VCLT: High-Yield ETF with Interest Rate Risk

Locales: UNITED STATES, UNITED KINGDOM

What is VCLT?

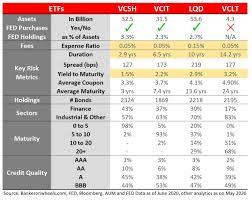

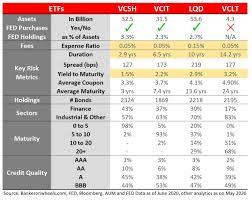

The VanEck Long-Term Corporate Bond ETF (VCLT) provides investors with exposure to a portfolio of U.S. investment-grade corporate bonds, specifically those with maturities extending 15 years or longer. It's designed to offer a higher yield compared to shorter-term bond funds, but at the cost of increased sensitivity to interest rate changes. As of early 2026, the fund maintains an expense ratio of 0.40%, reflecting the costs associated with managing this specialized portfolio. The current yield stands at 5.52%, a factor to consider when evaluating its attractiveness compared to other fixed-income investments.

Understanding the Appeal of Long-Term Bonds

The allure of long-term bonds, and subsequently VCLT, lies in the potential for higher yields. Generally, the longer the time until a bond matures, the higher the interest rate it offers. This is due to the increased risk associated with lending money for extended periods. However, this potential reward comes hand-in-hand with heightened interest rate risk. A significant rise in interest rates can substantially erode the value of long-term bonds compared to their shorter-term counterparts. This dynamic makes VCLT particularly susceptible to shifts in the prevailing interest rate environment.

Investment Objectives & Suitability

According to its prospectus, VCLT aims to maximize total return through a combination of current income generation and potential capital appreciation. While capital appreciation is a possibility, the primary driver of returns is expected to be the consistent income stream from the underlying bonds. Therefore, VCLT is generally considered appropriate for investors who:

- Have a long investment time horizon (e.g., retirement savings, long-term financial goals).

- Possess a moderate to high tolerance for interest rate volatility.

- Seek a higher yield than available in shorter-term bond investments.

Navigating the Risks

Before considering VCLT, a thorough understanding of the inherent risks is crucial. The key risks include:

- Interest Rate Risk: This remains the most significant concern. Rising interest rates directly impact the value of long-term bonds, potentially leading to losses. Economic indicators like inflation and Federal Reserve policy announcements should be closely monitored.

- Credit Risk: While the bonds held within VCLT are classified as investment-grade (meaning they are considered relatively low-risk for default), the possibility of a company defaulting on its debt still exists. The creditworthiness of the underlying issuers is continuously evaluated, but unexpected economic downturns or company-specific issues can impact credit ratings.

- Market Risk: Broad market downturns can negatively impact all asset classes, including bonds. Investor sentiment and overall economic conditions play a role in bond pricing.

A Look at the Portfolio (as of 2024)

As of October 2024, the fund's top holdings provided a snapshot of the types of companies whose debt VCLT invests in. These included prominent names like AT&T (T), Verizon (VZ), Exxon Mobil (XOM), Apple (AAPL), and Procter & Gamble (PG). It's important to note that portfolio composition changes over time based on market conditions and the fund's rebalancing strategy.

Performance and Outlook (as of early 2026)

In late 2024, VCLT's year-to-date return was -0.77%. Performance, of course, fluctuates. Looking ahead to early 2026, the investment landscape remains complex. The Federal Reserve's actions regarding interest rates, inflation trends, and overall economic growth will heavily influence VCLT's trajectory. If interest rates remain stable or decline, VCLT could experience positive performance. However, if interest rates increase significantly, the fund's value could face downward pressure.

Conclusion

VCLT offers a specialized approach to fixed-income investing, targeting a higher yield through long-term corporate bonds. While the potential for income is attractive, investors must be fully aware of the inherent risks, particularly interest rate risk. Careful consideration of one's risk tolerance, investment timeframe, and overall portfolio strategy is paramount before incorporating VCLT into a diversified investment portfolio. Continuous monitoring of economic conditions and the fund's performance is also essential for informed decision-making. As always, consult with a qualified financial advisor before making any investment decisions.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4862391-vclt-learn-about-this-long-dated-investment-grade-corporate-bond-etf ]