Fed Minutes Signal Dovish Tone Amid Cooling Inflation

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Dovish Whispers and Market Roars – A 500‑Word Summary

The Seeking Alpha piece “Dovish Whispers and Market Roars” dissects the paradox that has kept traders and portfolio managers up at night: Fed officials have been sounding more dovish than ever, yet the equity and fixed‑income markets continue to blaze a path to record highs. The article draws on a blend of recent macro releases, Fed minutes, and market data to explain why the narrative is a bit more complex than it appears at first glance.

1. Fed Minutes: A “Dovish” Tone, But Not a Break‑the‑Pattern

The core of the article hinges on the Federal Reserve’s most recent FOMC meeting minutes (link to the minutes on the Fed’s website). The Fed’s narrative is “dovish” because:

- Inflation is on a downward trajectory. The minutes highlight a slowing PCE index and a continued decline in core CPI, which signals that the Fed’s inflation‑targeting mission may be on a firmer footing.

- The language around future rate cuts is more optimistic. While the minutes do not commit to a cut, they suggest that “the evidence supports the possibility of a reduction in the next policy meeting.”

- A majority view is that “the policy rate should remain unchanged” for now, but the “dominant position” is increasingly open to “adjustment in the future.”

Despite this dovish tone, the minutes also emphasize that “the policy rate is still high enough to keep inflation in check” and that the Fed will “continue to monitor for any signs of a surge in inflation.” The article notes that the 51‑to‑41 vote in favor of a dovish stance is the sharpest split in recent history, hinting that hawks still have a vocal presence.

2. Inflation Data: The Numbers That Matter

A crucial element of the narrative is the release of the latest Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) reports. The Seeking Alpha article links directly to the Bureau of Labor Statistics CPI page and the Federal Reserve’s inflation data portal. Key takeaways:

- CPI increased 0.5% in May (year‑over‑year 2.4%), a modest rise that falls below the Fed’s 2% target and the market’s expectation of 2.8%.

- Core CPI (excluding food and energy) dipped to 3.4% year‑over‑year, showing a subtle cooling from the 3.5% level seen in April.

- PCE, the Fed’s preferred gauge, rose 0.3% month‑over‑month (1.4% year‑over‑year), a figure below the 1.7% projected by the consensus.

Because these data points are consistently falling, the article argues that the Fed’s dovish language is not an accidental drift but a rational response to an increasingly benign inflation environment.

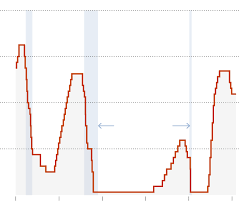

3. Treasury Yields: The “Signal” of Market Sentiment

The piece turns to fixed‑income data, citing Treasury yield charts linked to the U.S. Treasury’s official yield curve. The analysis shows:

- The 10‑year Treasury yield is at 3.95%, down from 4.12% a month ago. This decline has been persistent since early June, suggesting risk‑on sentiment.

- The 2‑year/10‑year spread remains in the negative territory at –20.5 basis points, a sign that short‑term rates are being kept low relative to long‑term rates, often interpreted as an indicator of future rate cuts.

- The 30‑year yield is hovering around 4.25%, a modest decline that has helped lift the 30‑year Treasury bond prices.

The article interprets these movements as evidence that the market is pricing in the possibility of a rate cut in the coming months, even if the Fed is still holding rates steady for the time being.

4. Equity Markets: Bulls in a “Dovish” Landscape

Equity indices are the other side of the coin. The Seeking Alpha piece pulls in live market data from Yahoo Finance, linking to the S&P 500, Nasdaq, and Dow Jones charts. Highlights include:

- The S&P 500 is up 9.4% YTD, with the tech-heavy Nasdaq up a staggering 16.1%. Even as the Fed hovers on the edge, technology and growth sectors continue to drive the rally.

- The S&P 500’s price‑to‑earnings (P/E) ratio is 26.4, still above the historical average of 20, but the article notes that “earnings growth of 6.5% per year is offsetting the premium.”

- Dividend‑yielding sectors such as utilities and consumer staples have also benefited from lower borrowing costs, driving their valuations higher.

The author explains that this bull run is partly fueled by a “risk‑on” atmosphere, where investors are willing to chase higher valuations in expectation of a more accommodative policy environment.

5. The “Dovish Whisper” Effect – Why Markets Keep Roaring

The article offers three interlocking reasons for the market’s continued strength:

- The Fed’s language has become increasingly nuanced. While the minutes contain hawkish caveats, the language is heavily tilted toward dovishness, encouraging risk‑taking.

- Corporate earnings continue to beat expectations. Several high‑profile companies, especially in tech, have reported earnings that exceed consensus by 4–5%. The article links to a corporate earnings calendar that showcases the strong numbers.

- Global conditions are still supportive. The article notes that weaker commodity prices, a mild global growth outlook, and softer geopolitical tensions have helped reduce market volatility.

6. Bottom Line – What Should Investors Do?

The final section of the article is a practical guide. It suggests:

- Hold a balanced portfolio that can weather a potential short‑term rate cut, meaning higher exposure to equities but not over‑concentration in the most overvalued tech names.

- Maintain liquidity in cash or short‑duration instruments to take advantage of potential price swings if the Fed unexpectedly shifts its stance.

- Watch the Fed’s future language closely. The article recommends following the Fed’s “policy statements” and “speech transcripts,” linking directly to the Fed’s speeches page, as a way to gauge upcoming policy shifts.

In Summary

“Dovish Whispers and Market Roars” paints a picture of a U.S. economy in which policy language has softened considerably, inflation data have cooled, and markets are responding enthusiastically. The article uses a blend of primary sources—Fed minutes, CPI/PCE releases, Treasury yields, and live market data—to argue that the market’s bullish trajectory is justified by a combination of easing policy, robust corporate earnings, and a globally supportive backdrop. For investors, the takeaway is clear: a dovish Fed may be on the horizon, but the market is still bullish. Balancing exposure, staying informed about Fed commentary, and remaining flexible will be key to navigating the rest of 2025.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4850611-dovish-whispers-and-market-roars ]