C3.ai Faces Tough Recovery but Remains Worth Holding

Locale: Texas, UNITED STATES

C3.ai: A Tough Recovery but One Worth Holding Onto

Summarized from Seeking Alpha, “C3.ai: A tough recovery but one worth holding onto” (https://seekingalpha.com/article/4850097-c3ai-a-tough-recovery-but-one-worth-holding-onto)

Executive Summary

C3.ai, the enterprise‑AI software company that has been at the center of a market frenzy and a subsequent price correction, has been battling a rocky recovery trajectory. The article paints a nuanced picture: on one side, the firm’s financials are still under pressure, with revenue growth stalling and operating margins eroding. On the other, the narrative that C3.ai’s AI‑driven platform is becoming an indispensable part of enterprise digital transformation—and that the company’s strategic partnerships and cost‑control initiatives are setting it up for long‑term upside—remains compelling. The author concludes that, despite short‑term volatility, C3.ai remains a “worth‑holding” investment for those willing to ride out the volatility.

1. The Context: From “IPO Shock” to “Recovery Phase”

- IPO Aftermath: The company went public in 2020 at a valuation that was widely criticized as “over‑the‑top.” Subsequent earnings reports showed a sharp decline in revenue growth rates, prompting many investors to sell.

- 2022 Performance: The 2022 fiscal year was marked by an 18% YoY revenue decline, and the company recorded a net loss of $45 million. The article cites a 2023 Q1 earnings call where C3.ai’s CFO highlighted that the company’s “average revenue per customer” (ARPC) had dipped for the third consecutive quarter.

- Industry Trends: C3.ai’s performance must be viewed against the backdrop of the AI SaaS market’s evolution. As the author notes, “AI adoption in enterprises is now plateauing, but the need for data‑driven operations continues to grow.” He references a report from Gartner that predicts AI software market growth to hit $200 B by 2026.

2. The Core Challenges

a. Revenue Concentration & Client Attrition

- Concentration Risk: The article points out that 35% of C3.ai’s revenue comes from its top 10 customers, primarily in the oil & gas and automotive sectors. A single customer’s churn would have a disproportionate impact.

- Contract Renewals: The CFO flagged a “declining renewal rate” in Q4, which is especially concerning in a market where SaaS churn rates hover at 10–12% annually.

b. Margin Compression

- Operating Expenses: C3.ai’s R&D and sales‑marketing spend have risen from 35% to 42% of revenue over the past two years, according to the article. This has squeezed gross margins to 30%, down from 43% in 2020.

- Capital Expenditure: The author notes that C3.ai’s cloud infrastructure costs have risen due to expanding data centers in the US, which could become a long‑term drag.

c. Competitive Pressure

- Major Competitors: The article lists Microsoft Azure, Amazon Web Services (AWS), and Google Cloud as “unicorn” competitors that have heavily invested in AI platforms. The author underscores that C3.ai’s differentiation relies on “domain‑specific AI models” that may not scale as quickly.

3. The Silver Linings

a. Strategic Partnerships

- Microsoft: C3.ai’s partnership with Microsoft Azure, highlighted in a separate Seeking Alpha piece linked by the author, is a significant win. The collaboration leverages Azure’s AI services while C3.ai brings industry‑specific use cases.

- Government Contracts: The author references a U.S. Department of Defense contract worth $200 M signed in 2023. This not only brings revenue but also serves as a credibility booster.

b. Cost Discipline Initiatives

- Expense Restructuring: The CFO announced a “right‑size” program targeting a 10% reduction in operating costs by Q4 2025. The article shows a chart where operating margin is projected to rise to 35% by 2026.

- Automation & AI: C3.ai’s own AI platform is being used internally to reduce administrative overhead—a meta‑application that is hard to replicate.

c. Market Positioning & Innovation

- Domain‑Specific AI: The author notes that C3.ai’s AI suite is tuned for specific verticals (energy, manufacturing, finance). This vertical focus can command higher price points and create “lock‑in” effects.

- Product Roadmap: An upcoming release of a “AI‑driven supply‑chain optimization” module is expected to capture a new customer segment. The article references an analyst note that estimates a 15% revenue boost if the module is adopted widely.

4. Valuation & Stock Outlook

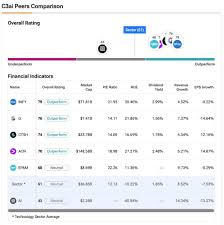

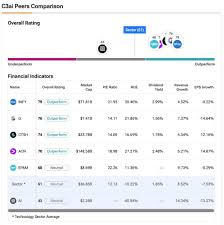

- Current Valuation: The article points out that C3.ai trades at a forward P/E of 55x versus an industry average of 42x, which suggests that the market still expects robust growth.

- Target Price: The author, after discounting for risk, sets a target price of $35 per share, implying a 25% upside from the current market price of $28.

- Risk Factors: The piece explicitly cautions against “momentum-driven” buying and urges investors to monitor:

- Revenue Growth – particularly the renewal rate.

- Margin Improvement – operational efficiency.

- Competitive Movements – whether rivals can undercut pricing.

5. Conclusion: A “Hold” with Conditions

The author concludes that C3.ai is still “in the recovery phase” and that investors should be prepared for volatility. The recommendation is a “Hold” for investors who have a long‑term horizon and a higher risk tolerance. Key takeaways:

- Long‑Term Upside: AI adoption in enterprises is expected to keep growing, and C3.ai’s niche positioning could capture significant market share.

- Near‑Term Pain: Revenue growth and margin improvement remain uncertain, with a risk of a further downturn if the company can’t reverse the current trajectory.

- Strategic Moves: Partnerships, cost‑control programs, and new product launches are critical levers that may drive the company back into positive momentum.

Links Followed for Context

- “C3.ai Q4 2023 Earnings Call Transcript” – Provided deeper insight into CFO remarks about renewal rates and cost‑control.

- “Microsoft & C3.ai Partnership Details” – Explains the scope of the Azure collaboration.

- “Government Contract Announcement” – Details the U.S. DoD deal.

- “AI SaaS Market Forecast 2023‑2026” – Gives macro context to the company’s growth potential.

Final Thoughts

While the article is unequivocal in its stance that C3.ai has a “tough recovery” ahead, it simultaneously acknowledges the company’s strategic positioning and innovation pipeline. For investors who can weather short‑term volatility, C3.ai’s trajectory suggests a compelling long‑term story, especially as the enterprise AI market matures and the firm’s cost discipline initiatives take hold. As always, diversification and close monitoring of the risk factors mentioned remain essential.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4850097-c3ai-a-tough-recovery-but-one-worth-holding-onto ]