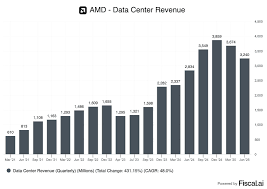

AMD's Data Center Revenue Surges 33%

Locales: California, Texas, Washington, UNITED STATES

Data Center Dominance: A Sign of Things to Come?

AMD's most recent quarterly reports reveal a compelling narrative of growth, particularly within its data center division. Revenue surged by a remarkable 33%, exceeding even the most optimistic analyst predictions. This isn't simply incremental growth; it's a clear indicator that AMD's strategy is resonating with customers demanding powerful and cost-effective AI solutions. The driving force behind this surge is the Instinct MI300 series of AI chips. Unlike NVIDIA's historically premium pricing, AMD has positioned its MI300 series as a compelling alternative, offering similar performance at a more competitive price point. This price-performance ratio is proving to be a powerful draw for cloud providers, research institutions, and businesses deploying AI at scale.

NVIDIA's Fortress and AMD's Assault

Let's be clear: NVIDIA isn't about to relinquish its leadership position easily. The company's GPUs remain the industry standard for many AI applications, powering everything from large language models and generative AI platforms like those seen in image generation, to complex simulations and autonomous vehicle systems. Its established ecosystem, software support (CUDA being a key differentiator), and deep relationships with key players provide a substantial moat. However, NVIDIA's dominance isn't absolute, and that's where AMD's opportunity lies.

AMD has strategically invested heavily in its AI chip portfolio, not just in GPUs like the MI300, but also in server CPUs designed to accelerate AI workloads. This holistic approach--offering both processing and graphics solutions--positions AMD as a complete provider for data center infrastructure. Furthermore, AMD's focus on High-Performance Computing (HPC) applications has broadened its reach beyond the consumer market and into specialized sectors requiring massive computational power.

Beyond Price: AMD's Technological Edge

While price is a significant factor, AMD's success isn't solely based on undercutting NVIDIA. The MI300 architecture boasts advancements in memory capacity and bandwidth, allowing it to handle larger and more complex AI models. This is crucial as AI models continue to grow in size and sophistication. AMD's chiplet design, where multiple smaller dies are combined into a single package, provides greater flexibility and scalability, enabling the company to adapt to evolving customer needs more quickly. This contrasts with NVIDIA's monolithic approach, which can be more challenging to scale.

Looking Ahead: Key Factors to Consider

The future success of AMD hinges on several critical factors:

- Sustained AI Demand: The AI market is projected to grow exponentially in the coming years. However, growth alone isn't enough. AMD needs to capture a significant share of that growth, and competition will be fierce.

- Competitive Landscape: Intel (INTC) is aggressively entering the AI chip market, alongside other emerging players. This increased competition will likely drive down prices and require continuous innovation from both AMD and NVIDIA.

- AMD's Innovation Pipeline: AMD must relentlessly push the boundaries of chip technology, introducing new and improved products that address the evolving demands of AI developers and researchers. Their roadmap needs to deliver consistent performance gains and features that differentiate them from the competition.

- Supply Chain Resilience: Global supply chain disruptions have plagued the tech industry in recent years. AMD must ensure a stable and reliable supply of chips to meet growing demand.

- Software Ecosystem: While AMD has made strides in improving its software offerings (particularly ROCm, its open-source platform), it still lags behind NVIDIA's CUDA ecosystem. Bridging this gap is crucial for attracting developers and ensuring broad compatibility.

Investment Implications

AMD presents a compelling investment opportunity for those seeking exposure to the AI revolution. While NVIDIA remains the dominant force, AMD's rapid growth, competitive pricing, and technological advancements suggest it's well-positioned to continue gaining market share. The risk remains that NVIDIA's sheer scale and resources may prove difficult to overcome in the long run. However, recent performance indicators paint a picture of a company that isn't just surviving, but thriving, in the face of a formidable competitor. Investors should closely monitor AMD's data center revenue, product roadmap, and its ability to navigate the increasingly competitive AI landscape. A diversified portfolio with exposure to both AMD and NVIDIA might offer the most balanced approach to capitalize on the AI boom.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/10/06/all-stock-investors-should-want-to-know-whats-goin/ ]