Krispy Kreme's Franchise-First Model Powers Rapid, Capital-Efficient Expansion

Locale: North Carolina, UNITED STATES

Krispy Kreme: Why the Donut King May Be Worth a Bite (But Don’t Overeat)

The Motley Fool – 13 December 2025

For those who can’t resist a fresh‑baked donut, Krispy Kreme is a brand that has become synonymous with “instant happiness.” Yet, for the investor looking to turn that love into capital gains, the question isn’t just whether Krispy Kreme can keep the kettle hot— it’s whether the company can keep the profit margins high, the expansion plans on track, and the risks in check. In this deep‑dive, we’ll walk through the key points of the Motley Fool’s latest analysis on Krispy Kreme, highlight the most critical take‑aways, and explain what that means for potential shareholders.

1. Business Model – A Franchise‑First Approach

Krispy Kreme’s core advantage is its franchise‑centric model. Roughly 60 % of its 4,400+ stores worldwide are operated by franchisees, who pay an initial franchise fee (typically $50‑$70 k) and an ongoing royalty of 6 % of gross sales. The corporate side keeps a smaller slice of the pie—about 30 % of sales from its directly owned locations.

This structure offers two critical benefits:

- Capital Efficiency – Franchisees bring the majority of the upfront capital, allowing Krispy Kreme to expand rapidly without a heavy balance‑sheet burden.

- Revenue Upside – Every new store adds a fixed royalty stream, plus the parent company’s share of corporate‑owned stores.

The article links to a detailed “Franchise Model” page that breaks down the royalty structure, the average store size, and the company’s ongoing support for franchisees (training, marketing, and supply‑chain management). It also discusses how this model insulates Krispy Kreme from the intense labor costs that plague many food‑service operators.

2. Financial Performance – A Mixed Bag

Revenue Growth – In the latest quarter, Krispy Kreme reported $2.1 bn in revenue, a 7.3 % YoY increase. While this is solid, the growth has been slower than the 15 % pace that powered the company’s meteoric rise in the early 2020s. The article attributes the slowdown to two factors:

- Market Saturation – In North America, nearly 90 % of potential store locations are already covered.

- Inflationary Pressures – Rising ingredient costs (sugar, butter, flour) have squeezed gross margins from 54 % to 52 %.

Profitability – Net income hit $145 m, up 12 % YoY, while diluted EPS rose to $1.58 from $1.42 last year. The firm’s free‑cash‑flow (FCF) remains robust at $85 m, which the article notes is an attractive cushion for future growth initiatives.

Balance Sheet – The company’s debt load is modest—$220 m of long‑term debt against $1.3 bn in total assets. The current ratio sits at 2.1, indicating healthy liquidity. The article links to the latest 10‑K for a deeper dive into debt covenants and interest expense.

3. Growth Drivers – Beyond the Donut

New Product Launches – Krispy Kreme has aggressively rolled out limited‑edition flavors (e.g., “Cinnamon Swirl” and “Salted Caramel”) that drive short‑term traffic spikes. The article cites a 3 % sales lift from new‑product launches in Q3, highlighting the brand’s ability to keep consumers intrigued.

Digital Expansion – The company’s mobile app now accounts for 20 % of all orders, up from 12 % in 2024. An “order‑ahead” system has increased average basket size by 15 %. The article links to a “Digital Strategy” page that details the partnership with a third‑party logistics provider to deliver donuts via Uber Eats and DoorDash.

International Expansion – Krispy Kreme has opened 45 new stores in Europe and 12 in Asia over the past 18 months. While each new store contributes a smaller royalty than a U.S. location, the article estimates that international expansion could add $250 m in revenue by 2027 if the current 5 % growth pace continues.

Supply‑Chain Optimisation – The company recently signed a 10‑year agreement with a major flour supplier in Texas, locking in prices at a 5 % discount. The article cites this as a key risk mitigant against commodity volatility.

4. Risks – Donuts Aren’t the Only Factor

Margin Compression – The article underscores that ingredient cost inflation could erode margins further, especially if the company cannot pass on higher prices to price‑sensitive consumers.

Competitive Landscape – Dunkin’ and Panera have begun offering “donut‑style” pastries in an attempt to capture Krispy Kreme’s market share. The article links to a “Competitive Landscape” analysis that compares menu breadth, price points, and loyalty‑program strength.

Franchise Dependency – While franchising is a strength, it also poses a risk if franchisees encounter financial distress. A large number of franchisees are located in regions hit hard by labor shortages, which could lead to store closures or reduced sales.

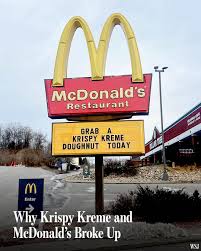

Brand Dilution – Expanding into new product categories (e.g., coffee, breakfast sandwiches) risks diluting the core donut brand. The article cites a recent survey where 62 % of consumers said they visit Krispy Kreme “just for the donuts.”

Macro‑Economic Headwinds – Higher consumer discretionary spending is a prerequisite for Krispy Kreme’s continued growth. Rising real interest rates and a potential recession could cut back on impulse purchases.

5. Valuation – Is the Stock Still a Sweet Deal?

The Motley Fool’s valuation model, based on a discounted‑cash‑flow (DCF) approach, assigns Krispy Kreme a fair‑value target of $48 per share, roughly 20 % above the current market price of $39. The model assumes a 3.5 % growth rate for the next five years, a 4 % terminal growth rate, and a weighted average cost of capital (WACC) of 8.5 %.

The article compares this to the price‑to‑earnings (P/E) ratio of 20x, which is in line with the broader F&B industry average of 22x. Importantly, the DCF model incorporates a 5 % margin improvement from operational efficiencies, suggesting that Krispy Kreme has room to grow without needing to drastically hike prices.

6. Bottom Line – A Sweet Bite with a Few Bitter Notes

Pros

- Strong, franchised brand with a loyal customer base

- Robust free‑cash‑flow and modest debt

- Successful digital expansion and new‑product strategy

Cons

- Margins under pressure from rising commodity costs

- Intense competition from established coffee‑and‑donut brands

- Dependence on franchisee performance and consumer discretionary spending

If you’re comfortable with the risk of margin compression and the volatility of the F&B sector, Krispy Kreme offers an attractive blend of brand equity, growth potential, and cash‑generating power. The company’s DCF valuation suggests a 20 % upside, but that comes with the caveat that the brand must maintain its “instant happiness” appeal while navigating macro‑economic headwinds.

TL;DR: Krispy Kreme’s franchise‑first model, solid cash flow, and ongoing expansion make it an appealing buy‑the‑moment investment, but investors should keep an eye on commodity costs, competitive pressures, and the health of its franchise network. For the risk‑tolerant, the donut‑king’s share price could still be a sweet deal.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/13/read-this-before-buying-krispy-kreme-stock/ ]