Rigetti Faces Challenges in Quantum Computing Race

Locales: California, Colorado, Massachusetts, UNITED STATES

The Quantum Computing Landscape: A Rapidly Evolving Field

The quantum computing landscape is characterized by rapid innovation and fierce competition. Companies are racing to develop more powerful and stable quantum computers, pushing the boundaries of what's possible. Key metrics for evaluating these companies include qubit quality, coherence times (how long qubits maintain their quantum state), and the ability to scale up the number of qubits while maintaining performance. These advancements aren't merely incremental; they represent significant leaps toward practical quantum computation.

Rigetti's Challenges: Lagging Technology and Financial Strain

Rigetti Computing has consistently fallen behind key competitors in crucial areas. While the company's Aspen series processors represent an evolution, their performance still doesn't match the capabilities demonstrated by companies like IonQ (IONQ). IonQ's advancements in qubit technology and increased coherence times provide a demonstrable advantage, allowing them to tackle more complex calculations with greater reliability. Furthermore, Rigetti's publicly stated roadmap for future processor development appears less aggressive than those of its rivals.

Beyond the technical challenges, Rigetti's financial situation raises serious concerns. Like most quantum computing ventures, Rigetti isn't currently profitable. However, the company's 'burn rate,' or the rate at which it consumes cash, is particularly alarming. To stay afloat, Rigetti has relied heavily on issuing new stock - a practice known as equity dilution - which devalues the holdings of existing shareholders. This constant need for capital infusions isn't a sustainable long-term strategy.

Comparing Rigetti to the Competition: A Tale of Two Approaches

IonQ's approach offers a more encouraging trajectory. The company is actively working to reduce operating expenses and is establishing a clearer pathway to revenue generation through cloud-based services and strategic partnerships. Quantinuum, formed by the merger of Honeywell's quantum division and Cambridge Quantum Computing, adopts a more measured strategy. Rather than solely focusing on hardware development, Quantinuum prioritizes the critical work of developing quantum software and algorithms, a crucial element for unlocking the full potential of quantum computers. This balanced approach mitigates some of the risks inherent in purely hardware-focused development.

Valuation Discrepancies: Paying a Premium for Uncertainty

Rigetti's valuation remains a significant point of concern. Despite its lagging performance and uncertain future, the company's market capitalization is disproportionately high compared to its revenue and the progress it's made. Even with recent stock declines, Rigetti maintains a premium valuation compared to its competitors, suggesting a potential overvaluation.

Alternative Investment Opportunities in the Quantum Realm

For investors seeking exposure to the quantum computing revolution, several compelling alternatives to Rigetti exist. These options provide a more balanced risk-reward profile:

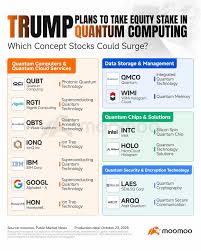

- IonQ (IONQ): As mentioned previously, IonQ's superior qubit technology and focus on commercialization make it an attractive option.

- Quantinuum: The combined expertise in both hardware and software, along with their conservative, software-first approach, positions Quantinuum favorably.

- Alphabet (GOOGL): Alphabet's significant and ongoing investment in quantum computing through its Google AI Quantum division provides indirect exposure to the sector with the backing of a tech giant. This reduces some of the risk associated with investing in a pure-play quantum computing company.

Conclusion: A Call for Prudence in the Quantum Frontier

While quantum computing undoubtedly holds immense potential, investing in the sector requires careful due diligence. Rigetti Computing, burdened by technical challenges, a concerning burn rate, and a premium valuation, appears to be an overhyped and overpriced opportunity. Investors should carefully consider the alternatives and prioritize companies with stronger fundamentals, a clearer path to profitability, and a more demonstrable lead in quantum technology. The future of quantum computing is bright, but Rigetti may not be the vehicle to capitalize on that future.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4861271-rigetti-not-the-quantum-computing-stock-to-own-there-are-better-alternatives ]