2025 Market Forecast: AI Bubble, Macro Headwinds and Non-AI Defensive Picks

Locale: New York, UNITED STATES

Summary of Business Insider’s “Stock‑Market Crash Bubble & Non‑AI Picks: Where to Invest (2025‑11)”

In late 2025 the United States equity market is in the eye of a storm. Business Insider’s November 2025 piece examines the looming “crash bubble” that many investors fear will be triggered by a confluence of macro‑economic pressures, an AI‑driven valuation frenzy, and a resurgence of traditional defensive sectors. The article provides a detailed inventory of “non‑AI picks” that the author argues will be the safest bets as the market heads toward a correction, and it offers a roadmap for investors who want to protect capital while still capturing upside in the long term.

1. The “Crash Bubble” Explained

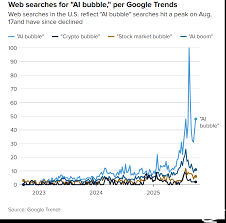

The article opens with a brief historical context. Business Insider points out that the market has been in a bubble since 2020, a period in which AI and “smart” tech stocks have surged past fundamentals. The author compares the current situation to the Dot‑Com boom and the 2008 housing‑credit crisis, noting that both periods involved a massive speculative overlay that eventually collapsed when macro‑economic fundamentals caught up.

The piece cites a Bloomberg analysis that shows the S&P 500’s price‑to‑earnings ratio now sits at a 20‑year high, with the AI sector (defined by the author as companies that generate at least 40 % of their revenue from AI‑related products or services) pulling a disproportionate share of the upside. When the author notes the “AI mania” article that was published earlier in the year, the piece underscores that the surge in AI stocks has been fueled largely by hype rather than sustainable cash flows, especially in the “non‑core” AI firms that are still ramping up production or are early‑stage.

2. Macro‑Economic Headwinds

The article lays out three macro‑economic forces that are tightening the economic environment:

Rising Interest Rates – The Federal Reserve has been hiking rates at a rapid pace, and the yield on the 10‑year Treasury has crossed 4 %. Higher discount rates make high‑growth AI companies less attractive.

Supply‑Chain Bottlenecks – China’s ongoing trade tensions and a slowdown in semiconductor production are putting pressure on technology supply chains. The author cites a recent report from the International Monetary Fund that indicates that global GDP growth will slow to 2.3 % in 2026.

Consumer Spending Shifts – With inflation still stubbornly high, consumers are cutting back on discretionary spending. This shift disproportionately hurts the “growth‑heavy” AI‑based consumer tech sector and benefits consumer staples and healthcare.

3. The Non‑AI Pick Playbook

Business Insider’s author identifies several sectors that have remained resilient through previous downturns and are likely to provide steady dividends and growth even when the AI bubble bursts. The article divides the picks into three categories: Defensive, Growth‑with‑Stability, and Value‑Focused.

A. Defensive Sectors

Utilities – The author highlights Duke Energy (DUK) and NextEra Energy (NEE) as leaders in clean‑energy transition and reliable dividend growth. Both companies have a robust pipeline of renewable projects and a strong cash‑flow base that can weather higher rates.

Consumer Staples – Procter & Gamble (PG), Coca‑Cola (KO), and Costco (COST) are listed for their resilient demand and high operating margins. The article notes that these companies have long histories of dividend hikes and are not heavily leveraged.

Healthcare – Johnson & Johnson (JNJ) and Pfizer (PFE) are identified for their diversified product lines and large cash reserves. The piece references a recent FDA approval for a new J&J drug that could generate a new growth stream.

B. Growth‑with‑Stability

Semiconductors – TSMC (TSM) and Intel (INTC) are presented as “non‑AI” growth stocks because their revenue streams are largely hardware, not software. Both companies have a strong R&D pipeline for next‑generation chips.

Infrastructure – Brookfield Infrastructure Partners (BIP) and iShares Global Infrastructure ETF (IGF) are highlighted as opportunities to invest in a sector that will benefit from the U.S. infrastructure bill and the growing need for digital connectivity.

C. Value‑Focused

Financials – Bank of America (BAC) and JPMorgan Chase (JPM) are noted for their high dividend yields and strong capital buffers. The article underscores the importance of banking regulation, pointing out that the Fed’s stress tests are tightening but still show robust capital ratios.

Energy – ExxonMobil (XOM) and Chevron (CVX) are mentioned as energy companies that benefit from a potential energy price rebound. The author references an OPEC+ announcement that will likely lift crude prices.

4. ETFs and Index Funds as Diversifiers

Business Insider’s piece emphasizes the power of index funds and ETFs to capture exposure to multiple non‑AI picks without needing to pick individual stocks. The article suggests the following vehicles:

- Vanguard Consumer Staples ETF (VDC) – Provides exposure to the biggest names in staples.

- iShares U.S. Utilities ETF (IDU) – Covers a wide range of utility companies.

- SPDR S&P 500 Growth ETF (SPYG) – Although it has some AI exposure, it is balanced with strong consumer‑sector weights.

- Schwab U.S. Dividend Equity ETF (SCHD) – Focuses on high‑yield, dividend‑paying companies across all sectors.

The author argues that a combination of these ETFs can reduce volatility during a crash while still preserving upside potential.

5. Tactical Allocation Advice

The article offers a concrete “cash‑first” strategy for investors looking to ride out the anticipated correction:

Maintain 20‑30 % of portfolio in cash or short‑term Treasury funds to capitalize on post‑crash buying opportunities.

Allocate 50 % to defensive and value sectors as described above.

Keep 20 % in growth‑with‑stability picks, with an eye toward sectors that have a tangible product pipeline.

Rebalance quarterly to keep the allocation in line with the 5‑year averages for each sector.

The article also suggests that investors use a dollar‑cost averaging approach to buy into these picks during the downturn, smoothing out the entry points.

6. The Bottom Line

Business Insider’s November 2025 article concludes that the market is at a tipping point. The AI sector, while still alluring, is heavily overvalued and will be the first casualty of a macro‑economic squeeze. In contrast, non‑AI picks such as utilities, consumer staples, and healthcare offer stability, dividends, and a lower valuation risk. The author recommends a defensive, diversified approach with a clear exit plan should the crash deepen.

The article provides readers with a concise playbook for protecting capital while staying positioned for long‑term growth, making it a valuable resource for both seasoned investors and those just entering the market.

Read the Full Business Insider Article at:

[ https://www.businessinsider.com/stock-market-crash-bubble-non-ai-picks-where-to-invest-2025-11 ]