A Warning to Young Dividend Investors: Why the High-Yield Trap Isn't a Safe Bet

A Warning to Young Dividend Investors: Why the “High‑Yield” Trap Isn’t a Safe Bet

Dividend investing has long been marketed as a low‑risk, “set‑and‑forget” strategy—particularly appealing to younger investors who want a steady stream of income while still building a growth portfolio. However, a recent Seeking Alpha piece titled “A Warning to Young Dividend Investors” cautions that the pursuit of high yields can be a perilous shortcut. The article, written by a seasoned market commentator, unpacks the hidden risks behind chasing top‑tier dividend payouts and offers a framework for a more sustainable, growth‑oriented approach.

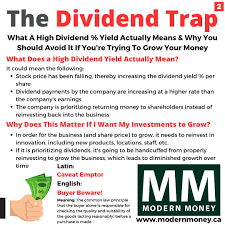

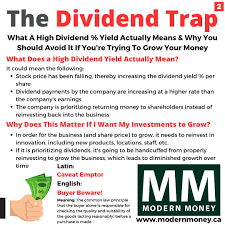

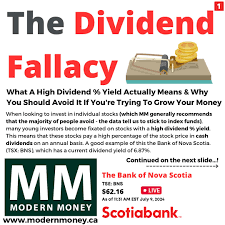

1. The Myth of “Safe” Dividends

The article opens with a stark reminder: high dividend yield does not equal safety. Many young investors fall into the trap of selecting the highest-yielding stocks on a market‑wide basis, assuming that a larger payout guarantees stability. The writer points out that yield calculations can be misleading because they are based on a stock’s current price rather than the company’s earnings or cash flow generation.

To illustrate, the piece contrasts a high‑yield telecom stock with a robust, high‑growth technology company that pays a modest dividend. While the telecom firm may appear attractive on paper, its payout ratio (dividends as a percentage of earnings) sits at 90 %, leaving little room for reinvestment or cushioning during downturns. The tech company, in contrast, has a payout ratio of 30 % and is reinvesting heavily in R&D, positioning itself for long‑term value creation.

2. Dividend Sustainability: Payout Ratios, Cash Flow, and Earnings

A key theme is the concept of dividend sustainability—the idea that a company must be able to sustain its dividend payments without jeopardizing its core operations. The article explains that sustainability is best assessed through three metrics:

| Metric | What It Tells You | How It’s Calculated |

|---|---|---|

| Payout Ratio | Indicates how much of earnings is paid out. | Dividends ÷ Net Income |

| Free Cash Flow (FCF) | Measures the actual cash available after capital expenditures. | Operating Cash Flow – Capital Expenditures |

| Dividend Coverage Ratio | Shows how many times a firm’s earnings cover dividends. | Earnings Before Interest & Taxes (EBIT) ÷ Dividends |

The author emphasizes that a payout ratio above 70 % is generally a red flag, especially for companies in cyclical industries. Likewise, a dividend coverage ratio below 2× signals potential vulnerability if earnings dip.

3. The Yield‑Growth Paradox

The article then tackles the yield‑growth paradox—the trade‑off between high yields and capital appreciation. Young investors are often drawn to dividend‑heavy portfolios because they provide “income” without the need to sell shares. However, this focus on yield can crowd out growth opportunities that might lead to larger stock price gains over time.

To demonstrate, the piece cites a case study of a consumer staples giant that raised its dividend by 5 % annually for the past decade, while its stock price grew modestly. In contrast, a lower‑yield peer with aggressive reinvestment outperformed both the dividend stock and the broader market over the same period. The point is clear: dividend growth (or the lack of it) can be a stronger indicator of long‑term wealth accumulation than a current yield.

4. Sector Concentration Risks

Seeking Alpha readers are no strangers to sector‑specific ETFs such as “Dividend Kings” or “High‑Yield Dividend Funds.” The article warns that many of these funds concentrate heavily in utilities, telecom, and real‑estate investment trusts (REITs). While those sectors often provide attractive yields, they also tend to be less flexible, more regulated, and susceptible to rate hikes or changing consumer preferences.

The writer suggests diversifying across sectors—especially into financials, industrials, and consumer discretionary—to mitigate the risk of a single sector downturn wiping out a significant portion of the dividend income.

5. Corporate Governance and Dividend Policy

Beyond financial metrics, the article calls attention to corporate governance as a key determinant of dividend stability. Boards with strong independence, transparent payout policies, and a proven track record of honoring dividends are far more likely to maintain payments during economic stress.

The piece recommends researching a company’s dividend history (whether it’s a Dividend Aristocrat or not), the consistency of its payout over multiple recession cycles, and the presence of a formal dividend policy. A company that has cut dividends during a downturn (such as a recession or supply‑chain crisis) may be more prone to repeat cuts when earnings decline.

6. Practical Takeaways for Young Investors

- Assess Sustainability First: Look at payout ratios, free‑cash‑flow coverage, and dividend coverage before adding a stock to your portfolio.

- Prioritize Dividend Growth: A company that raises dividends over time demonstrates confidence in earnings and a willingness to reinvest.

- Diversify Across Sectors: Avoid heavy concentration in any single industry that may face regulatory or cyclical headwinds.

- Check Governance: Examine board composition and dividend policy statements to gauge a firm’s commitment to its dividend stream.

- Use a “Dividend Growth Index”: Instead of chasing the highest yield, consider a growth‑oriented index like the S&P 500 Dividend Aristocrats or the Vanguard Dividend Appreciation ETF (VIG).

The article concludes by reminding readers that dividend investing is not a “one‑size‑fits‑all” strategy. For younger investors, the balance should tilt toward quality and growth, not just yield. The goal is a portfolio that can grow in value and pay a reliable, sustainable dividend—two goals that are mutually reinforcing when approached with diligence.

7. Related Resources (Based on Linked Articles)

Seeking Alpha’s ecosystem encourages readers to dig deeper. The linked articles in the original piece include:

- “The Dividend Discount Model Explained” – A step‑by‑step guide on calculating intrinsic dividend value using the Gordon Growth Model.

- “Dividend Aristocrats vs. High‑Yield ETFs: Which Performs Better?” – A comparative performance analysis of dividend‑growth focused funds versus high‑yield funds.

- “Reinvesting Dividends: The Power of DRIP” – An overview of dividend reinvestment plans and their compounding benefits for long‑term investors.

These resources help reinforce the article’s core message: Sustainable, growth‑oriented dividend investing is more valuable than chasing a top‑line yield.

In sum, “A Warning to Young Dividend Investors” serves as a cautionary tale that encourages careful analysis, long‑term thinking, and a balanced approach to income and growth. The article urges young investors to move beyond headline yields and to focus on the underlying fundamentals that truly support a lasting dividend stream.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4850062-a-warning-to-young-dividend-investors ]