IonQ: A Compelling Quantum Computing Investment?

Locales: California, Massachusetts, Texas, UNITED STATES

Sunday, January 18th, 2026 - The promise of quantum computing continues to captivate investors, offering the potential to reshape industries from drug discovery to financial modeling. However, the reality of realizing that potential remains years away, making investment in this sector inherently risky. Amidst the burgeoning landscape of quantum computing companies, one name consistently emerges as a frontrunner: IonQ (IONQ). While caution is advised, analysis suggests IonQ represents a strategically compelling investment opportunity for 2026, leveraging a differentiated technology approach and backed by significant industry validation.

Beyond the Hype: Why Quantum Computing Matters

Before diving into IonQ, it's crucial to understand the transformative power of quantum computing. Unlike classical computers that use bits representing 0 or 1, quantum computers leverage qubits. Qubits exploit quantum mechanics to exist in a superposition of states (both 0 and 1 simultaneously), allowing them to tackle problems currently intractable for even the most powerful supercomputers. The implications are vast: breakthroughs in materials science enabling the design of revolutionary new compounds, the development of personalized medicines tailored to individual genetic profiles, and advancements in financial modeling to optimize portfolios and manage risk with unprecedented accuracy.

IonQ's Trapped-Ion Advantage: A Path to Stability

While several companies are pursuing various qubit technologies, IonQ has opted for a trapped-ion approach. This contrasts with the more common, but often less stable, superconducting qubit technology. Trapped-ion qubits, as the name suggests, involve suspending individual ions (charged atoms) using electromagnetic fields, allowing for greater control and coherence - a key factor in reducing errors and increasing computational accuracy. The inherent stability of trapped-ion qubits gives IonQ a significant advantage, enabling them to achieve higher quantum volume, a more robust measure of quantum computer power than simply counting the number of qubits.

Milestones and Momentum: Demonstrating Technological Leadership

IonQ hasn't just talked about potential; it has delivered demonstrable progress. In 2021, the company achieved a quantum volume of 32, a landmark accomplishment indicating substantial performance improvements. This was followed by a pivotal moment in 2023: the declaration of algorithmic supremacy. This signifies IonQ's ability to solve a complex problem faster than the world's leading classical supercomputers - a critical validation of its technology. Continued improvements in 2024, alongside the expansion of their cloud-based services, further solidify their position as an innovator.

Strategic Partnerships: Validation from Industry Giants

Confidence in IonQ's technology extends beyond internal advancements. Key partnerships with industry titans underscore their potential. A collaboration with Google (GOOGL) is integrating IonQ's quantum computers within Google's cloud platform, broadening access to their technology and validating its capabilities for large-scale applications. Furthermore, a partnership with BMW (BMWYY) aims to leverage quantum computing to optimize critical automotive processes, particularly in battery design and materials science - a significant indication of real-world applicability. While these partnerships represent a financial investment for IonQ, they serve as a powerful endorsement of its technology's promise.

Navigating the Risks: A Long-Term Perspective Required

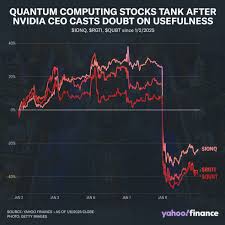

Investing in quantum computing, particularly a company like IonQ, carries significant risk. The technology is still nascent, and commercial viability remains years away. The timeline for realizing the full potential of quantum computing is highly uncertain and subject to technological breakthroughs and unforeseen challenges. Moreover, the competition in the quantum computing space is intensifying. However, IonQ's consistent track record of progress, its differentiated technology approach, and the validation provided by major industry players, make it a compelling, albeit speculative, investment opportunity for those with a long-term perspective.

Conclusion: A Measured Optimism for 2026

For investors seeking exposure to the transformative potential of quantum computing, IonQ presents a uniquely positioned opportunity. While acknowledging the inherent risks, the company's technological leadership, strategic partnerships, and continuous innovation justify a cautiously optimistic outlook for 2026. Careful consideration of risk tolerance and a long-term investment horizon are essential for any potential investor.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/18/the-smartest-quantum-computing-stock-buy-for-2026/ ]