Quantum Computing Stocks to Watch in 2026: IonQ, Rigetti, and IBM

Locale: New York, UNITED STATES

The Quantum Leap in Investing: A Summary of Top Quantum Computing Stocks for 2026

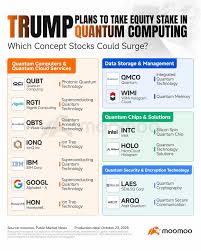

The Motley Fool article "3 Top Quantum Computing Stocks to Buy in 2026" (published Jan 7, 2026 - accessed Feb 29, 2024) identifies three companies positioned to capitalize on the burgeoning, albeit still nascent, quantum computing industry: IonQ, Rigetti Computing, and IBM. The article stresses that quantum computing remains a high-risk, high-reward investment area, characterized by significant technological hurdles and a long timeline for widespread commercialization. However, it argues that these three companies are leading the charge and represent compelling opportunities for investors with a long-term outlook and high risk tolerance.

The Quantum Computing Landscape – Why Now?

The article begins by outlining the fundamental promise of quantum computing. Unlike classical computers which store information as bits representing 0 or 1, quantum computers leverage qubits. Qubits utilize quantum mechanical phenomena like superposition and entanglement to represent 0, 1, or both simultaneously. This enables quantum computers to potentially solve complex problems currently intractable for even the most powerful supercomputers. Applications touted include drug discovery, materials science, financial modeling, logistics optimization, and artificial intelligence.

However, the article is quick to point out the current limitations. Building and maintaining stable qubits is incredibly challenging. They are extremely sensitive to environmental noise (decoherence) requiring supercooled, isolated environments. Scalability – increasing the number of qubits while maintaining coherence – remains a major obstacle. Furthermore, programming quantum computers requires entirely new algorithms and a skilled workforce, which is currently in short supply. Despite these challenges, the article highlights growing investment from both public and private sectors, signifying increasing confidence in the technology's eventual impact.

IonQ: The Trapped-Ion Pioneer

IonQ (NYSE: IONQ) is presented as a leading player utilizing trapped-ion technology. This approach uses individual ions (electrically charged atoms) held in place by electromagnetic fields as qubits. The article points to IonQ's claimed technological advantages: higher qubit fidelity (accuracy) and longer coherence times compared to other approaches. They’ve consistently demonstrated improvements in these areas, evidenced by increasing algorithmic qubits – qubits capable of running complex algorithms.

The Fool’s analysis emphasizes IonQ’s growing customer base, including collaborations with research institutions, government agencies, and companies like Samsung and Airbus. IonQ offers access to its quantum computers through cloud services, a model crucial for attracting early adopters and allowing experimentation without requiring massive upfront infrastructure investment. A key aspect highlighted is IonQ's focus on system-level performance rather than simply increasing qubit count. The article acknowledges IonQ’s relatively small revenue and continued losses, classifying it as a growth stock dependent on future technological breakthroughs and market adoption. They recently announced a partnership with T-Systems, a Deutsche Telekom subsidiary, expanding its reach into the European market and demonstrating growing commercial traction (as detailed on IonQ's investor relations page: [ https://ir.ionq.com/news-releases ]).

Rigetti Computing: Integrated Quantum Computing & Fabless Manufacturing

Rigetti Computing (NASDAQ: RGTI) differentiates itself through its vertically integrated approach. Unlike IonQ which focuses solely on the quantum processing unit (QPU), Rigetti designs, manufactures, and operates its own superconducting qubit processors. This ‘fabless’ model (designing but outsourcing the physical manufacturing) gives them greater control over the entire process and allows for faster iteration.

The Motley Fool’s assessment notes Rigetti’s historical struggles with profitability and stock volatility. However, the article points to recent advancements in their multi-chip processor architecture, “Ankaa”, which aims to improve scalability by interconnecting multiple qubit chips. This is a crucial step towards building larger, more powerful quantum computers. Rigetti also offers cloud access to its processors through its Quantum Cloud Services (QCS) platform and is actively pursuing applications in areas like machine learning and materials science. The article notes that Rigetti recently secured a contract with the U.S. Department of Energy, further validating their technology and providing a significant revenue stream (detailed in this press release: [ https://www.rigetti.com/news/rigetti-computing-secures-up-to-30-million-doe-contract-to-advance-quantum-computing ]). The analysis views Rigetti as a riskier play than IonQ, but with potentially higher upside if they can successfully scale their technology.

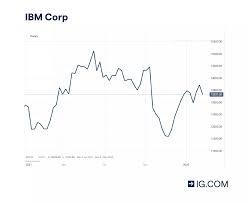

IBM: The Established Powerhouse

IBM (NYSE: IBM) is presented as the most established and diversified player in the quantum computing space. While not a pure-play quantum company, IBM has invested heavily in quantum research and development for over a decade, building a robust team, developing quantum hardware (superconducting qubits), and creating the Qiskit open-source software development kit.

The article argues that IBM's strength lies in its ability to integrate quantum computing into its existing enterprise services and cloud infrastructure. They offer access to their quantum computers via the IBM Quantum Experience cloud platform, boasting the largest number of publicly available quantum processors. Furthermore, IBM is focusing on developing "quantum-ready" applications and building a quantum ecosystem. The Motley Fool highlights IBM’s commitment to building a 1000+ qubit system – Osprey – and a future 4000+ qubit system, demonstrating a long-term vision for quantum computing. Although IBM's quantum division currently represents a small fraction of its overall revenue, the article posits that it could become a significant growth driver in the future. IBM’s stability and financial resources mitigate some of the risks associated with investing in pure-play quantum companies, making it a more conservative, yet potentially rewarding, option.

Conclusion:

The Motley Fool article concludes by reiterating the speculative nature of quantum computing investments. While the potential rewards are significant, the risks are equally high. IonQ, Rigetti, and IBM are identified as leading companies with distinct strengths and weaknesses. Investors considering these stocks should conduct thorough due diligence, understand the technological challenges, and have a long-term investment horizon. The article emphasizes that quantum computing is a marathon, not a sprint, and patience will be crucial for realizing the technology’s full potential.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/07/3-top-quantum-computing-stocks-to-buy-in-2026/ ]