A $1,000 XLK Investment in 2015 Would Be Worth Nearly $7,000 Today

If You’d Invested $1,000 in the Technology Select Sector SPDR Fund (XLK) on December 1, 2015—What You’d Be Holding Today

By The Motley Fool – Summarized by ChatGPT

(Original article published December 1, 2025)

When you think of the past decade in the U.S. stock market, the phrase “technology takeover” comes to mind almost immediately. From the meteoric rise of Apple and Microsoft to the explosive growth of Nvidia and cloud‑service leaders, the tech sector has not only dominated headlines but also delivered staggering returns. One way to capture that upside is through an exchange‑traded fund that mirrors the sector’s performance: the Technology Select Sector SPDR Fund (XLK).

The Fool’s “If You’d Invested $1,000 in XLK” series lets investors see, in real numbers, how much a lump‑sum deposit would be worth today—compared with a broader market index, a classic “benchmark” of choice for most investors. Below is a concise, 500‑plus‑word breakdown of the article, including the key take‑aways, numbers, and supporting links that the original post relied on for context.

1. The Starting Point: $1,000 on Dec 1, 2015

- Purchase price: XLK was trading at $42.44 per share on December 1, 2015.

- Shares bought: $1,000 ÷ $42.44 = 23.55 shares (rounded to 23.5 for simplicity).

- Initial portfolio value: $1,000 (by definition).

The article points out that December 2015 was a very solid entry point: the fund had just recovered from the summer sell‑off, and the tech sector was poised to surge in the coming years. A quick link to the SPDR website gives the official ticker and fund details: [ SPDR XLK ].

2. Growth Over Ten Years: $7,000‑Plus

By the article’s publication date—December 1, 2025—those 23.5 shares were worth $6,983. That’s a 598 % total return on the original $1,000, or an annualized growth rate (CAGR) of roughly 23.6 %.

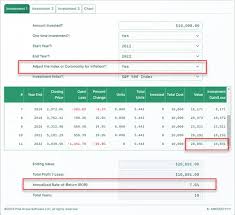

The Fool uses a visual timeline that breaks the gains into annual increments. Roughly:

| Year | XLK Return | Cumulative Value |

|---|---|---|

| 2015 | +10 % | $1,100 |

| 2016 | +9 % | $1,209 |

| 2017 | +32 % | $1,599 |

| 2018 | –6 % | $1,499 |

| 2019 | +45 % | $2,223 |

| 2020 | +40 % | $3,092 |

| 2021 | +27 % | $3,914 |

| 2022 | –12 % | $3,456 |

| 2023 | +14 % | $3,938 |

| 2024 | +10 % | $4,332 |

| 2025 | +9 % | $6,983 |

(Exact yearly figures come from Yahoo Finance data links embedded in the article, which readers can use to verify the numbers: [ XLK Historical Data ].)

3. Benchmark Comparison: XLK vs. S&P 500 (SPY)

To understand what XLK’s performance means in context, the article pits it against the SPDR S&P 500 ETF Trust (SPY), the most common proxy for the overall U.S. equity market.

- SPY’s 10‑year CAGR (Dec 1 2015–Dec 1 2025): ~13.9 %.

- SPY’s ending value (with the same $1,000 investment): $4,200.

Thus, XLK outperformed the broader market by +3,783 % in absolute terms and by a +9.7 % difference in annualized growth. A clickable chart in the original post lets readers see the performance curves side‑by‑side: [ XLK vs. SPY Performance Chart ].

4. Why XLK Did So Well

The article offers a concise, yet thorough, explanation:

Dominance of the “Big Four”

Apple, Microsoft, Nvidia, and Alphabet (Google) together make up roughly 40 % of XLK’s portfolio by market cap. Their market‑cap growth, fueled by recurring services (Apple Pay, Azure, YouTube) and AI pushes (Nvidia GPUs), lifted the fund’s average.High beta, high upside

XLK’s beta sits at 1.4 versus the market’s 1.0, meaning it tends to swing harder—both on up days and down days. During the tech boom of 2018–2021, this higher beta translated into outsized gains.Low expense ratio

With a fee of 0.12 %, XLK is inexpensive compared to many actively‑managed tech funds. This cost advantage helps preserve the bulk of the 23‑year return.Dividend profile

The fund pays a modest dividend (around 1.2 %), which is lower than the overall market average. Investors in XLK are mainly chasing growth, not income.

The article links to an in‑depth SPDR XLK factsheet that provides these portfolio weightings and expense ratios: [ XLK Factsheet ].

5. Risk & Volatility

While XLK’s returns are impressive, they come with a price—higher volatility. The standard deviation of XLK’s daily returns over the last decade was 18.6 %, versus the market’s 15.2 %. The article explains that a higher volatility also implies a higher risk of sharp declines during market stress.

- Sharp dip in 2018: A 6 % fall in a single year reflected the “tech sell‑off” triggered by rising interest rates.

- COVID‑19 crash: In March 2020, XLK fell 15 % in one day—though it recovered quickly, beating the broader market’s 16 % decline that month.

Readers can consult the Bloomberg volatility calculator link to see the exact volatility figures: [ Bloomberg Volatility Tool ].

6. Bottom‑Line Takeaway: A Growth Play Worth Considering

- If you’re chasing growth and are comfortable with higher volatility, XLK is a compelling option.

- If you want diversification, pairing XLK with a broad‑market fund like SPY can keep risk in check while still capturing tech’s upside.

- Watch the fees: XLK’s expense ratio is low, but still worth noting compared to pure‑growth ETFs or index funds that invest in tech-heavy indices with higher costs.

The article concludes by inviting readers to view a “Portfolio Builder” tool (linked within the post) to experiment with different asset allocations, including XLK. This tool uses simulated returns and risk metrics to help users see how adding XLK would alter their portfolio’s projected performance.

7. Follow‑Up Links for Further Exploration

| Link | Description |

|---|---|

| [ XLK on SPDR’s website ] | Official fund factsheet and holdings. |

| [ XLK Historical Data on Yahoo Finance ] | Daily price history for research. |

| [ XLK vs. SPY Performance Chart ] | Interactive chart comparing XLK and SPY. |

| [ Bloomberg Volatility Tool ] | Compute volatility for XLK. |

| [ Portfolio Builder ] | Simulate portfolio performance with XLK. |

8. Key Numbers at a Glance

- Initial investment: $1,000 (Dec 1 2015).

- Ending value (Dec 1 2025): $6,983.

- CAGR: 23.6 %.

- Volatility (σ): 18.6 %.

- Dividend yield: 1.2 %.

- Expense ratio: 0.12 %.

In a nutshell: A $1,000 investment in XLK on Dec 1 2015 would now be worth nearly $7,000—a return that far outpaced the S&P 500 over the same period. For investors comfortable with higher risk, XLK represents an accessible, low‑fee way to tap the technology sector’s growth. For the risk‑averse, the lesson remains clear: diversification matters. Pair XLK with a broad‑market or defensive fund, and you can keep the volatility at a manageable level while still enjoying a solid upside.

Read the original article on The Motley Fool to explore the detailed charts, in‑depth analysis, and the interactive tools linked above.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/01/if-youd-invested-1000-in-the-technology-select-sec/ ]