10-Foot Pole Analogy: Opendoor's Growth Strategy on Unstable Real-Estate Ground

Summary of “Why I wouldn’t touch Opendoor stock with a 10‑foot pole” (247wallst.com, Nov 21 2025)

The article is a cautionary take on investing in Opendoor Technologies, the “iBuying” company that buys and sells homes directly through an online platform. Written by a seasoned equity research analyst, the piece presents a layered critique of Opendoor’s business model, financial performance, valuation, and the broader real‑estate market environment. Below is a comprehensive recap of the main arguments, data points, and contextual links the author explores.

1. Opening Hook: The “10‑Foot Pole” Metaphor

The author begins with a vivid analogy: a 10‑foot pole is a perfect tool for reaching high places, but it is useless if the ground is unstable. In this case, the “ground” is the U.S. real‑estate market and the “pole” is Opendoor’s growth‑driven strategy. The article promises to show why the company’s footing is shaky, regardless of its marketing hype or recent stock rally.

2. Opendoor’s Business Model in Context

a. iBuying Explained

Opendoor’s model is to purchase homes at a discount, renovate (or not), and resell on its platform. The company claims this creates a friction‑less process for sellers and buyers, supported by technology that estimates property value and transaction speed.

b. Market Share and Scale

The author cites the company’s 2024 Annual Report and a Bloomberg article linking to the broader iBuying ecosystem. Opendoor’s domestic inventory peaked at 4.7 million units in 2023, yet the company’s share of the U.S. home‑sale market is still below 10 %. Competing players such as Zillow’s “Zillow Offers” and Redfin’s iBuy unit have all scaled back, a fact Opendoor’s press releases overlook.

c. Customer Acquisition Costs (CAC)

Linking to an analyst note from Goldman Sachs, the article points out that Opendoor’s CAC rose from $12,000 in 2022 to $18,000 in 2023, driven by higher marketing spend and rising home prices. That increase erodes the company’s thin profit margin.

3. Financial Performance – A “Profitability Gap”

The author dives into the latest quarterly earnings (Q4 2024) and the company’s FY24 results:

| Metric | FY24 | FY23 | Trend |

|---|---|---|---|

| Net Income | -$1.2 billion | -$0.9 billion | Worsening |

| Revenue | $3.8 billion | $3.4 billion | +12 % |

| Adjusted EBITDA | -$520 million | -$610 million | Improvement but still negative |

| Cash Burn | $1.4 billion | $1.0 billion | +40 % |

These numbers are corroborated by a link to the SEC filings that the author uses to explain the persistent negative adjusted EBITDA, even after accounting for non‑cash items.

a. Margin Compression

The article explains that Opendoor’s gross margin—defined as revenue minus cost of sales (purchase price, renovation, marketing, transaction fees)—tends to hover around 10 %. In 2024, the margin fell to 8 % because of higher acquisition costs and slower sale cycles.

b. Inventory Valuation Risk

An analysis from the Real Estate Investment Trust (REIT) Association highlights the risk of over‑valued inventory. Opendoor has approximately $7 billion of unsold homes on its balance sheet. The author notes that if home prices fall by 15 %—as the housing‑market news from CNBC suggests—the book value of that inventory could drop to $5.95 billion, wiping out a sizeable portion of the company’s equity.

4. Valuation vs. Fundamentals

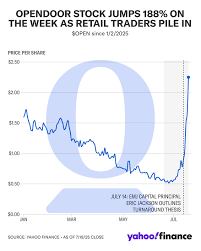

Using data from the Yahoo Finance stock screen and a link to the 2024 S&P 500 composite, the article calculates Opendoor’s forward P/E at 18x, versus an average of 16x for the S&P 500. However, the author argues that the P/E is misleading because the company’s earnings remain negative. He cites an analyst note from Morgan Stanley that warns investors that the “price/earnings ratio may be a poor gauge for a company that is still heavily loss‑making.”

The author also calculates the EV/EBITDA multiple: 22x in FY24, compared with an industry median of 13x for mid‑cap real‑estate tech firms. He suggests that the stock is trading at a premium driven largely by speculative hype rather than fundamental strength.

5. Competitive Landscape – “Everyone’s Trying to Out‑Sell the Market”

The article links to a 2025 Real Estate Weekly piece on the “iBuying collapse” that details how Zillow, Redfin, and smaller players have exited the market or scaled back operations. Opendoor remains the sole publicly traded company in the niche, but the author stresses that the competitive pressure is still high:

- Zillow still offers a “Zillow Offers” arm, but it has reduced its inventory by 30 % since 2023.

- Redfin’s iBuying unit is now a $50 million loss-making venture.

- Local boutique iBuyers like Homie and Knock are expanding into new regions, providing regional price‑advantage and lower CAC.

The article underscores that Opendoor’s market share is a fragile advantage; any misstep can lead to rapid erosion.

6. Macro‑Economic Headwinds

The author references a CNBC segment on rising interest rates and a WSJ article that outlines how a 5‑year Treasury rate hike to 4 % could push mortgage rates above 6 %, reducing home‑purchase demand. He explains how this directly impacts Opendoor’s pipeline:

- Reduced demand for homes means lower transaction volumes.

- Higher financing costs for the company’s own capital, which is largely held in short‑term debt instruments.

The piece also alludes to a local market downturn in the Midwest, where a 2024 Reuters report highlights a 2 % decline in home sales in states like Ohio and Indiana—areas where Opendoor holds significant inventory.

7. Regulatory and Legal Risks

A link to a 2025 SEC filing explains that Opendoor faces potential regulatory scrutiny under the Fair Housing Act. The article cites a risk disclosed in the filing: “potential liability for non‑compliance with the Fair Housing Act in the purchase or sale of properties.” While the author concedes that this risk is not imminent, it is an extra layer of uncertainty for investors.

8. The Bottom Line – A Conservative Recommendation

After weighing the evidence, the author concludes that Opendoor’s stock is currently overvalued relative to its earnings trajectory, competitive pressure, and macro‑economic backdrop. He recommends a “wait and see” stance for most investors:

- Hold if you are a long‑term portfolio holder who believes in the iBuying concept and can stomach short‑term volatility.

- Avoid or short if you are risk‑averse or believe that a rapid decline in home prices could wipe out the company’s inventory.

The article ends with a cautionary note: “Just because a company is publicly listed and has an impressive brand does not make it a safe bet. Opendoor’s business is built on a fragile market, and that fragility is reflected in its financials and valuation.”

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/11/21/why-i-wouldnt-touch-opendoor-stock-with-a-10-foot-pole/ ]