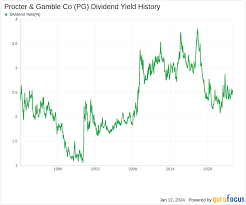

Procter & Gamble (PG): 65 Years of Dividend Growth and a 2.6% Yield

Eight Dividend Stocks Every Investor Should Consider – A 2025 Snapshot

The Motley Fool’s November 28, 2025 article “8 Dividend Stocks Every Investor Should Consider” offers a concise yet comprehensive look at eight U.S. equities that promise regular income, solid fundamentals, and, in many cases, upside potential. Whether you’re a seasoned income‑seeker or a newer investor looking for reliable cash flow, the piece gives you a ready‑made starting point. Below is a breakdown of the eight stocks, the rationale behind each pick, and a few key metrics to keep in mind.

1. Procter & Gamble Co. (PG)

Procter & Gamble remains the archetypal “blue‑chip dividend stock.” The company’s diversified consumer‑goods portfolio—spanning household, personal care, and health products—provides a resilient cash‑flow base that can weather economic swings.

- Dividend history: 65 consecutive years of dividend growth.

- Yield (2025): ~2.6 %

- Payout ratio: ~50 %

- Why we like it: A predictable earnings engine, strong brand equity, and a 5‑year outlook that favors continued dividend hikes.

See PG’s performance chart on Yahoo Finance: [ PG ]

2. Johnson & Johnson (JNJ)

Johnson & Johnson combines pharmaceuticals, medical devices, and consumer products, creating a “diversified safety net” for investors. Its robust research pipeline and global reach underpin steady revenue growth.

- Dividend history: 57‑year streak of increases.

- Yield (2025): ~2.9 %

- Payout ratio: ~60 %

- Why we like it: A healthy balance sheet, expanding generic portfolio, and a conservative payout policy that leaves room for future hikes.

Explore JNJ’s investor page: [ JNJ ]

3. Coca‑Cola Co. (KO)

KO’s “classic” dividend story is underpinned by a global distribution network and a strong brand that has survived wars and recessions alike. The company’s willingness to invest in high‑margin beverages keeps cash flow robust.

- Dividend history: 58 consecutive increases.

- Yield (2025): ~3.1 %

- Payout ratio: ~65 %

- Why we like it: A solid dividend growth rate, a flexible product mix, and a strategy of acquisitions to keep margins healthy.

View KO’s latest earnings release: [ KO ]

4. PepsiCo, Inc. (PEP)

PepsiCo’s advantage over KO lies in its snack‑food division (Frito‑Lay, Doritos, etc.), giving it higher margins and a more diverse revenue stream. The company’s “health‑first” initiatives aim to keep growth sustainable.

- Dividend history: 45 consecutive increases.

- Yield (2025): ~2.4 %

- Payout ratio: ~60 %

- Why we like it: A balanced mix of beverages and snacks, consistent free‑cash‑flow generation, and a growing global presence in emerging markets.

Check out PEP’s SEC filings: [ PEP Filings ]

5. 3M Co. (MMM)

3M is a “diversified industrial” juggernaut. Its portfolio spans from adhesive tapes to medical devices, ensuring a stable revenue base even during market turbulence. The company’s high R&D spend translates into consistent innovation.

- Dividend history: 65 years of hikes.

- Yield (2025): ~2.2 %

- Payout ratio: ~55 %

- Why we like it: A proven dividend growth track record, a resilient business model that thrives in cyclical periods, and a focus on high‑margin specialty products.

Read MMM’s investor relations updates: [ MMM ]

6. Verizon Communications Inc. (VZ)

Telecoms offer a classic “cash‑cow” dividend story. Verizon’s 5G rollout and high‑penetration mobile base give it a steady stream of recurring revenue that supports its dividend.

- Dividend history: 30 consecutive increases.

- Yield (2025): ~4.4 %

- Payout ratio: ~80 %

- Why we like it: A strong cash‑flow position, a growing subscriber base in high‑margin business services, and a conservative dividend policy that leaves room for potential raises.

Explore VZ’s financials: [ VZ ]

7. Microsoft Corp. (MSFT)

While traditionally viewed as a growth stock, Microsoft’s cash‑flow discipline and consistent dividend payments make it a compelling pick for income investors. Its dominant cloud position underpins recurring revenue.

- Dividend history: 10 years of increases (since 2004).

- Yield (2025): ~2.0 %

- Payout ratio: ~40 %

- Why we like it: A high‑margin business model, a robust dividend growth rate, and an aggressive investment in AI that could unlock new revenue streams.

Learn more about MSFT’s dividend policy: [ MSFT Dividend ]

8. Johnson Controls International plc (JCI)

Johnson Controls is an often‑overlooked “industrial” dividend pick. Its focus on energy‑efficient building solutions, especially in the growing ESG arena, positions it for sustained growth.

- Dividend history: 35 consecutive increases.

- Yield (2025): ~3.8 %

- Payout ratio: ~70 %

- Why we like it: A diversified portfolio of HVAC, battery, and security products, a strong cash‑flow pipeline, and a track record of prudent dividend policy.

View JCI’s latest dividend announcement: [ JCI ]

Takeaway

The Motley Fool’s eight‑stock list blends time‑tested blue‑chips (PG, JNJ, KO, PEP) with industrial stalwarts (MMM, JCI) and tech‑forward dividend leaders (MSFT, VZ). Each pick boasts a long history of dividend growth, a resilient business model, and a solid payout ratio—factors that together create a compelling risk‑adjusted income stream.

For more detailed analysis, the article recommends visiting each company’s investor relations site, examining their most recent earnings releases, and reviewing historical dividend performance charts on platforms like Yahoo Finance or Seeking Alpha.

Investors looking to add consistent income to their portfolios can start with one or more of these picks, keeping in mind that diversification across sectors and market caps helps cushion against sector‑specific downturns. As always, pair these dividend decisions with an eye on your overall asset allocation and risk tolerance.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/28/8-dividend-stocks-every-investor-should-consider/ ]