Generational Wealth Shift: $68 Trillion at Stake

Boston Herald

Boston HeraldLocales: Massachusetts, UNITED STATES

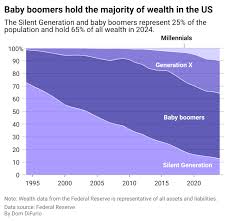

A Generational Handover of Historic Proportions

The $68.4 trillion figure is a conservative estimate, representing a significant portion of national wealth. It encompasses a broad spectrum of assets - from traditional investments like stocks and bonds to tangible holdings such as real estate, privately held businesses, and valuable collectibles. This wealth isn't just liquid cash; it's productive capital that will be deployed, invested, and managed by a new generation.

Millennials and Gen Z: The Inheritors of a New Financial Power

The primary recipients of this staggering wealth are Millennials (born 1981-1996) and Gen Z (born 1997-2012). While previous generational shifts occurred, this one is distinguished by the sheer volume of capital involved. These younger generations, often burdened with student loan debt and facing economic uncertainties in their own right, are now suddenly positioned with the potential to wield substantial financial influence.

However, this newfound power isn't without its complexities. Financial literacy remains a significant concern. While some inheritors will undoubtedly be sophisticated investors, many may lack the experience and knowledge to manage such significant assets effectively. This presents a risk of misallocation and potential financial setbacks for individuals and, potentially, the wider economy.

Economic Ripple Effects: Opportunity and Disruption

The Great Wealth Transfer is expected to trigger a cascade of economic changes:

- Entrepreneurial Renaissance: Increased access to capital will undoubtedly fuel a resurgence in entrepreneurship. Expect a surge in new business formations, particularly in innovative sectors. Younger generations are also demonstrating a preference for purpose-driven businesses, suggesting a focus on socially responsible ventures.

- Technology Investment Surge: Millennials and Gen Z are digital natives, comfortable with emerging technologies. Their investment preferences will likely drive significant growth in sectors like artificial intelligence, renewable energy, blockchain technology, and biotechnology, accelerating innovation and potentially disrupting established industries.

- Philanthropy Reimagined: The next generation of philanthropists is likely to approach charitable giving differently than their predecessors. Expect a shift towards impact investing, focusing on measurable social and environmental outcomes, and a greater emphasis on addressing systemic inequalities.

- Real Estate Market Dynamics: The disposition of inherited real estate will create localized fluctuations in property values. While some areas may experience a boost from new investment, others could see a decline as properties are sold off. This necessitates careful regional economic analysis.

- Potential for Increased Inequality: While opportunities abound, the Great Wealth Transfer also risks exacerbating existing wealth inequalities. If access to financial education and advice isn't equitable, the gap between the haves and have-nots could widen.

Navigating the Challenges and Preparing for the Future

The Great Wealth Transfer is not a singular event but a protracted process unfolding over the next two to three decades. Policymakers, financial institutions, and individuals alike must proactively address the challenges it presents. Estate tax reform, simplification of inheritance processes, and increased financial literacy programs are crucial. Furthermore, fostering a culture of responsible wealth management and encouraging long-term, sustainable investment strategies will be paramount to ensuring that this generational shift benefits society as a whole.

As we enter 2026, understanding the nuances of the Great Wealth Transfer is no longer optional; it's essential for navigating the economic landscape of the future.

Read the Full Boston Herald Article at:

[ https://www.bostonherald.com/2026/01/24/great-wealth-transfer/ ]