Nvidia: $2,000 Investment Soars to $21,080 in 5 Years

Locales: UNITED STATES, TAIWAN PROVINCE OF CHINA

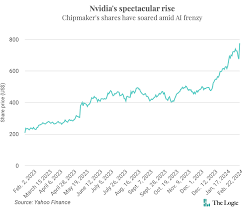

Nvidia (NVDA) five years ago. An initial investment of just $2,000 in January 2021 would now be worth a staggering approximately $21,080, demonstrating the phenomenal growth trajectory of the semiconductor giant. This analysis explores the factors behind this impressive return and offers a snapshot of Nvidia's journey over the past half-decade.

A Rewind to 2021: The Initial Investment

Back on January 8, 2021, Nvidia stock was trading at around $24.28 per share. A $2,000 investment at this price would have secured approximately 82.30 shares. While seemingly a modest sum at the time, these shares represent a substantial claim on a company poised for explosive growth.

The Present Day: A Tenfold Increase

As of today, January 8, 2026, Nvidia's stock is trading at approximately $256.19 per share. Multiplying this current price by the original 82.30 shares yields a remarkable total of approximately $21,080. This represents a tenfold increase on the initial investment, a return that significantly outperforms many other sectors of the market.

Navigating the 2024 Stock Split

It's crucial to note a key event in Nvidia's recent history: the 10-for-1 stock split that occurred on June 7, 2024. This corporate action increased the number of outstanding shares, making the stock more accessible to a wider range of investors. Simultaneously, the price per share was reduced by a factor of ten. The aforementioned calculation already accounts for this split, meaning the $21,080 figure reflects the adjusted share count and price.

The AI Revolution Fuels Nvidia's Ascent

But what drove such extraordinary growth? The answer lies squarely in Nvidia's leadership within the burgeoning field of Artificial Intelligence (AI). The company's Graphics Processing Units (GPUs) have become the industry standard for training the complex algorithms powering large language models and a wide range of AI applications. The relentless demand for these GPUs, particularly within data centers, has fueled Nvidia's revenue and, consequently, its stock price.

Initially recognized for its prowess in gaming graphics, Nvidia strategically pivoted to capitalize on the AI boom. Its CUDA platform, a parallel computing architecture, provides the necessary framework for developing and deploying AI models. This foresight, coupled with consistent innovation in GPU technology, has cemented Nvidia's position as a critical enabler of the AI revolution.

The demand isn't limited to tech giants either. Industries like automotive (self-driving cars), healthcare (medical image analysis), and finance (algorithmic trading) are increasingly reliant on AI, and therefore, on Nvidia's GPUs. This diversified demand further solidifies Nvidia's long-term growth potential.

Beyond the Numbers: A Look at Nvidia's Innovation

Nvidia's success isn't purely a matter of riding the AI wave. The company continues to invest heavily in research and development, consistently pushing the boundaries of what's possible with GPU technology. Its Hopper architecture, for example, introduced significant performance improvements for AI workloads, maintaining its competitive edge. Furthermore, Nvidia's foray into data center systems, offering complete AI infrastructure solutions, demonstrates a commitment to providing end-to-end capabilities.

A Word of Caution: Investing Involves Risk

While the past five years have been exceptionally lucrative for Nvidia investors, it is vital to remember that historical performance is not indicative of future results. The stock market inherently carries risk, and even the most promising companies can experience fluctuations. This analysis is for informational purposes only and should not be construed as financial advice. Potential investors should conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/07/you-invest-2000-nvidia-stock-5-years-ago-how-much/ ]