Great Wealth Transfer: Trillions in Assets Shifting Generations

Locales: California, Texas, UNITED STATES

Northridge, CA - January 24th, 2026 - The global economic landscape is undergoing a profound transformation, driven by what experts are increasingly referring to as the 'Great Wealth Transfer.' A recent report from the Institute for Future Economics paints a detailed picture of this phenomenon, revealing a staggering movement of assets and a reshaping of financial priorities with far-reaching implications for individuals, businesses, and governments worldwide.

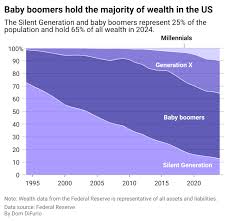

The core of this shift lies in the demographic realities facing developed nations. The Baby Boomer generation, having accumulated significant wealth over decades, is now entering retirement and, ultimately, the legacy phase. The transfer of this wealth - estimated to reach trillions of dollars over the next decade - is primarily occurring through inheritance to their heirs, predominantly Millennials and Gen Z. However, the scale of this transfer is amplified by a widening income distribution gap, ensuring a complex interplay of generational wealth and growing economic disparity.

Dr. Anya Sharma, lead author of the Institute's report, emphasizes the changing investment philosophies of the new wealth recipients. "This isn't simply about passing down estates," she explains. "It's a fundamental shift in how that wealth is deployed. Younger generations prioritize values-driven investing, seeking opportunities in sustainable businesses and groundbreaking technology startups. They're demonstrating a marked interest in alternative asset classes, and crucially, digital currencies."

The rise of digital assets is a particularly significant component of this Great Wealth Transfer. Cryptocurrencies and blockchain technologies are providing new avenues for wealth management, and, importantly, offer a degree of independence from traditional financial institutions. Individuals are increasingly leveraging these platforms to directly manage and distribute their inherited assets, bypassing conventional brokerage accounts and trust funds. While this offers potential benefits in terms of accessibility and control, it also introduces novel risks related to volatility, security, and the evolving regulatory environment surrounding digital assets. Governments worldwide are struggling to keep pace with the rapid innovation and adaptation within the blockchain space.

The impact isn't limited to investment strategies. Charitable giving is also poised for a significant realignment. While philanthropic traditions are likely to continue among some heirs, many are demonstrating a desire to direct their resources more strategically, either towards niche causes that resonate with their personal values or by prioritizing direct investment that generates both financial return and social impact. This shift could lead to a decline in traditional charitable donations and a redirection of funds towards newer, more targeted initiatives.

Beyond the individual level, the Great Wealth Transfer is rippling through financial markets. The influx of capital from a younger, more diversified investor base is fueling demand for ESG (Environmental, Social, and Governance) focused companies and disruptive technologies. Traditional industries may face increased pressure as investment flows shift away from established players and towards those embracing innovation and sustainability. This creates both opportunities and challenges for businesses navigating this evolving landscape.

The report concludes with a crucial call to action for policymakers. The potential social and economic consequences of this wealth transfer - including exacerbated inequality, shifting power dynamics, and volatility in financial markets - require proactive intervention. Addressing these challenges will necessitate strategies focused on equitable access to opportunities, skills development, and responsible regulation of emerging technologies like blockchain and digital currencies. Furthermore, fostering financial literacy among younger generations is paramount to ensuring they can effectively manage and leverage their inherited wealth.

Looking forward, the Institute for Future Economics predicts a continued acceleration of the Great Wealth Transfer over the next 10-15 years, intensifying the need for adaptable policies and innovative financial solutions. The sands of fortune are shifting, and understanding the dynamics of this monumental transfer is critical for navigating the economic landscape of the future.

Read the Full Los Angeles Daily News Article at:

[ https://www.dailynews.com/2026/01/24/great-wealth-transfer/ ]