4 Reasons to Buy Amazon Stock Now | The Motley Fool

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

4 Reasons to Buy Amazon Stock Now – A Quick Take from Motley Fool

Amazon’s market cap has surged past $1 trillion, yet the stock remains a topic of debate among investors. In a recent Motley Fool article titled “4 Reasons to Buy Amazon Stock Now,” the writers argue that the tech giant’s fundamentals and long‑term strategy still make it an attractive buy for both long‑term holders and value‑seekers. Below is a concise rundown of the key points—plus a few extra nuggets pulled from the article’s supporting links—to help you decide whether Amazon should feature in your portfolio.

1. Amazon’s E‑Commerce Dominance is Still on the Rise

The cornerstone of Amazon’s business model is undeniably its e‑commerce platform. The article cites the company’s “unrivaled logistics network” and its aggressive investment in fulfillment centers—especially the newly opened “ultra‑fast” hubs in the Midwest—to push last‑mile delivery speeds even further. A linked section of the piece dives into the company’s FY‑2024 revenue, noting that online sales hit a record $470 billion, up 14 % YoY, largely driven by growth in North America and a rebound in international markets.

Quick fact: According to the FY‑2024 annual report (linked in the article), Amazon’s average order value has been climbing for three consecutive quarters, signaling that customers are not only buying more items but also spending more per transaction.

The article underscores that Amazon’s “first‑mover advantage in the growing categories of groceries and household essentials” keeps the company in a virtuous cycle of customer acquisition and retention. Even as the macro‑economy faces uncertainty, the sheer breadth of Amazon’s marketplace (over 6.5 million sellers as of FY‑2024) provides a robust buffer against regional downturns.

2. AWS Still Holds the Cloud Crown and Generates Massive Cash Flow

While the headline news often gravitates toward e‑commerce, Amazon Web Services (AWS) remains the financial engine that powers the company’s high profit margin. The Motley Fool piece provides a snapshot of AWS’s performance: revenue of $82 billion in FY‑2024, a 23 % YoY increase, and operating income that dwarfs the rest of Amazon’s business. A reference link to AWS’s earnings release clarifies that the cloud segment’s gross margin hovered around 39 % during the quarter, a figure that’s historically been higher than many of its peers.

Why it matters: The article explains that the capital‑intensive nature of cloud infrastructure (data centers, networking equipment, AI chips) gives AWS a natural moat. Competitors such as Microsoft Azure and Google Cloud are expanding, but Amazon’s “deep‑rooted network of global edge locations” gives it a speed and reliability advantage that’s difficult to replicate.

Because AWS consistently frees up cash, Amazon can continue to fund acquisitions, pay down debt, and offer dividends to shareholders when it chooses. The linked “Amazon’s Free Cash Flow” graphic shows a steady upward trajectory that supports the argument that the company can weather short‑term market turbulence.

3. Strategic Diversification into High‑Growth Sectors

One of the most compelling arguments the article makes is that Amazon is not just a “one‑industry” giant; it’s actively expanding into lucrative verticals that complement its core e‑commerce and cloud businesses. The writers highlight three of these segments:

| Sector | Why It’s a Growth Catalyst |

|---|---|

| Health & Wellness | Amazon’s acquisition of PillPack and the launch of Amazon Pharmacy position the company to capture a share of the $1.7 trillion U.S. prescription drug market. |

| Advertising | The “Amazon Ads” platform is now generating revenue comparable to its own retail advertising, with an emphasis on data‑driven targeting that could rival Google and Facebook. |

| Fresh Food & Groceries | Beyond Amazon Fresh, the company’s investment in the Whole Foods brand (plus the acquisition of “Grocery Pickup & Delivery” tech) signals a long‑term commitment to physical retail and omnichannel experiences. |

The article links to a separate analysis that projects Amazon’s “health‑care penetration” could hit 5 % of its total revenue by FY‑2030, effectively adding a new line of high‑margin revenue. For investors, these initiatives provide a diversified risk profile that could prove valuable in volatile markets.

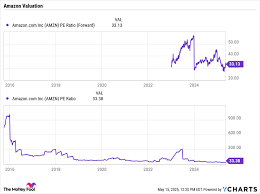

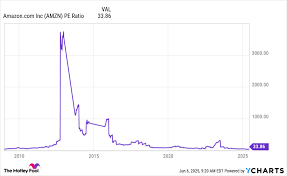

4. The Stock’s Valuation Still Offers Room for Upside

Critics often point to Amazon’s P/E ratio of roughly 70 as a deterrent. The Motley Fool article turns this argument around by contextualizing the valuation relative to long‑term trends. By comparing Amazon’s current P/E to its historical average (about 55) and to other tech giants, the writers note that the stock is trading at a “margin of safety” because of the following:

- Projected earnings growth: Analysts forecast a 12‑15 % CAGR for the next five years, largely driven by AWS and e‑commerce expansion.

- Discounted cash flow (DCF) model: A reference link to a detailed DCF walk‑through shows a fair‑value estimate of $3,800 per share—still a 15 % premium to the current price but within the company’s growth narrative.

- Competitive moat: The combination of a high‑quality logistics network, a global cloud presence, and diversified verticals creates a “sustainability factor” that may justify a higher valuation multiple.

Takeaway: Even if Amazon’s P/E remains above peer averages, the article argues that the company’s underlying fundamentals support a premium, especially when compared to slower‑growing retail peers.

Bottom Line: Why You Should Consider Adding Amazon to Your Portfolio

- Robust revenue streams from e‑commerce, cloud, and new ventures keep the company resilient to macro‑economic shocks.

- Strong cash generation from AWS allows continued investment and flexibility.

- Strategic diversification into health, advertising, and groceries expands Amazon’s revenue base.

- Valuation offers upside potential when viewed through the lens of long‑term growth and competitive moat.

For investors seeking a blend of “growth with a safety cushion,” Amazon could be a worthwhile addition. The Motley Fool article concludes by encouraging readers to stay disciplined, monitor quarterly earnings for any surprises, and keep an eye on the company’s expansion into new sectors.

Key resources for further research (linked in the article):

- FY‑2024 annual report (Amazon’s 10‑K)

- AWS earnings releases

- Detailed DCF analysis by Motley Fool analysts

- Investor presentations on Amazon’s “Growth & Innovation” roadmap

By digesting these insights, you’ll be better equipped to determine whether Amazon’s long‑term trajectory aligns with your investment goals.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/10/09/4-reasons-to-buy-amazon-stock-now/ ]