SCHD: A Resilient Income-Focused ETF

Locale: Not Specified, UNITED STATES

Schwab U.S. Dividend Equity ETF (SCHD) continues to stand out not simply as a source of passive income, but as a strategically sound building block for a resilient portfolio.

SCHD, launched in 2015, has rapidly gained popularity, and for good reason. It's a passively managed ETF designed to track the performance of high-dividend-yielding U.S. equities, but its success isn't solely down to dividend payouts. The ETF's methodology differentiates it from many of its peers, emphasizing quality, financial health, and a sustainable dividend profile. While many dividend ETFs simply chase the highest yields, SCHD takes a more discerning approach, seeking companies capable of continuing to deliver income even during economic headwinds.

A Deeper Dive into the SCHD Methodology

The core of SCHD's appeal lies in its rigorous screening process. Unlike ETFs that rely on market capitalization weighting, SCHD employs a factor-based approach. It begins with the S&P 500 universe, then narrows the field based on several key criteria:

- Dividend Consistency: Companies must have a minimum of 10 consecutive years of dividend payments.

- Payout Ratio: The payout ratio (dividends paid as a percentage of earnings) must be sustainable, generally below 75%.

- Free Cash Flow: SCHD prioritizes companies with strong free cash flow generation, indicating their ability to cover dividend payments and reinvest in the business.

- Return on Equity (ROE): A high ROE signals efficient capital allocation and profitability.

- Debt Levels: Companies with manageable debt levels are favored, enhancing financial stability.

This multi-faceted approach results in a portfolio tilted towards established, financially sound businesses. It's a strategy that's proven effective, consistently delivering competitive returns and income.

Current Landscape and Yield (as of January 31, 2026)

As of January 31st, 2026, SCHD boasts a yield of approximately 3.3%. While this isn't the highest yield available in the ETF universe, it's important to remember that SCHD isn't chasing yield at all costs. The yield represents a reasonable return given the ETF's focus on quality and sustainability. Comparing this to the current 10-year Treasury yield (hovering around 4.2% as of today), SCHD provides a compelling alternative for investors seeking income with potential for growth. The relatively stable nature of the dividend payouts also provides a buffer against interest rate fluctuations.

Top Holdings: A Portrait of Stability

The composition of SCHD's portfolio offers further insight into its strategy. As of January 31, 2026, the top holdings include:

- Johnson & Johnson (JNJ)

- Procter & Gamble (PG)

- Coca-Cola (KO)

- Amgen (AMGN)

- NextEra Energy (NEE)

These aren't high-growth, speculative companies. They are mature, established businesses with strong brands, consistent earnings, and a long history of rewarding shareholders with dividends. This stability is particularly attractive in the current economic climate, where uncertainty remains high.

The Power of Low Costs

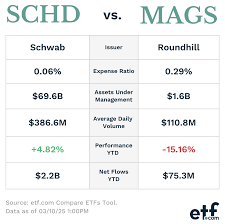

SCHD's incredibly low expense ratio of 0.06% is a significant advantage. Over the long term, even seemingly small differences in expense ratios can have a substantial impact on returns. By minimizing costs, SCHD maximizes the amount of income that flows to investors.

Beyond Income: Potential for Capital Appreciation

While SCHD is primarily an income-focused ETF, it's important to note that it also offers the potential for capital appreciation. The companies held within the ETF are generally well-managed and financially healthy, positioning them for long-term growth. This dual benefit - income and potential growth - makes SCHD a versatile addition to any portfolio.

Looking Ahead

In conclusion, the Schwab U.S. Dividend Equity ETF (SCHD) remains a compelling choice for income investors seeking a combination of yield, quality, and affordability. Its rigorous methodology, low expense ratio, and focus on financially sound companies make it a relatively conservative, yet potentially rewarding, investment. While no investment is guaranteed, SCHD's track record and strategic approach suggest it will continue to be a valuable tool for generating passive income and building a resilient portfolio for years to come.

Disclaimer: I own SCHD.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/02/01/this-low-cost-dividend-etf-can-be-a-surprisingly-g/ ]