and hydrogen production. Canada's abundant natural resources - including vast underground geological formations suitable for carbon storage and potential for renewable-powered hydrogen production - position the nation to become a leader in these emerging technologies. The promise is significant: these technologies could not only reduce greenhouse gas emissions but also create new, high-skilled jobs and attract substantial foreign investment.

Michael Ferguson, a partner at Deloitte Canada, emphasizes that "CCUS is critical to Canada's net-zero ambitions." Several pilot projects are underway across the country, testing the feasibility of capturing carbon emissions from various industrial sources and either storing them permanently underground or utilizing them in the production of other valuable products. However, widespread adoption hinges on overcoming significant hurdles. Both CCUS and hydrogen technologies are still in relatively early stages of development, demanding substantial upfront capital and continued government support to scale up and achieve economic viability. The fluctuating costs associated with production, storage, and transportation remain a major concern for private investors.

Geopolitical Uncertainties and Policy Pressures

The broader global energy landscape remains vulnerable to geopolitical shocks. The prolonged war in Ukraine continues to disrupt supply chains and contribute to price volatility. This instability is prompting governments worldwide to prioritize energy security and diversify their energy sources, leading to increased demand for reliable and stable suppliers like Canada. Simultaneously, national and international climate change policies are dramatically reshaping the energy sector. Carbon pricing mechanisms, stringent regulations, and incentivized programs designed to reduce greenhouse gas emissions are adding costs to fossil fuel production and consumption, pushing companies to adopt cleaner technologies and explore alternative energy sources.

Investment Strategies in a Transforming Sector

For investors navigating this complex environment, a discerning approach is crucial. Companies demonstrating strong financial health, efficient operations, and a demonstrable commitment to Environmental, Social, and Governance (ESG) principles are poised to outperform. Augustine stresses that "ESG factors are increasingly important for investors." Those companies actively embracing sustainability and transparency are more likely to attract capital and secure long-term growth. Furthermore, investors are increasingly scrutinizing companies' long-term strategies for transitioning to a low-carbon future, favoring those with clear plans for diversifying their portfolios and embracing renewable energy sources.

As the trading year unfolds, Canada's energy sector stands at a pivotal moment. Successfully navigating the intricate web of geopolitical risks, evolving climate policies, and technological advancements will be paramount to securing its future and unlocking its full potential. The ability to adapt, innovate, and collaborate will determine whether Canada can maintain its position as a responsible and reliable energy supplier in a rapidly changing world.

Read the Full The Globe and Mail Article at:

[ https://www.theglobeandmail.com/investing/article-assessing-canadas-energy-future-to-start-the-trading-year/ ]