Digital Age Savings: Beyond Traditional Accounts

wjla

wjlaLocales: Virginia, UNITED STATES

The Evolution of Saving in a Digital Age

Traditionally, saving meant stashing cash in a savings account or perhaps a Certificate of Deposit (CD). These remain viable options for emergency funds - readily accessible capital for unexpected expenses like car repairs or medical bills. High-yield savings accounts (HYSAs) have become increasingly prevalent, offering marginally better interest rates than traditional savings accounts, often driven by online-only banks. Money market accounts continue to bridge the gap between savings and low-risk investments, offering check-writing privileges and competitive rates. However, even the most competitive HYSAs are often struggling to surpass the current inflation rate of 3.2% (as of late 2025).

The Power of Investing: More Than Just Stocks and Bonds

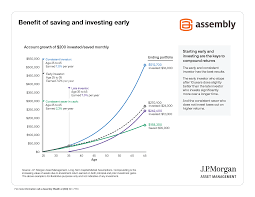

Investing, unlike saving, is about putting your money to work. It's the engine for long-term financial growth, designed to outpace inflation and build wealth. While stocks and bonds remain cornerstones of most investment portfolios, the options available in 2026 are significantly broader and more accessible than ever before.

- Stocks: Represent ownership in a company. Growth potential is high, but so is risk. Diversification - owning stock in multiple companies across various sectors - is crucial to mitigate this risk. The rise of fractional shares has made stock ownership accessible to investors with limited capital.

- Bonds: Loans to governments or corporations. Generally considered less risky than stocks, bonds provide a fixed income stream. Bond yields have been gradually increasing in response to recent economic conditions, making them an attractive option for income-seeking investors.

- Mutual Funds & ETFs: These pooled investment vehicles offer instant diversification. Exchange-Traded Funds (ETFs), in particular, have gained popularity due to their low expense ratios and tax efficiency. Thematic ETFs - focusing on specific trends like renewable energy, artificial intelligence, or space exploration - offer targeted investment opportunities.

- Real Estate: Historically a strong investment, real estate now includes diverse options beyond traditional property ownership. Real Estate Investment Trusts (REITs) allow investors to participate in the real estate market without directly owning property. Platforms facilitating fractional ownership of vacation rentals have also emerged.

- Alternative Investments: The wealthy have long diversified into alternatives like private equity, hedge funds, and commodities. In 2026, these are becoming more accessible through regulated platforms, though often requiring higher minimum investments and understanding of associated risks. Cryptocurrencies, while volatile, continue to be a consideration for some investors, representing a high-risk, high-reward potential.

Risk Tolerance: The Key to a Sustainable Strategy

Determining your risk tolerance is arguably the most important step in building an investment portfolio. Are you comfortable with the possibility of short-term losses in pursuit of long-term gains? Or do you prioritize capital preservation above all else? A financial advisor can help assess your risk profile, time horizon, and financial goals to develop a personalized investment strategy. Robo-advisors, leveraging algorithms to manage investments, offer a low-cost alternative for those comfortable with a hands-off approach.

Inflation & the Importance of Real Returns

The insidious effect of inflation cannot be overstated. Even a modest inflation rate erodes the value of savings over time. Investing isn't simply about achieving a positive return; it's about achieving a real return - a return that exceeds the inflation rate. In 2026, with inflation remaining a concern, focusing on asset classes with the potential to generate real returns is crucial.

The Hybrid Approach: Saving and Investing

The optimal financial plan isn't an either/or proposition. It's a blend of both saving and investing. A robust emergency fund - typically 3-6 months of living expenses - should be maintained in a readily accessible savings account. Beyond that, surplus funds should be strategically allocated to investments aligned with your long-term goals. Regularly rebalancing your portfolio - adjusting asset allocations to maintain your desired risk level - is also essential.

Seeking Professional Guidance

The financial landscape is constantly evolving. While online resources are readily available, navigating the complexities of saving and investing can be overwhelming. Consulting a qualified financial professional can provide personalized guidance, ensuring your financial plan aligns with your unique circumstances and helps you achieve your financial aspirations.

Read the Full wjla Article at:

[ https://wjla.com/money/investing/saving-vs-investing ]