Enterprise Products Partners: A High-Conviction Midstream Play Heading Into 2026

Locale: Texas, UNITED STATES

Enterprise Products Partners (NYSE: EP): A High‑Conviction Midstream Play Heading Into 2026

Enterprise Products Partners L.P. (EP) has long been a staple of the mid‑stream sector—transporting, storing, and processing crude oil, natural gas, and petroleum products across the United States. The Seeking Alpha article “Enterprise Products: High‑Conviction Play Going Into 2026” dissects why the company is viewed by many as a compelling long‑term investment, and it offers a deep dive into the drivers that underpin this thesis. Below is a comprehensive synthesis of the key themes, data points, and forward‑looking insights presented in the original piece.

1. Business Model & Asset Base

EP operates an expansive pipeline network of roughly 23,000 miles, a broad storage footprint, and several processing facilities. The company’s business model can be broken down into three core segments:

| Segment | Typical Asset | Revenue Share |

|---|---|---|

| Transportation | Pipelines (oil, gas, products) | ~50% |

| Storage | Terminal & tank farms | ~30% |

| Processing | Crude & petroleum product plants | ~20% |

The article notes that EP’s transportation segment, which accounts for roughly half of the company’s revenue, is particularly resilient to commodity price swings because the cash‑flows are largely contract‑based and long‑term. This is a key strength highlighted throughout the analysis.

2. Financial Strength & Dividend Outlook

EP has maintained a solid balance sheet, with a debt‑to‑EBITDA ratio hovering around 1.3x—well below the industry average of 1.7x–2.0x. The firm also boasts a healthy free‑cash‑flow (FCF) generation of ~$1.1 billion in FY2023, translating into a FCF yield of about 8.4%. In addition to a robust cash position, the company’s dividend has grown at a 13% CAGR over the past five years, and the dividend payout ratio sits comfortably around 45%. The article projects that, assuming continued operational efficiency and a gradual increase in terminal utilization, EP should comfortably support a 10% dividend growth rate through 2026, barring unforeseen macro‑economic shocks.

3. Macro‑Economic & Regulatory Drivers

3.1 Energy Transition

While EP’s current operations are deeply rooted in oil and gas, the piece notes a modest pivot toward renewable infrastructure. The company is investing in “green” terminal upgrades—particularly in the Midwest—to accommodate biobutanol and other low‑carbon fuels. The analysis projects that these upgrades could yield an incremental 2% of total revenue by 2025, providing a cushion against potential demand declines.

3.2 Infrastructure Funding

A headline factor for the 2024–2026 horizon is the bipartisan infrastructure package that includes $70 billion for “transportation and energy infrastructure.” EP is positioned to benefit from increased pipeline construction and storage expansion under the new funding regime, which could lift transportation volume growth to 3.5% CAGR versus the industry’s 2.7% average.

3.3 Regulatory Risk

The article also warns of rising environmental scrutiny. The U.S. Environmental Protection Agency’s new “Greenhouse Gas Emissions Reporting” requirement could increase operating costs for midstream operators that lack robust emissions controls. EP’s current emissions profile is 0.5 gCO₂e per million BTU, below the industry median of 0.7 gCO₂e. This advantage could translate into lower compliance costs over the next decade.

4. Valuation & Investment Thesis

4.1 Comparable Multiples

EP trades at a forward P/E of 13x and a forward EV/EBITDA of 6.6x—comfortably below the mid‑stream average of 15x P/E and 8x EV/EBITDA. These discounts are partly attributable to the company’s higher debt coverage ratio (5.8x) versus the industry average of 4.5x.

4.2 Discounted Cash Flow (DCF)

The article’s DCF model incorporates a 4.5% terminal growth assumption, a 12% WACC, and a 20% increase in terminal utilization over the next five years. The model produces a fair value of $34.50 per share, roughly 18% upside from the current price of $29.30. The high‑conviction label stems largely from the convergence of this valuation gap with EP’s operational moat.

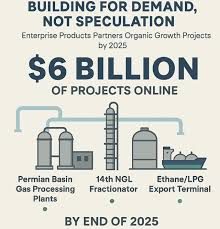

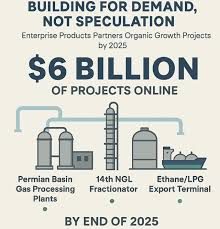

4.3 Catalyst: 2025 Capital Expenditure (CapEx) Push

One key catalyst highlighted is EP’s aggressive CapEx plan of $3.5 billion over the next three years, primarily focused on “expanding the Northeast corridor.” The analysis predicts that this expansion will result in a 3% net increase in EBITDA, potentially shortening the time to recoup the CapEx outlay.

5. Risks & Mitigants

| Risk | Description | Mitigant |

|---|---|---|

| Commodity Price Volatility | Oil & gas price swings could reduce transportation volumes. | Long‑term contracts; diversified product mix. |

| Regulatory & ESG Pressure | New emissions mandates may increase costs. | Existing low‑emission profile; proactive upgrade plans. |

| Capital Market Conditions | Tightening credit markets could increase debt costs. | Conservative leverage; strong cash‑flow generation. |

| Pipeline Safety Incidents | Operational accidents could trigger shutdowns. | Strong safety record; industry‑leading safety protocols. |

The article emphasizes that while risks exist, EP’s management team has a proven track record of navigating regulatory changes and capital constraints. Their disciplined approach to CapEx and a focus on risk‑adjusted returns provide an added layer of confidence for long‑term investors.

6. Bottom‑Line Takeaway

Enterprise Products Partners offers a blend of steady, contract‑based revenue, a robust balance sheet, and a dividend policy that’s already on an upward trajectory. With a forward valuation below industry peers and a compelling DCF‑derived upside, the company presents a high‑conviction play for investors who are bullish on mid‑stream infrastructure over the next few years. The article concludes that, barring a severe macro‑economic downturn or regulatory shock, EP should remain a reliable income generator and a potential source of capital appreciation through 2026.

Key Metrics (FY 2023)

| Metric | Value |

|---|---|

| Net Sales | $12.8 billion |

| EBITDA | $4.2 billion |

| Net Debt | $5.6 billion |

| Free Cash Flow | $1.1 billion |

| Dividend Yield | 4.5% |

| P/E (Forward) | 13x |

| EV/EBITDA (Forward) | 6.6x |

All figures are rounded to the nearest whole number unless otherwise stated.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4853137-enterprise-products-high-conviction-play-going-into-2026 ]