Simple Retirement Plan: 3 Dividend Growth Stocks Could Be Enough

Locale: UNITED STATES

The Simple Retirement Plan: Focusing on Three Dividend Growth Pillars

The recent Seeking Alpha article “If I Could Retire with Only 3 Dividend Growth Investments” by David Jaffe presents a compelling, albeit simplified, strategy for building a retirement portfolio centered around just three dividend-growth stocks. Jaffe's premise is that relying heavily on a small number of high-quality companies can provide the income and growth necessary to achieve financial independence, potentially streamlining investment management and reducing anxiety. While acknowledging the inherent risks in concentration, he argues that careful selection based on specific criteria can mitigate those risks significantly.

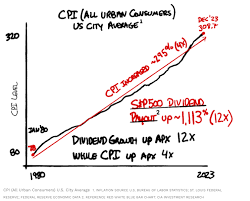

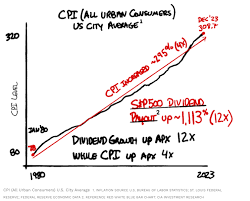

The core argument revolves around identifying companies possessing robust business models, consistent dividend increases, and a history of weathering economic cycles. Jaffe isn't advocating for a "buy-and-hold forever" approach but rather emphasizing the power of holding exceptional businesses through thick and thin, reinvesting dividends strategically, and allowing compounding to work its magic over time.

The Three Chosen Pillars: A Deep Dive

Jaffe’s hypothetical retirement portfolio consists of three companies: Automatic Data Processing (ADP), Illinois Tool Works (ITW), and Realty Income (O). Let's examine each in detail, as presented by the author, along with some additional context gleaned from linked articles and general company information.

Automatic Data Processing (ADP): ADP is a global leader in human resources management software and services. Jaffe highlights its recurring revenue model – businesses need payroll processing regardless of economic conditions – making it remarkably resilient. The article emphasizes ADP’s pricing power, consistently raising prices to offset inflation and maintain margins. As noted in the linked Seeking Alpha article on ADP's Q3 2023 results ("ADP: Still A Solid Choice"), while facing headwinds like slowing business growth, ADP maintains a strong competitive position due to its scale and entrenched relationships with clients. Jaffe appreciates ADP’s history of consistent dividend increases (a Dividend King), demonstrating commitment to shareholder returns. He notes the current yield is relatively modest, but the focus is on long-term growth rather than immediate income. The article points out that ADP's valuation isn't cheap, reflecting its quality and stability, which requires careful consideration by investors.

Illinois Tool Works (ITW): ITW operates in a diverse range of industrial markets, providing specialized products and systems. Jaffe appreciates the company’s "multi-industrial" nature – diversification across various sectors reduces dependence on any single industry's performance. The linked article discussing ITW's Q2 2023 ("Illinois Tool Works: A Solid Choice For Dividend Growth Investors") highlights its focus on operational efficiency and disciplined capital allocation, allowing it to consistently generate cash flow for dividends and reinvestment. ITW’s business model benefits from a global presence and often deals with essential industrial components, making demand less susceptible to consumer discretionary trends. While the article acknowledges potential cyclicality in some of ITW's end markets (like construction), its overall resilience is considered a key strength. Like ADP, ITW boasts a long track record of dividend increases, further solidifying its appeal for income-focused investors.

Realty Income (O): Often referred to as "The Monthly Dividend Company," Realty Income is a Real Estate Investment Trust (REIT) specializing in single-tenant properties leased to strong tenants on long-term leases. Jaffe praises Realty Income's consistent monthly dividend payments, providing a predictable income stream. The linked article detailing the REIT’s recent performance ("Realty Income: A Buy After Recent Price Drops") discusses its focus on “mission critical” properties – businesses that need physical locations regardless of economic conditions (e.g., pharmacies, convenience stores). While REITs are sensitive to interest rate changes (as highlighted in numerous articles discussing the impact of rising rates on REITs), Realty Income's strong tenant base and careful lease structuring help mitigate this risk. The article also acknowledges that Realty Income’s premium valuation has compressed recently due to higher interest rates, potentially presenting a more attractive entry point for investors.

The Strategy: Simplicity & Discipline

Jaffe's strategy isn’t just about picking these three stocks; it’s about the approach to investing. He emphasizes:

- Concentration with Confidence: Recognizing that holding only three stocks increases risk, he stresses the importance of thorough due diligence and believing in the long-term prospects of each company.

- Dividend Reinvestment (DRIP): Initially, all dividends would be reinvested to accelerate compounding growth. As retirement nears, a portion could be taken as income.

- Periodic Review: While advocating for a buy-and-hold philosophy, Jaffe suggests periodically reviewing the companies' fundamentals and competitive landscape to ensure they still meet his criteria.

- Ignoring Market Noise: The strategy requires ignoring short-term market fluctuations and focusing on the long-term performance of the underlying businesses.

Caveats & Considerations

The article acknowledges several potential drawbacks:

- Concentration Risk: A significant downturn in any one of these companies could severely impact the portfolio's performance. Diversification, while generally recommended, is sacrificed for quality and conviction.

- Valuation Matters: Paying too high a price for even excellent companies can significantly hinder returns. Jaffe stresses the importance of waiting for opportunities to buy when valuations are reasonable.

- Interest Rate Sensitivity (Realty Income): REITs are particularly vulnerable to rising interest rates, which can increase borrowing costs and depress property values.

- Limited Flexibility: A portfolio with only three holdings offers less flexibility to adapt to changing market conditions or personal financial needs.

Conclusion

David Jaffe’s “3 Dividend Growth Investments” strategy provides a compelling framework for those seeking a simplified retirement plan focused on high-quality, dividend-paying businesses. While the concentration risk is undeniable, the potential rewards – consistent income, long-term growth, and reduced investment complexity – are attractive to certain investors. The key lies in meticulous selection, unwavering discipline, and a deep understanding of the chosen companies' strengths and weaknesses. It’s not a plan for everyone, but it offers a valuable perspective on building a robust retirement portfolio through focused, quality investing.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4856198-if-i-could-retire-with-only-3-dividend-growth-investments ]