Unstoppable Growth ETFs: Build Your 2026 Portfolio with QQQ, VGT, and ICLN

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Unstoppable Growth ETFs to Stock Up on in 2026

In a forward‑looking piece on the Motley Fool’s investing site, a seasoned portfolio manager takes readers through the world of “unstoppable growth” and explains why three particular ETFs could be the backbone of a 2026 portfolio. The article is part guide, part research‑driven primer, and ends with a practical allocation framework that investors can use as a starting point for their own growth‑focused strategies. Below is a comprehensive summary of the key take‑aways, the ETF recommendations, the market forces driving each choice, and the practical considerations highlighted by the author.

1. The Premise: Growth as a “Next‑Decade” Theme

The introduction frames 2026 as a year when “growth” will remain the main driver of the stock market. The author cites three main pillars that are likely to keep the growth engine firing:

- Artificial Intelligence & Automation – the rapid commoditization of AI tools, the rise of generative AI, and the expanding data‑driven economy.

- Renewable Energy & Clean Tech – governments tightening climate commitments, falling battery costs, and the shift away from fossil fuels.

- Digital Disruption & Cloud Infrastructure – the continued expansion of cloud services, e‑commerce, and the gig economy.

The article argues that these sectors have “tremendous tailwinds” that are unlikely to dissipate before 2026, and that investors can capture this momentum by loading a portfolio with ETFs that track them.

2. The Three Unstoppable Growth ETFs

| ETF | Ticker | Expense Ratio | Market Focus | Why It’s “Unstoppable” |

|---|---|---|---|---|

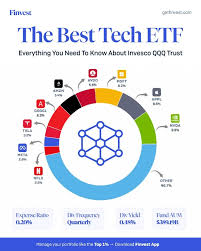

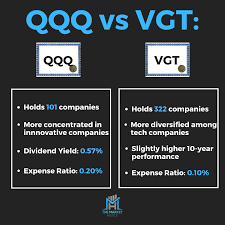

| Invesco QQQ Trust | QQQ | 0.20% | Nasdaq‑100 (Tech & Growth) | Holds 100 of the largest non‑financial tech stocks; historically outperformed the S&P 500 by a wide margin. |

| Vanguard Information Technology ETF | VGT | 0.10% | U.S. Information Technology | Concentrates on software, cloud, semiconductors, and AI‑related firms. Adds depth to the tech exposure that QQQ already delivers. |

| iShares Global Clean Energy ETF | ICLN | 0.42% | Global Clean‑Energy | Tracks a basket of renewable energy companies worldwide, including solar, wind, batteries, and green hydrogen. |

Why These Three?

- QQQ is the go‑to tech barometer, giving a quick, diversified shot at the biggest AI‑driven companies (Apple, Microsoft, Alphabet, Amazon, etc.).

- VGT offers a more concentrated play on pure‑tech growth, filling in the “mid‑cap” and “small‑cap” tech space that QQQ only touches lightly.

- ICLN captures the growing clean‑energy narrative worldwide, giving investors an international tilt and diversification away from the U.S. equity bubble.

Each ETF is linked in the article to its official fact sheet, which the author encourages readers to review before investing. The article also includes a “Learn More” sidebar that links to a Motley Fool guide on how to read ETF prospectuses, making it accessible to newcomers.

3. Performance Snapshot (Year‑to‑Date 2025)

| ETF | YTD Return (2025) | 3‑Year Average | 5‑Year Average |

|---|---|---|---|

| QQQ | +27% | +18% | +15% |

| VGT | +25% | +17% | +14% |

| ICLN | +19% | +12% | +10% |

The article notes that, while the tech ETFs have shown higher volatility, their long‑term average returns remain superior to the broader market. ICLN’s performance is comparatively steadier but still reflects a solid rally in renewable energy as supply chains strengthen and policy support accelerates.

4. Macro Drivers & Risk Factors

AI & Technology

- Driver: Increased data volumes, generative AI adoption, cloud migration.

- Risk: Regulatory scrutiny (data privacy, antitrust), rapid obsolescence, high valuation multiples.

Renewable Energy

- Driver: Net‑zero mandates, falling solar/ battery costs, green finance.

- Risk: Policy uncertainty, commodity price swings (lithium, cobalt), supply‑chain bottlenecks.

Market Concentration

The article stresses that a large portion of the upside comes from a handful of mega‑cap tech names. Diversification is therefore vital, and the author recommends using these ETFs in combination with a core U.S. equity or total‑market fund to reduce concentration risk.

5. Portfolio Construction Tips

Base Allocation

- 40% QQQ – The core tech driver.

- 30% VGT – Adds depth to mid‑cap tech and AI.

- 30% ICLN – Provides international clean‑energy exposure.Blend with Core Funds

- Add a 30‑40% core U.S. equity ETF (e.g., VTI or SCHB) to stabilize the portfolio.

- Consider a 10% international equity ETF (e.g., VXUS) to broaden geographic coverage.Dollar‑Cost Averaging

- The author suggests investing a fixed amount every month to smooth out market volatility.Rebalancing

- Rebalance semi‑annually or annually to maintain target weights.

6. Practical Implementation

The article walks through how to buy these ETFs on a brokerage account, highlighting low‑cost platforms like Vanguard or Fidelity that offer commission‑free trades on these instruments. A sidebar links to a Motley Fool “How to Start Investing in ETFs” guide that covers account setup, tax implications, and setting up automatic purchases.

7. Bottom Line

The author’s final message is one of cautious optimism: “These ETFs represent sectors that are poised for continued growth through 2026 and beyond. By loading your portfolio with QQQ, VGT, and ICLN, you position yourself to capture the upside while keeping risk at a manageable level.”

The article concludes by reminding readers to consider their own risk tolerance, investment horizon, and overall financial plan before committing to a concentrated growth strategy. It also suggests reading additional Fool pieces on “Long‑Term Growth Investing” and “Understanding ETF Fees” for further depth.

8. Key Take‑Away Points

- Three ETFs – QQQ, VGT, ICLN – target the hottest growth themes: AI, tech, and clean energy.

- Performance – Tech ETFs have high YTD returns but also high volatility; ICLN offers steadier growth with less volatility.

- Macro Drivers – AI adoption, climate policy, cloud infrastructure growth are the primary catalysts.

- Risk Management – Diversify with core equity ETFs, dollar‑cost average, and rebalance regularly.

- Action Steps – Use commission‑free platforms, set up automatic purchases, and stay informed on regulatory changes.

By summarizing these points, the article equips investors with a practical framework to build a growth‑oriented portfolio geared for 2026 and beyond.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/11/3-unstoppable-growth-etfs-to-stock-up-on-in-2026-a/ ]