AI Hype Cools: Software Stocks Plunge

Locales: California, Delaware, UNITED STATES

NEW YORK - February 5th, 2026 - US software stocks experienced a significant downturn today following a sobering assessment of the artificial intelligence landscape from Anthropic, a leading AI development firm. The sell-off, triggered by Anthropic CEO Dario Amodei's recent blog post, suggests the market is beginning to grapple with the gap between AI hype and demonstrable productivity gains.

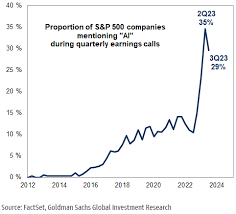

The warning from Anthropic, a direct competitor to OpenAI and other AI giants, isn't a dismissal of AI's potential, but rather a recalibration of expectations. Amodei argues that while AI models like those powering ChatGPT and others are advancing at an astonishing pace, translating that raw capability into real-world productivity boosts is proving more challenging than initially predicted. This disconnect has shaken investor confidence, leading to a broad-based decline in the valuation of major software companies.

Yesterday saw notable drops in the stock prices of industry leaders including Salesforce, Oracle, Adobe, and Microsoft. The Nasdaq 100, a benchmark heavily influenced by technology stocks, closed down 1.7% on Wednesday, continuing a downward trend into today's trading session. Experts predict further volatility as the market digests Anthropic's message and reassesses AI investment strategies.

"The narrative around AI has gotten ahead of the fundamentals," explained Bill Rosch, a managing director and strategist at Active Alphas. "For the past two years, we've seen massive investment based on the promise of AI, often without a clear path to monetization or measurable improvements in key performance indicators. Anthropic's commentary is forcing investors to ask 'where's the beef?' and demand proof of return."

Beyond the Hype: The Challenges of AI Implementation

Amodei's concerns aren't unique. Many businesses are finding that simply having an AI tool doesn't automatically unlock significant productivity gains. Several key challenges are hindering widespread AI adoption and value realization:

- Data Integration & Quality: AI models are only as good as the data they're trained on. Many organizations struggle with siloed data, inconsistent formats, and data quality issues, significantly limiting the effectiveness of AI applications.

- Workflow Integration: Successfully integrating AI into existing business workflows requires significant process re-engineering. AI is often seen as a 'bolt-on' solution rather than a core component of operations, leading to friction and limited impact.

- Skill Gap: A shortage of skilled AI professionals - data scientists, machine learning engineers, and AI ethicists - is hampering the ability of companies to develop, deploy, and maintain AI solutions.

- Explainability & Trust: The 'black box' nature of many AI algorithms raises concerns about transparency and accountability. Businesses are hesitant to rely on AI-driven decisions if they can't understand why those decisions were made.

- Cost of Implementation: Beyond the initial investment in software and hardware, there are ongoing costs associated with data storage, model training, and maintenance. These costs can quickly outweigh the perceived benefits if AI implementations aren't carefully managed.

Jefferies analysts echoed these sentiments in a research note released this morning: "It's not about the fact that AI won't be impactful. It's about the timing and the magnitude of that impact. We anticipate a period of consolidation in the AI software space, with a focus on companies that can demonstrate tangible value and address the practical challenges of implementation."

A Market Correction or a Healthy Reset?

The current stock sell-off has sparked debate about whether this is a temporary market correction or the beginning of a more significant downturn in the AI sector. Some analysts believe the market has simply become overheated and a correction was inevitable. Others argue that Anthropic's warning is a wake-up call, forcing investors to adopt a more realistic and sustainable approach to AI investment.

Regardless of the immediate outcome, the current situation underscores the importance of due diligence and a cautious approach to investing in hyped-up technologies. Investors are now demanding more than just promising demos and ambitious projections. They want to see concrete evidence of AI's ability to deliver tangible business results, including increased revenue, reduced costs, and improved efficiency.

The coming months will be crucial as companies work to demonstrate the true potential of AI. Those that can bridge the gap between promise and reality are likely to thrive, while those that fail to adapt may face further scrutiny and downward pressure on their valuations.

Read the Full Channel NewsAsia Singapore Article at:

[ https://www.channelnewsasia.com/business/us-software-stocks-hit-anthropic-wake-up-call-ai-disruption-5907141 ]