Verizon & Realty Income: Dividend Stock Showdown

Locales: Delaware, Texas, UNITED STATES

The Allure of Dividend Investing in a Volatile Landscape

The appeal of dividend stocks stems from their inherent ability to provide income regardless of broader market fluctuations. While capital appreciation (stock price increase) is desirable, the steady stream of dividends offers a buffer against downturns and can contribute significantly to overall portfolio returns. Selecting companies with a proven track record of dividend growth and a robust business model is paramount.

Verizon (VZ): A Communications Giant with a Solid Dividend History

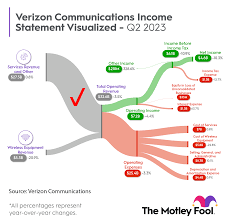

Verizon, a dominant force in the telecommunications sector, has consistently rewarded shareholders with dividends for 16 consecutive years. This commitment, reflected in its current dividend yield of approximately 6.7% (as of January 18, 2026), signifies financial stability and a shareholder-friendly approach. Verizon's strength lies in its extensive network infrastructure and vast customer base, providing a reliable revenue stream.

Beyond the current yield, Verizon's significant investment in 5G technology is a crucial factor for future growth. The rollout of 5G is not just about faster mobile data; it's enabling a whole host of new services and applications for both consumers and businesses - from connected cars to smart cities. While the 5G rollout has faced challenges (including infrastructure deployment costs and regulatory hurdles), the long-term potential remains substantial. Investors should be mindful of the competitive landscape; T-Mobile and AT&T represent significant rivals. Verizon's ability to differentiate its offerings and maintain its market share will be key to continued success and dividend sustainability.

Realty Income (O): The Monthly Dividend REIT Advantage

Realty Income, structured as a Real Estate Investment Trust (REIT), offers a unique proposition: monthly dividend payments. This frequency is particularly appealing to those seeking to supplement regular income. REITs, by law, must distribute a significant portion of their taxable income to shareholders, contributing to attractive dividend yields, currently around 5.3% (as of January 18, 2026).

Realty Income's portfolio is characterized by a geographically diverse collection of commercial properties, leased to a wide range of tenants. This diversification reduces risk compared to REITs concentrated in a single sector or region. The company's emphasis on long-term leases provides a predictable and stable income stream. However, REITs are sensitive to interest rate changes - rising rates can increase borrowing costs and potentially impact profitability. Furthermore, economic downturns can negatively impact occupancy rates and rental income. Analyzing the REIT's tenant base and lease terms is crucial to assessing its long-term viability.

Comparing the Two: Which Investment is Right for You?

While both Verizon and Realty Income present attractive dividend opportunities, they cater to different investment styles. Verizon offers a higher dividend yield but carries exposure to the competitive telecommunications industry. Its future growth is closely tied to the success of 5G adoption. Realty Income, on the other hand, provides the convenience of monthly payments and a broader exposure to the real estate sector. However, its performance is linked to the health of the commercial real estate market and interest rate environments.

Beyond the Numbers: Due Diligence is Key

Investing in dividend stocks requires more than just a quick glance at yield. A thorough understanding of the company's business model, competitive landscape, financial health, and potential risks is essential. Consider factors like debt levels, cash flow generation, and management's dividend policy. Diversification is always a good practice - don't put all $2,000 into a single stock, even seemingly "safe" ones. Consultation with a qualified financial advisor is recommended, especially for those new to dividend investing.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/20/got-20000-2-top-dividend-stocks-to-buy-in-2026/ ]