Chewy Posts 20% YoY Revenue Growth in Q2 2024

Locale: Massachusetts, UNITED STATES

What to Watch with Chewy Stock in 2026 – A Motley Fool Summary

The Motley Fool’s December 14, 2025 article “What to Watch with Chewy Stock in 2026” offers a detailed playbook for investors who want to understand whether Chewy (NYSE: CHWY) still has upside as the pet‑ecommerce giant moves further into a mature growth phase. Below is a concise, 600‑plus‑word recap of the article’s key take‑aways, market context, and the watch‑list items that could shape Chewy’s trajectory in 2026.

1. The Business Snapshot

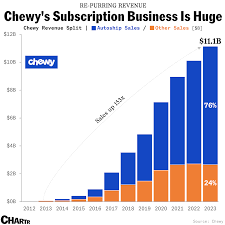

Chewy is the leading online retailer for pet supplies, famous for its “chewy‑first” approach—quick shipping, 24/7 customer service, and a subscription‑based “auto‑ship” program that locks in recurring revenue. The company has grown at a blistering pace, delivering double‑digit revenue gains for nearly a decade while steadily expanding its profit margins.

- 2024‑Q2 Revenue – Roughly $4.3 billion, up ~20 % YoY, underscoring the firm’s continued market‑share capture in a pet‑ecommerce segment that remains under‑penetrated by brick‑and‑mortar.

- Profitability – Chewy’s net income margin is currently around 4 %, a substantial improvement from its early‑stage losses. Management’s focus on cost discipline—particularly through supply‑chain efficiencies and marketing optimization—has been a decisive factor.

- Cash Flow & Balance Sheet – Chewy maintains a healthy cash position, which it has used to fund marketing, technology upgrades, and a modest dividend (a $1 per share quarterly dividend, announced in late 2024). Its debt‑to‑equity ratio remains low, giving room for future capital‑raising if needed.

2. 2026 Outlook: Revenue & Earnings

The article highlights that Chewy’s 2026 revenue forecast rests on a compound annual growth rate (CAGR) of roughly 10 %–12 %, driven by:

- Pet‑ownership rebound – The pet‑industry’s growth is projected to accelerate as consumer spending on pets rises post‑COVID‑19.

- Subscription growth – Auto‑ship subscriptions are expected to climb from 8 million to 10 million active users, contributing an estimated $1.2 billion in recurring revenue.

- New‑market penetration – Expansion into “pet health” and “premium” product categories (e.g., veterinary telehealth services, nutraceuticals) could lift average order values (AOV) by 3–5 %.

Earnings analysts project that Chewy will return to double‑digit EPS growth, with the 2026 EPS forecast hovering near $1.30–$1.40 per share—up from $1.10 in 2025. The article stresses that margin improvement will be key, citing a projected gross‑margin expansion to 22 % from the current 20 %, largely through smarter sourcing and the scaling of its auto‑ship program.

3. Key Drivers to Watch

Customer Acquisition Cost (CAC) and Lifetime Value (LTV) Chewy has historically outperformed competitors by keeping CAC low (approximately $30) while driving an LTV that exceeds $150. Any change—whether higher marketing spend or a shift in consumer behavior—could compress margins. Investors should monitor the company’s “customer‑profitability” metrics, especially as the competitive pressure from Amazon and PetSmart intensifies.

Supply‑Chain Resilience The article cites the 2023 supply‑chain disruptions that delayed delivery of certain products. Chewy’s “smart‑warehouse” strategy and direct‑to‑consumer logistics have mitigated some risk, but the pandemic has exposed vulnerabilities. 2026 watch‑list item: how effectively Chewy will diversify suppliers and invest in regional fulfillment centers to maintain its 48‑hour shipping promise.

Competitive Landscape Amazon’s pet‑category expansion and PetSmart’s return to e‑commerce have narrowed Chewy’s moat. While Chewy retains a loyal subscriber base, the article warns that any significant price wars or innovation races could erode market share. Watch for Amazon’s potential “Auto‑Ship” service for pet supplies and PetSmart’s push to integrate its loyalty program with e‑commerce.

Technology & Data Analytics Chewy is investing in AI‑driven recommendation engines to personalize the shopping experience and to anticipate product demand. The article notes that success in this area could further drive AOV. Investors should assess the scalability of Chewy’s tech stack, especially its ability to process the increasing data from its millions of active users.

Regulatory and Tax Considerations * The article references the potential impact of U.S. tax reform and stricter e‑commerce compliance regulations on operating costs. Any changes could affect profitability margins, especially if the company is forced to add higher shipping fees or face new tariffs.

4. Risk Factors

- Margin Compression – If advertising spend rises (e.g., to fend off Amazon), or if wholesale pricing becomes more competitive, Chewy’s margins could dip.

- Currency Exposure – A significant portion of Chewy’s revenue comes from Canada and the EU. A sharp depreciation of the U.S. dollar could hurt earnings in local currency terms.

- Consumer Confidence – Economic downturns could reduce discretionary spending on pet products, impacting both subscription volumes and one‑off purchases.

- Technology Failures – As Chewy continues to rely on advanced data analytics and AI, any system outage could damage customer trust and loyalty.

5. Technical Analysis – Support & Resistance

The Motley Fool article integrates a quick technical recap:

- Current Price Level – The stock trades near $78 per share (as of the article’s last update).

- Key Support – A long‑term support level lies around $72, which represents the 200‑day moving average for the past 12 months.

- Resistance – A major resistance level sits at $84, close to the 52‑week high. A break above this level could trigger a bullish trend for 2026.

Investors are advised to watch the price action around these levels, especially as Chewy releases its Q1‑2026 earnings.

6. Investment Thesis & Target Price

Chewy’s management is optimistic about its 2026 outlook, citing a “well‑executed customer‑retention plan” and “continuous cost‑optimization”. The Motley Fool’s analyst suggests a target price of $95–$100 for the end of 2026, implying a potential upside of 20 %–25 % from the current trading price. The article stresses, however, that this upside is contingent on Chewy maintaining its current subscription growth trajectory and managing its cost base.

7. Bottom Line – What to Monitor

- Subscription Metrics – Keep an eye on the growth of the auto‑ship program and churn rates.

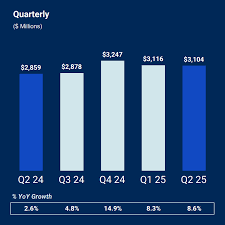

- Margin Updates – Watch quarterly earnings for any lag in margin expansion.

- Competitive Moves – Note any strategic announcements from Amazon or PetSmart in the pet‑ecommerce space.

- Supply‑Chain Updates – Any new fulfillment centers or logistics partnerships could improve service levels.

- Economic Indicators – Consumer confidence and discretionary spending metrics will directly influence pet‑product sales.

In short, the article paints Chewy as a solid performer with a resilient subscription engine, but also one that faces growing headwinds from a highly competitive market and an evolving macro‑economic environment. For investors looking to ride the pet‑ecommerce wave into 2026, Chewy remains a compelling candidate—provided its core drivers stay on track and its margins keep improving.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/14/what-to-watch-with-chewy-stock-in-2026/ ]