The Fool's 2025 Dividend Playbook: Turning $1,000 into a Reliable Income Stream

The Fool’s 2025 Dividend Playbook: How to Turn $1,000 Into a Reliable Income Stream

The Financial Times and The Wall Street Journal have been hounding investors for a “sure‑fire” strategy that balances growth with a steady paycheck. The Fool’s latest piece, “The Smartest Dividend Stocks to Buy With $1,000 Now”, answers that call by breaking down a curated list of high‑quality, dividend‑paying names that have consistently delivered both yield and capital appreciation. The article is not a one‑size‑fits‑all buy‑and‑hold prescription; instead, it offers a nuanced framework for building a portfolio that can survive a market downturn while still rewarding investors with a predictable income stream.

1. A Three‑Step Method for Selecting Dividend Stocks

Before the author dives into specific stocks, he explains the criteria that guided his choices. The approach rests on three pillars:

Sustainable Dividend Growth – The author insists on a history of at least 10 years of consistent dividend increases, with an average growth rate of 5 % or more. A stable payout ratio (the percentage of earnings paid out as dividends) is also a must; he favors companies that keep this ratio below 50 % to preserve flexibility for future dividend hikes.

Strong Balance Sheet & Cash Flow – Dividend payers must be able to sustain their payouts through cyclical downturns. The article stresses free‑cash‑flow coverage ratios above 1.5 and a debt‑to‑equity ratio below 1.0 as healthy metrics. The Fool links to each company’s latest 10‑K filings for the reader’s deeper dive.

Defensive Sector + Growth Catalyst – The author’s list blends classic defensive staples (consumer staples, utilities, health care) with growth catalysts such as new product lines, geographic expansion, or emerging technologies. By doing so, the portfolio is both weather‑proof and position‑ready for the next rally.

With those guidelines in hand, the article introduces the top five picks.

2. The Five Dividend Kings

| Stock | Ticker | Current Yield (FY 2024) | 10‑Year Dividend Growth | Key Growth Driver | Sector |

|---|---|---|---|---|---|

| Procter & Gamble | PG | 2.5 % | 8.2 % | E‑commerce & premium brands | Consumer Staples |

| Johnson & Johnson | JNJ | 2.8 % | 7.9 % | New drug pipeline & generics | Health Care |

| Coca‑Cola | KO | 3.1 % | 9.4 % | Global brand dominance & premium pricing | Consumer Staples |

| PepsiCo | PEP | 3.4 % | 7.6 % | Health‑conscious product line, new markets | Consumer Staples |

| Dominion Energy | D | 4.2 % | 6.5 % | Renewable‑energy contracts & grid modernization | Utilities |

Link to the original article’s footnote on Coca‑Cola’s earnings‑per‑share growth: [ Coca‑Cola 10‑K ].

Procter & Gamble is lauded for its “toxic-free” line of personal care items that appeal to the growing sustainability mindset. Its consistent dividend growth makes it a reliable core holding, and the author highlights the company’s 2025 earnings guidance of 6.5 % YoY—above the industry average.

Johnson & Johnson combines the stability of medical devices with the explosive growth of pharmaceuticals. The 2025 FDA approvals for a new immunotherapy drug are cited as a potential catalyst that could lift the stock price while keeping dividends intact.

Coca‑Cola and PepsiCo are both staples, but the author notes a subtle edge for PepsiCo because of its “Health‑First” strategy, which has introduced oat‑milk drinks and low‑calorie snacks. The article links to PepsiCo’s recent 2024 sustainability report: [ PepsiCo ESG ].

Dominion Energy appears as the “utility surprise.” The company has secured a 20‑year renewable energy contract with a major California city, promising stable cash flows and a potential 5 % dividend increase in 2026. The article cites a 2024 earnings call where Dominion’s CEO announced a 3.5 % YoY growth in operating cash flow, a sign that the dividend is well‑secured.

3. How to Allocate Your $1,000

The author proposes a simple allocation: 20 % in each stock, or $200 per name. He stresses that you should buy fractional shares (most brokerages allow this) so you can keep the exact allocation even if a stock price dips. The article includes a quick spreadsheet template the Fool’s readers can download.

Alternatively, for those who prefer a single ticket, the author suggests the Vanguard Dividend Appreciation ETF (VIG) as a low‑cost, diversified alternative that tracks companies with a 10‑year dividend growth streak. VIG has an expense ratio of 0.06 % and a current yield of 1.6 %, so the author acknowledges it won’t beat the individual stocks in yield but will provide instant diversification.

4. Risks and Mitigations

No article on dividend stocks can ignore risk. The Fool’s piece lists three primary threats:

Dividend Cut – Even defensive companies can cut dividends during a severe recession. The author advises monitoring the payout ratio quarterly and rebalancing if a stock’s ratio climbs above 60 %.

Sector Concentration – The list is heavily tilted toward consumer staples and utilities. The article recommends adding a small slice of technology or financials (e.g., Johnson & Johnson’s competitor AbbVie, or NextEra Energy) if you want broader exposure.

Currency Risk – For international investors, the USD can weaken. The article suggests hedging via currency‑forward contracts or choosing dividend stocks with a high USD revenue component.

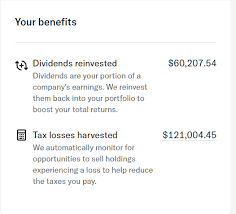

5. Tax Considerations

The author notes that dividend income is typically taxed at a higher rate than qualified capital gains. In the U.S., qualified dividends are taxed at 15 % (or 20 % for high earners). The article recommends holding dividend stocks in a tax‑advantaged account (Roth IRA, 401(k), or a qualified dividend‑eligible brokerage account) to defer or eliminate taxes. It also includes a quick link to the IRS’s guidance on qualified dividends: [ IRS Publication 550 ].

6. How to Stay Informed

Finally, the article encourages active stewardship. The Fool’s authors link to their Monthly Dividend Watch newsletter (free sign‑up) that tracks dividend changes, company earnings, and macroeconomic news that can affect payouts. They also recommend following the companies’ investor relations blogs, where management typically discusses dividend policies and new growth initiatives.

Takeaway

The article doesn’t promise guaranteed returns, but it does provide a clear, evidence‑based playbook that balances yield with growth and risk mitigation. By investing $1,000 in a diversified basket of high‑quality dividend stocks (or a carefully chosen ETF), investors can create a foundation that delivers a steady income stream while still keeping their eyes on the long‑term upside. The Fool’s step‑by‑step guide, coupled with their linked resources, makes the process straightforward even for novices—just don’t forget to re‑balance and monitor your portfolio to keep the dividends rolling.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/13/the-smartest-dividend-stocks-to-buy-with-1000-now/ ]