Covered Calls: Generate Income by Selling Stock Options

Locales: Delaware, Pennsylvania, UNITED STATES

Understanding Covered Call Options

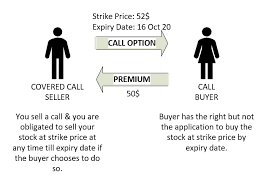

At its core, a covered call involves owning shares of a stock and simultaneously selling a call option on those shares. The call option grants the buyer the right, but not the obligation, to purchase your shares at a predetermined price (the strike price) before a specific date (the expiration date). In exchange for granting this right, you, as the seller, receive a premium. This premium is your immediate income. The 'covered' aspect comes from the fact that you already own the shares, ensuring you can deliver them if the option is exercised.

Why Energy Transfer (ET)?

Energy Transfer LP is a limited partnership focused on the transportation, storage, and processing of natural gas, crude oil, natural gas liquids (NGLs), and refined products. The company's consistent cash flow, driven by long-term contracts, makes it a potentially suitable candidate for covered call strategies. While ET isn't known for a high dividend yield currently, the relatively stable price and consistent demand for its services can create an environment where option premiums are relatively predictable. However, it's important to monitor the industry and company-specific news that could impact its stock price and premium values.

The $500/Month Scenario - A Practical Example

Let's break down how to potentially achieve a $500 monthly income using ET. As of today, February 17th, 2026, let's assume ET is trading at $20 per share. A realistic scenario might involve selling a call option with a strike price of $22, expiring in one month, for a premium of $1.25 per share (or $125 per contract). Each option contract represents 100 shares.

To generate $500 in monthly income, you would need to sell four contracts ($500 / $125 = 4). This requires owning 400 shares of Energy Transfer (4 contracts x 100 shares/contract). At a $20 per share price, the initial investment would be $8,000. This calculation simplifies the situation and doesn't account for brokerage fees.

Beyond the Basics: Rolling Options and Adjusting Strategy

This $500/month isn't necessarily a 'set it and forget it' situation. A key element of successful covered call writing is rolling the options. If ET's price rises significantly and approaches the strike price, you may want to 'roll' the option forward - buying back the existing call option and selling a new one with a higher strike price and a later expiration date. This allows you to potentially capture further upside while continuing to generate premium income.

Conversely, if the stock price falls, you can choose to 'roll down' the strike price, accepting a lower premium but reducing the risk of your shares being called away.

The Risks: A Realistic Assessment

While appealing, covered call strategies aren't without risk. It's crucial to understand these before investing:

- Capped Upside Potential: If ET's price soars above $22 (in our example), your shares will likely be 'called away' (sold at the strike price). You'll miss out on any gains above $22 per share. This is the primary trade-off of the strategy.

- Downside Risk: If the stock price declines, the premium received only partially offsets the loss. You're still exposed to the risk of capital depreciation. The premium acts as a small buffer, but doesn't eliminate the downside.

- Opportunity Cost: Holding shares for covered call writing means you forgo other potential investment opportunities. You're essentially sacrificing potential capital appreciation for current income.

- Volatility and Premium Decay: Option premiums are affected by volatility. If volatility decreases, premiums will likely fall, reducing your income potential. The value of the option also decays over time (theta decay).

- Complexity: Options trading involves a learning curve. It's vital to understand the intricacies of options, including strike prices, expiration dates, and the impact of different market conditions.

Disclaimer and Further Research

This article is for informational purposes only and should not be considered financial advice. Trading options carries inherent risks, and you could lose money. Before implementing any investment strategy, it's essential to consult with a qualified financial advisor and conduct thorough research. Investors should review Energy Transfer's financial statements, understand the dynamics of the energy sector, and carefully consider their own risk tolerance and investment goals. Resources like the Options Clearing Corporation (OCC) ([ https://www.theocc.com/ ]) provide valuable educational materials on options trading.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/02/17/how-to-earn-500-a-month-from-energy-transfer-stock/ ]