Credit Card Stocks Plunge Amidst Fintech Competition and Regulatory Concerns

WDIO

WDIOLocales: New York, UNITED STATES

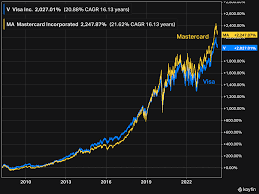

NEW YORK (AP) - February 18, 2026 - Shares of major credit card companies experienced a significant downturn today, mirroring a generally cautious tone on Wall Street. Visa, Mastercard, American Express, and Discover all saw declines, raising questions about the future trajectory of these industry behemoths. The dip follows a robust start to the year for equity markets, suggesting a potential shift in investor sentiment.

Specifically, Visa closed down 3.7%, Mastercard fell 2.9%, American Express shed 3.1%, and Discover dipped 1.4%. These drops contributed to a broader market that lacked a clear upward trend. The Dow Jones Industrial Average edged down 65 points (0.2%) to 36,741.20, while the S&P 500 and Nasdaq Composite fell 12 points (0.3%) and 34 points (0.2%) respectively, closing at 4,765.55 and 16,084.13.

While European and Asian markets generally posted gains, the negative performance of credit card stocks indicates sector-specific pressures. Two primary factors appear to be driving this concern: mounting competition in the payments processing landscape and increasing regulatory scrutiny from the Biden administration.

The Rise of Fintech and the Challenge to Traditional Networks

For decades, Visa and Mastercard have enjoyed a duopoly in the credit card processing industry. However, a new wave of fintech companies is emerging, seeking to disrupt this established order. These challengers are leveraging innovative technologies like blockchain, real-time payments, and 'buy now, pay later' (BNPL) services to offer alternatives to traditional credit cards. Companies like Block (formerly Square), Affirm, Klarna, and a host of smaller startups are gaining traction, particularly among younger demographics who are more open to these new payment methods.

The appeal of these alternatives isn't solely based on novelty. Many offer lower fees for merchants, faster transaction times, and more flexible payment options for consumers. This increased competition is directly impacting the revenue potential of Visa and Mastercard, as a larger share of transactions bypasses their networks. The fear among investors is that these fintechs will continue to erode market share, forcing the established players to lower fees or invest heavily in innovation to remain competitive.

Regulatory Concerns and Potential for Intervention

Adding to the pressure, the Biden administration has signaled a growing interest in regulating the credit card industry. Concerns center around the high fees charged to merchants, which ultimately get passed on to consumers, and the perceived dominance of Visa and Mastercard. The administration believes that fostering greater competition in the payments processing industry will benefit both businesses and consumers.

Possible regulatory interventions could include capping interchange fees (the fees merchants pay for accepting credit cards), mandating open access to payment networks, or even breaking up the dominant players. While the specifics remain unclear, the mere possibility of increased regulation is spooking investors. Tighter rules could significantly impact the profitability of credit card companies, forcing them to adapt their business models.

Looking Ahead: Adaptation and Innovation are Key

The current situation presents a challenge for Visa, Mastercard, American Express, and Discover. To navigate these headwinds, these companies will need to focus on several key strategies.

- Innovation: Investing in new technologies and services, such as digital wallets, real-time payments, and data analytics, is crucial to differentiate themselves from the competition.

- Diversification: Expanding into new markets and payment methods can help reduce reliance on traditional credit card transactions.

- Partnerships: Collaborating with fintech companies can allow them to leverage innovative technologies and reach new customer segments.

- Lobbying and Advocacy: Engaging with regulators to shape the future of payments regulation is essential to protect their interests.

The coming months will be critical for the credit card industry. The ability of these companies to adapt to the changing landscape and address regulatory concerns will determine their long-term success. The market's reaction today suggests that investors are demanding a clear demonstration of their ability to do so. The broader market, while exhibiting some resilience, will also be closely watching developments in the payments sector, as the health of these key companies has a significant impact on the overall economy.

Read the Full WDIO Article at:

[ https://www.wdio.com/ap-top-news/stocks-of-credit-card-companies-slump-as-wall-street-overall-drifts-in-mixed-trading/ ]