Beyond Meat Stock: From $175 to $23 - A Dramatic Decline

Locales: UNITED STATES, ISRAEL

From Peak to Plunge: The BYND Stock Journey

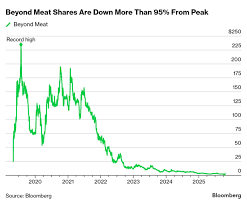

When Beyond Meat debuted on May 2nd, 2019, shares were priced at $175. An investor committing $1,000 would have secured approximately 5.66 shares. Initially, the stock soared, reaching an impressive high of $239.81 in July 2019. This peak briefly transformed that $1,000 investment into roughly $1,346 - a tantalizing glimpse of potential returns.

However, the ascent proved to be short-lived. As of today, January 29th, 2026, Beyond Meat's stock is trading around $23.37 per share. This dramatic decline means that initial $1,000 investment is now worth a mere $131, representing a significant loss for early investors. The story of BYND is a powerful reminder that initial enthusiasm doesn't guarantee long-term success.

The Roots of the Decline: A Perfect Storm of Challenges

Several interconnected factors contributed to Beyond Meat's struggles. Initially, the company enjoyed a first-mover advantage, but this quickly eroded as the plant-based meat market became increasingly crowded. Established food giants like Tyson and Cargill entered the fray, alongside numerous startups, all vying for a piece of the growing, yet competitive, pie. This increased competition put immense pressure on Beyond Meat to innovate and maintain market share.

Beyond the competitive landscape, Beyond Meat faced significant operational hurdles. Scaling up production to meet burgeoning demand proved challenging, leading to supply chain disruptions and inconsistencies in product availability. These production issues were compounded by disappointing sales figures, which consistently fell short of analyst expectations. The company struggled to convert initial consumer curiosity into sustained purchasing habits.

Furthermore, consumer preferences within the plant-based sector have proven to be more nuanced than initially anticipated. While the desire for sustainable food options remains strong, consumers are increasingly discerning, seeking not just alternatives to meat, but also options that deliver on taste, texture, and price. Beyond Meat's products, while innovative, have sometimes been criticized for not fully replicating the experience of traditional meat, and often come with a premium price tag.

A Glimmer of Hope? The Future of Plant-Based Protein

Despite the substantial losses, the future isn't necessarily bleak for Beyond Meat. The broader plant-based meat market is still projected to grow in the long term, driven by concerns about environmental sustainability, animal welfare, and health. Market analysts predict continued, albeit slower, growth in the sector.

However, for Beyond Meat to capitalize on this potential, significant changes are needed. The company must address its production inefficiencies, refine its product offerings to better meet consumer preferences, and effectively differentiate itself in a crowded market. This could involve investing in research and development to improve taste and texture, streamlining supply chains to reduce costs, and focusing on targeted marketing campaigns to reach specific consumer segments.

The company is also exploring new product lines, including partnerships and expansion into international markets. Whether these strategies will be enough to turn the tide remains to be seen. The plant-based sector is maturing, and success will require more than just innovation; it demands efficient operations, consumer-centric product development, and a sustainable business model.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investment decisions should be made after careful consideration and consultation with a qualified financial advisor.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/28/if-youd-invested-1000-in-beyond-meat-stock-bynd-1/ ]