AI Hype Cools as Market Reassesses Potential

Locales: California, Washington, Texas, UNITED STATES

The AI Narrative Faces Scrutiny

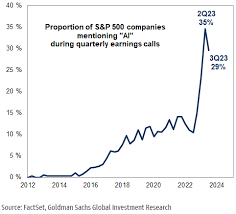

The current downturn appears inextricably linked to a growing skepticism surrounding the sustainability of the artificial intelligence (AI) boom. Over the past two years, a considerable influx of capital has been directed towards companies involved in AI development and implementation. This fervent investment activity fueled rapid stock price appreciation, often exceeding levels justified by current revenue or profits. The expectation was, and in many cases remains, that AI would fundamentally transform business operations, boost productivity, and unlock significant new revenue streams.

However, the market is now forcing a reassessment of these lofty expectations. The core question is whether these companies can genuinely deliver on the transformative potential of AI, or if the hype has outpaced reality. Several factors contribute to this growing uncertainty. The cost of developing and deploying AI solutions, particularly large language models (LLMs), is proving substantial. Computational power demands are high, and skilled AI engineers are in short supply, driving up labor costs. Furthermore, the practical applications of AI, while promising, are still unfolding, and the return on investment remains unproven for many businesses.

Beyond AI: Macroeconomic Headwinds

While AI concerns are a key driver, it's crucial to acknowledge the broader macroeconomic environment impacting software stocks. Interest rates, though showing signs of potential easing, remain at elevated levels. The Federal Reserve's aggressive tightening cycle over the past two years has increased the cost of capital, making growth stocks - particularly those reliant on future earnings - less attractive to investors. Lingering inflationary pressures, though moderating, continue to erode consumer purchasing power and business profitability.

The specter of a potential recession further complicates the outlook. Historically, software spending is often one of the first areas to be cut during economic downturns as companies prioritize cost reduction and capital preservation. This cyclical vulnerability makes software stocks particularly sensitive to macroeconomic risks. Many companies are delaying major software upgrades or implementations, opting for maintenance mode instead, which directly impacts revenue growth for software vendors.

The Rise of 'Realistic' Valuations & the Importance of Fundamentals

The recent sell-off is, in effect, a recalibration of valuations. The era of seemingly limitless expansion multiples, fueled by cheap money and AI exuberance, is likely over, at least for the near term. Investors are now demanding demonstrable profitability and sustainable revenue growth. Companies that were previously rewarded for simply being AI-focused are now being scrutinized for actual AI-driven results.

This shift favors established software companies with strong fundamentals, proven business models, and consistent profitability. Companies like Microsoft, despite not being a 'pure-play' AI firm, are benefitting from their cloud infrastructure (Azure) which powers many AI applications and their integration of AI into existing products like Office 365. Similarly, Adobe, while experiencing recent declines, maintains a strong competitive position in the creative software market.

Navigating the Current Landscape: Investor Strategies

For investors, the current environment demands a disciplined approach. Panicking and selling during market downturns is rarely a sound strategy. Instead, a thorough re-evaluation of existing holdings is crucial. Questions to consider include: Does the company have a clear path to profitability? Is its valuation still reasonable given its growth prospects? Does it possess a sustainable competitive advantage?

Market downturns can also present buying opportunities. Companies with strong fundamentals that have been unfairly punished may represent attractive long-term investments. However, thorough research is paramount. Investors should focus on companies that are not simply chasing the AI hype but are strategically integrating AI to enhance their core products and services.

Finally, diversification is key. Don't put all your eggs in one basket. Spreading your investments across different sectors and asset classes can help mitigate risk and enhance overall portfolio stability. The software sector remains a vital component of the global economy, but navigating its current challenges requires a pragmatic and informed investment strategy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/31/software-stocks-are-getting-slashed-and-the-ai-bub/ ]