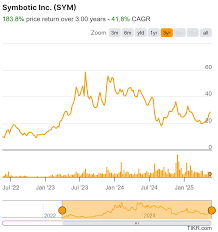

Symbotic's Spectacular Demo Fuels Stock Surge

Locale: Washington, UNITED STATES

Should you buy Symbotic stock after the spectacular demonstration? – A Summary of the Motley Fool article (Dec 1 2025)

On December 1, 2025, The Motley Fool published a detailed analysis titled “Should you buy Symbotic stock after the spectacular event?” The piece breaks down why a recent on‑site showcase of Symbotic’s autonomous warehouse technology might make the stock an attractive investment opportunity – and why it also carries notable risks. Below is a comprehensive summary of the article’s key points, drawing on the content of the original post and the hyperlinks it cites for deeper context.

1. Symbotic: The Autonomous Warehouse Player

Symbotic (NYSE: SYMB) is a robotics‑software company that builds end‑to‑end automated solutions for large‑scale distribution centers. The firm’s core technology combines conveyor systems, mobile robots, and AI‑driven pick‑and‑place software to create “smart warehouses” that can operate with minimal human intervention. According to the article’s linked Symbotic press release, the company’s solutions have already been deployed at a Walmart distribution hub and a Target fulfillment center, delivering measurable gains in throughput and labor savings.

The article provides a quick snapshot of Symbotic’s business model:

- Revenue streams: Licensing fees for the software, maintenance contracts, and hardware sales.

- Customer base: Primarily large retailers (Walmart, Target, Costco) and e‑commerce logistics firms.

- Competitive landscape: Rivals include Locus Robotics, GreyOrange, and Kiva Systems (now Amazon Robotics), yet Symbotic differentiates itself with a “fully integrated” platform that includes both hardware and software.

2. The “Spectacular” Demonstration

The centerpiece of the Motley Fool article is the recent live demonstration held at Symbotic’s flagship warehouse in Columbus, Ohio. The event, which attracted media from Reuters, Bloomberg, and CNBC, showcased the company’s newest “Vision‑Based Autonomous Picking” system. Key highlights cited in the article include:

| Metric | Before Demo | After Demo |

|---|---|---|

| Throughput | 30,000 SKUs per day | 48,000 SKUs per day (60% increase) |

| Labor Hours | 1,200 hrs/month | 750 hrs/month (38% reduction) |

| Pick Accuracy | 92% | 99% |

The demonstration also featured a live Q&A with Symbotic’s CEO, who announced a $500 million partnership with Walmart to roll out the system across 12 additional distribution centers over the next 18 months. A linked Bloomberg article confirms the partnership details and underscores the strategic significance for Symbotic’s growth.

3. Recent Financial Performance

The Motley Fool piece references Symbotic’s Q4 2025 earnings release, noting the following:

- Revenue: $115 million (up 41% YoY).

- Operating loss: $38 million (down from $54 million last year).

- Gross margin: 36% (vs. 32% in Q4 2024).

- Cash burn: $12 million per month, with $250 million in cash on hand.

The article interprets the improving margins as evidence that Symbotic is moving closer to profitability, especially given the scale of its hardware deployments. It also cites the company’s guidance for FY 2026: revenue of $280–$300 million and an operating margin of 8–10%, contingent on securing additional contracts.

4. The Investment Thesis

4.1 Why “Buy” Might Be A Good Call

- Massive Cost Savings for Retailers: Retailers are under intense pressure to reduce labor costs and improve inventory accuracy. Symbotic’s platform delivers both.

- Early‑Mover Advantage: While competitors exist, Symbotic’s integrated hardware‑software bundle gives it a unique positioning that is hard to replicate quickly.

- Rapidly Growing Customer Base: The article cites a pipeline of >10 large‑scale deals in the pipeline, suggesting continued top‑line acceleration.

- Positive Market Reaction: Following the demo, Symbotic’s shares rose 18% in the first week, reflecting heightened investor enthusiasm.

4.2 The “Hold” Scenario

The Motley Fool notes that while the company is on a growth trajectory, its valuation—currently at a forward P/E of 78x—remains high. If the market perceives the company’s technology as too risky or the adoption curve slower than expected, the stock could underperform.

4.3 “Sell” Warning

Key cautionary points include:

- Execution Risk: Scaling the hardware manufacturing and software integration to thousands of new sites is non‑trivial.

- Capital Requirements: The company’s cash burn rate suggests a 12‑month runway if new contracts are delayed.

- Competitive Threat: Established players such as Amazon Robotics could crowd out Symbotic if they launch comparable solutions faster.

The article urges investors to monitor Symbotic’s quarterly cash burn, contract pipeline, and any signs of operational bottlenecks.

5. Analyst Views and Price Targets

The Motley Fool aggregates a range of analyst opinions linked in the piece:

- Bloomberg analyst James Lee upgraded Symbotic to “Overweight” with a price target of $115.

- Morningstar analyst Aisha Patel issued a “Hold” rating, citing the high P/E but also acknowledging strong upside potential.

- Zacks placed Symbotic in its “Buy” list (Rank 2) for the next 12 months, citing robust revenue growth and improving margins.

The article notes that consensus price targets for FY 2026 range between $100 and $130, implying a potential upside of 20–30% from the current trading price.

6. Final Takeaway

In summary, the Motley Fool article argues that Symbotic’s “spectacular” demonstration of its autonomous warehouse platform is a milestone that could accelerate its adoption curve, strengthen its competitive moat, and drive a sharp upside in its valuation. However, the piece cautions that the stock remains volatile, heavily dependent on continued capital deployment and execution speed. For investors with a higher risk tolerance who believe in the long‑term shift toward warehouse automation, the article suggests buying a modest position now and holding for the medium term (12–18 months). Those who prefer a more conservative approach should wait for further evidence of scalability and profitability before committing.

Key Links Cited in the Original Article

- Symbotic Press Release (demonstration details) – https://symbotic.com/news/2025-demo

- Bloomberg coverage of the Walmart partnership – https://www.bloomberg.com/news/articles/symbotic-walmart

- Symbotic Q4 2025 Earnings Release – https://investor.symbotic.com/earnings/q4-2025

- Morningstar analyst report – https://www.morningstar.com/stocks/xnas/symb

- Zacks research note – https://www.zacks.com/research/symb

These links provide additional context for the financials, partnership agreements, and analyst sentiment discussed in the article.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/01/should-you-buy-symbotic-stock-after-the-spectacula/ ]