Small-Cap Rally: Is It a Trend or a Mirage?

MarketWatch

MarketWatchLocales: New York, California, UNITED STATES

The Current Landscape and Contributing Factors

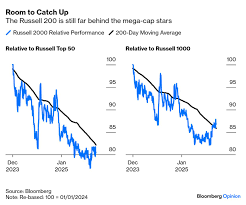

The recent outperformance of small-cap stocks has been attributed to several potential drivers. Some analysts believe the improved economic outlook provides greater growth opportunities for smaller, more agile companies. Others suggest a re-evaluation of the dominance of mega-cap technology stocks within the S&P 500 is playing a role, as investors seek diversification and potentially higher growth elsewhere. The narrative suggests a desire for investments beyond the established tech giants.

However, experts caution against interpreting this trend as a definitive, long-term shift. Brian Gendreau, head of investment strategy at Cetera Investment Management, emphasizes that small-cap performance is inherently cyclical, heavily influenced by macroeconomic conditions. Specifically, small caps tend to thrive when the economy is robust and interest rates are trending downwards. The current expectation of continued economic improvement and potential Federal Reserve rate cuts provides a tailwind for this asset class.

Historical Context: A Cyclical Pattern

Looking back, the historical relationship between small-cap and large-cap stock performance demonstrates a recurring pattern of outperformance followed by periods of underperformance. The 1980s saw small caps consistently outperform, followed by a decade of dominance by large caps in the 1990s. This pattern continued throughout the 2000s and 2010s, illustrating the cyclical nature of these market segments. This historical perspective underscores that market leadership is rarely permanent.

"Small caps can be a compelling investment option, but it's crucial to acknowledge that their performance isn't guaranteed," Gendreau warns. This acknowledgement is vital for any investor considering allocating capital to this asset class.

Navigating the Uncertainty: What to Watch

Given the cyclical nature and inherent volatility of small-cap stocks, investors should remain vigilant and closely monitor key economic indicators. Several factors deserve particular attention:

- Economic Data: Data releases related to inflation, unemployment rates, and Gross Domestic Product (GDP) growth will provide vital clues about the health of the economy and potential shifts in direction. A slowdown in any of these areas could negatively impact small-cap performance.

- Interest Rate Policy: The Federal Reserve's monetary policy decisions, particularly regarding interest rates, will continue to exert a significant influence. Further rate cuts would typically support small-cap growth, while rate hikes could dampen it.

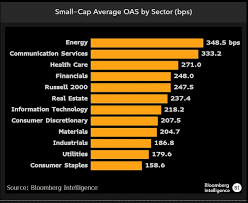

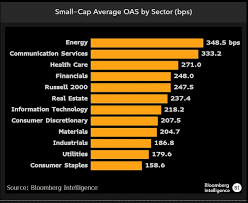

- Valuation Levels: Currently, small-cap stocks are trading at a premium valuation compared to their larger counterparts. This premium implies limited potential for further upside and increases the risk of a correction if market sentiment shifts.

The Mirage Effect: Proceed with Caution

The current outperformance of small-cap stocks, while encouraging for some investors, may ultimately prove to be a temporary phenomenon - a "mirage" as some analysts describe it. It's essential to avoid the trap of assuming this short-term trend represents a fundamental change in market dynamics. A measured and cautious approach is warranted, considering the broader market context and recognizing the inherent risks associated with investing in smaller companies. Diversification and a long-term investment horizon remain key to successful portfolio management.

Read the Full MarketWatch Article at:

[ https://www.marketwatch.com/story/small-stocks-have-crushed-big-ones-this-year-but-that-may-just-be-a-mirage-dcd84284 ]