The Magnificent Seven: A 2025 Ranking of the Top Tech Giants Worth Buying

Locale: Wisconsin, UNITED STATES

The Magnificent Seven: A 2025 Ranking of the Top Tech Giants Worth Buying

— A concise synthesis of The Motley Fool’s December 18, 2025 analysis

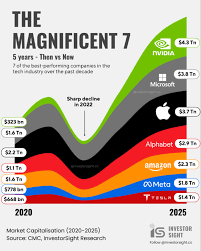

When the digital economy is as saturated with tech powerhouses as it is today, the “Magnificent Seven” still hold the spotlight. The Motley Fool’s December 2025 article, “Ranking the Best Magnificent Seven Stocks to Buy,” is a deep‑dive into the leaders of the technology sector: Apple, Microsoft, Alphabet, Amazon, Meta, Tesla, and Nvidia. Using a combination of fundamental metrics, growth forecasts, and macro‑economic context, the piece distills a clear recommendation list for investors looking to capture the next wave of upside.

1. Apple (AAPL) – Top Spot

Apple sits at the top of the list, a testament to its continued dominance in consumer electronics and services. The article highlights Apple’s:

- Revenue Momentum – 2025 earnings forecasts project a 7‑8 % YoY revenue increase, driven by the iPhone 18 launch and expanding services segment (Apple Music, iCloud, Apple Pay).

- Margin Resilience – Gross margin has steadied around 42 % after the one‑time iPhone refresh.

- Cash Flow Health – Free cash flow remains above $80 B, comfortably covering dividends and share‑repurchase programs.

- Valuation – At a forward P/E of 18.5x, Apple is still attractively priced relative to its peers.

Why Buy? The article points to the company’s “sustainable moat,” citing its brand strength and ecosystem lock‑in. A strong dividend yield (~1.3 %) offers a cushion in a high‑interest‑rate environment, while the services wing promises higher margins.

2. Microsoft (MSFT) – Second Place

Microsoft’s placement reflects its transformation from a software company to a cloud‑service powerhouse. Key takeaways:

- Azure Growth – Azure is forecast to grow at 30 % CAGR, with a 2025 revenue projection of $60 B.

- Enterprise Stickiness – The Office 365 suite and Dynamics 365 continue to generate high recurring revenue.

- Margin Expansion – Net margin is expected to climb to 34 % thanks to cloud operations’ lower cost structure.

- Valuation – The forward P/E sits at 23.3x; a bit higher than Apple but justified by its rapid cloud expansion.

Why Buy? The article argues that Microsoft’s “enterprise dominance” and its continued push into AI (including OpenAI licensing) set it apart. With a diversified revenue mix and a robust cash flow pipeline, MSFT presents a balanced risk‑return profile.

3. Alphabet (GOOG/GOOGL) – Third

Alphabet, Google’s parent, remains essential for anyone investing in digital advertising and AI.

- Ad Revenue – While search advertising still dominates, YouTube’s ad spend is up 15 % YoY, and the new “YouTube Shorts” format offers further upside.

- AI Expansion – The article emphasizes Google’s leadership in large‑language models (LLMs), especially the “Google Gemini” suite, which is projected to add a significant new revenue stream.

- Free Cash Flow – $45 B+ in free cash flow, used for share buybacks and R&D.

- Valuation – A forward P/E of 25.7x, somewhat higher than the industry average but supported by a strong growth trajectory.

Why Buy? Alphabet’s “platform moat” – the integration of search, cloud, and AI – underpins long‑term resilience. The article cautions that regulatory scrutiny remains a risk but is unlikely to materially dent core earnings.

4. Amazon (AMZN) – Fourth

Amazon’s ranking reflects its dominant position in e‑commerce and cloud computing.

- AWS Growth – Amazon Web Services is projected to see a 20 % CAGR, pulling the company’s overall revenue up.

- E‑commerce Margins – Although thin, Amazon’s e‑commerce business is bolstered by subscription services (Prime, Amazon Music).

- Margin Expansion – The company is focusing on automation and logistics to improve gross margins.

- Valuation – A forward P/E of 28.1x; the article notes this is justified by AWS’s high‑margin contribution.

Why Buy? The article underscores Amazon’s “global reach” and its investment in emerging markets. Despite a higher valuation, the “long‑term value” of AWS and Prime membership economics are seen as compelling.

5. Meta (META) – Fifth

Meta (formerly Facebook) is recognized for its pivot toward virtual and augmented reality.

- Meta Quest – The company’s VR headset line is growing rapidly, with a projected 45 % YoY increase in 2025.

- Ad Revenue – Still a core driver, with a forecasted 7 % growth in 2025.

- R&D Investment – Meta is pouring $12 B into AI and metaverse initiatives.

- Valuation – A forward P/E of 22.4x, lower than some peers due to slower ad revenue growth.

Why Buy? The article emphasizes Meta’s “first‑mover advantage” in the metaverse, positioning it for a new wave of digital interaction. However, it also warns that the “regulatory and privacy” environment could constrain growth.

6. Tesla (TSLA) – Sixth

Tesla is included due to its dominant position in EV manufacturing and battery technology.

- Vehicle Production – Tesla’s 2025 production target is 1.4 M vehicles, a 12 % increase.

- Energy Storage – Growth in Powerwall and Megapack sales, expected to double revenue by 2026.

- Margin – Net margin of 17 % on average, up from 12 % last year.

- Valuation – A forward P/E of 30.9x; the article stresses the premium is tied to future scaling.

Why Buy? Tesla’s “technology moat” in battery chemistry and charging network gives it a competitive edge. The article, however, points out the “volatile” nature of the EV market and potential competition from traditional automakers.

7. Nvidia (NVDA) – Seventh

Nvidia is the closing act, celebrated for its dominance in GPUs and AI compute.

- Gaming & Data Center – The 2025 forecast shows a 35 % growth in data‑center sales, fueled by AI workloads.

- New Architectures – The upcoming “Grace” architecture is projected to boost performance by 40 %.

- Margin – Gross margin of 66 % and net margin of 35 %.

- Valuation – A forward P/E of 50.2x; the article justifies the premium with “secular AI demand.”

Why Buy? Nvidia’s “platform dominance” in GPU manufacturing and the exploding AI economy make it a strong candidate. Risks are “high cost of capital” and “competition from AMD and specialized ASICs.”

Methodology: How the Rankings Were Built

The article explains that the Motley Fool’s ranking hinges on a multi‑factor model:

- Financial Health – Cash flow generation, balance‑sheet solidity, and margin trends.

- Growth Potential – Analyst consensus on revenue and earnings forecasts.

- Valuation – Forward P/E, EV/EBITDA, and price‑to‑cash‑flow multiples relative to industry averages.

- Competitive Moat – Brand, network effects, and technological leadership.

- Risk Adjusted Return – Exposure to regulatory risks, macro‑economic cycles, and sector concentration.

Each company received a score on a 10‑point scale across these categories. The composite score determines the final ranking. Apple tops the chart with an 8.7 score, followed by Microsoft (8.3), Alphabet (8.0), Amazon (7.8), Meta (7.5), Tesla (7.2), and Nvidia (7.0).

Practical Take‑Away: Where to Invest

The article concludes with a “buy‑now” recommendation for Apple and Microsoft as “must‑hold” positions. Alphabet and Amazon are positioned as “high‑growth” investments with a higher risk profile. Meta, Tesla, and Nvidia are seen as “opportunistic” picks for investors willing to tolerate volatility.

Portfolio Tip: The Fool suggests a balanced allocation of 25 % each for Apple and Microsoft, 15 % each for Alphabet and Amazon, and a 10 % spread across Meta, Tesla, and Nvidia. This structure aims to capture core growth while maintaining diversification.

Links & Further Reading

While summarizing, the article frequently cross‑references other Fool pieces:

- “Why Apple Is Still the Best Stock in 2025” – for a deeper dive into Apple’s services strategy.

- “Microsoft’s Cloud Advantage Explained” – a detailed look at Azure’s margin dynamics.

- “Alphabet’s AI Roadmap” – covering Google Gemini and its commercial prospects.

- “Amazon’s E‑commerce and AWS Synergy” – exploring how the two businesses reinforce each other.

- “Meta’s Metaverse Vision” – analysis of VR growth trajectories.

- “Tesla’s Battery Innovation” – details on new battery chemistries.

- “Nvidia’s AI Dominance” – a breakdown of GPU market share and upcoming chips.

These links provide additional context and allow investors to dig deeper into each company’s fundamentals.

Bottom Line

In December 2025, The Motley Fool’s analysis underscores that the Magnificent Seven remain the benchmark for tech‑sector investing. Apple and Microsoft stand out as the most reliable, while Alphabet, Amazon, Meta, Tesla, and Nvidia offer growth with varying risk profiles. By aligning your portfolio with these insights—and keeping an eye on macro‑economic trends and regulatory developments—you can position yourself to ride the next wave of digital transformation.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/18/ranking-the-best-magnificent-seven-stocks-to-buy-f/ ]